在线支付¶

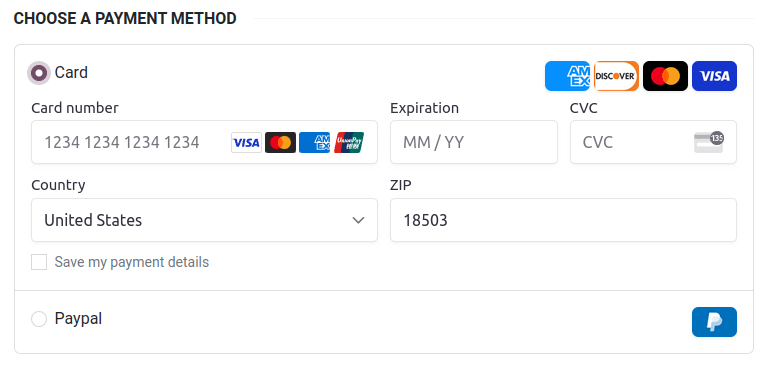

Odoo 内置了多个 支付服务商,允许您的客户通过他们的 客户门户 或您的 电子商务网站 在线付款。他们可以使用自己喜欢的支付方式(如 信用卡)通过销售订单、发票或定期付款的订阅进行支付。

每个支付提供商都与一组支持的 支付方式 相关联,您可以根据需要对其进行(停用/启用)。

注解

Odoo 应用程序将敏感信息的处理委托给经过认证的支付提供商,这样您就无需担心 PCI 合规性问题。Odoo 服务器或托管在其他地方的 Odoo 数据库中不会存储任何敏感信息(如信用卡号码)。相反,Odoo 应用程序使用唯一的参考编号来标识存储在支付提供商系统中的安全数据。

支持的付款提供商¶

要访问支持的付款提供商,请转到:,,或 。

在线支付提供商¶

付款流程从 |

令牌化 |

||||

|---|---|---|---|---|---|

奥多 |

✔ |

完整和部分 |

完整和部分 |

||

供应商的网站 |

|||||

供应商的网站 |

|||||

奥多 |

✔ |

仅完整项 |

仅完整项 |

||

供应商的网站 |

|||||

Flutterwave |

供应商的网站 |

✔ |

|||

供应商的网站 |

|||||

Mollie |

供应商的网站 |

||||

供应商的网站 |

|||||

奥多 |

✔ |

仅完整项 |

完整和部分 |

||

奥多 |

✔ |

仅完整项 |

完整和部分 |

✔ |

|

Worldline |

供应商的网站 |

✔ |

|||

供应商的网站 |

注解

小技巧

除了与 API 集成的常规付款提供商(如 Stripe、PayPal 或 Adyen),Odoo 还捆绑了 演示付款提供商。此付款提供商允许您测试涉及在线付款的业务流程。由于演示付款是模拟付款,因此无需任何凭证。

银行付款¶

- 当勾选此选项时,Odoo 会显示您的付款信息及付款参考编号。在您收到银行账户中的款项后,需要手动批准该笔付款。

- 您的客户可以通过银行转账来注册 SEPA 直接借记授权,并直接扣划其银行账户。

启用付款提供商¶

要添加一个新的付款提供商并使其相关的付款方式对您的客户可用,请按以下步骤操作:

前往支付提供商的网站,创建账户,并确保您已拥有为第三方使用而请求的 API 凭据。这些凭据对于 Odoo 与支付提供商进行通信是必需的。

在 Odoo 中,通过进入 、 或 来导航到 付款提供方。

选择供应商并配置 凭证 选项卡。

将 状态 字段设置为 启用。

注解

该 凭证 选项卡中可用的字段取决于付款提供商。有关更多信息,请参阅 相关文档。

一旦你启用了支付提供商,它会自动在你的网站上发布。如果你希望取消发布,请点击 已发布 按钮。客户无法通过未发布的提供商进行付款,但他们仍然可以管理 (删除并分配到订阅) 他们与该提供商相关联的现有令牌。

测试模式¶

如果您希望以测试方式尝试支付提供商,请将支付提供商表单中的 状态 字段设置为 测试模式,然后在 凭证 选项卡中输入您提供商的测试/沙箱凭据。

注解

默认情况下,在测试模式下,支付服务商处于 未发布 状态,以便对访客不可见。

警告

我们建议在复制数据库或测试数据库上使用测试模式,以避免发票编号可能出现的问题。

付款方式¶

每个支付提供商都与一组支持的支付方式相关联;在支付提供商表单的 配置 选项卡中的 支付方式 字段中列出的方式,是已激活的方式。要为某个提供商激活或停用支付方式,请点击 启用支付方式,然后点击相关方式的切换按钮。

小技巧

付款方式会根据其顺序在您的网站上显示。要重新排序,请在支付方式提供者表单中点击 启用支付方式,然后在 支付方式 列表中,将支付方式拖放到所需的顺序位置。

图标和品牌¶

您网站上支付方式旁边的图标,要么是该支付方式所激活的品牌图标,要么如果没有激活品牌图标,则显示支付方式本身的图标。要修改这些图标,请前往:、 或 ,然后点击相应的支付方式。

要修改付款方式的图标,请将鼠标悬停在付款方式表单右上角的图片上,然后点击 (铅笔) 图标。

选择 品牌 选项卡以查看已为付款方式激活的品牌。品牌及其相关图标会根据其顺序进行显示;如需重新排序,请将它们拖放到所需顺序。要修改品牌图标,请选择该品牌,然后在打开的弹出窗口中,将鼠标悬停在右上角的图片上,点击 (铅笔) 图标。

高级配置¶

要对付款方式进行进一步配置,请前往:、 或 。点击付款方式,然后启用 开发者模式。点击 配置 选项卡以调整功能。

分词¶

If the payment provider supports this feature, customers can save their payment method details for later. To enable this feature, go to the Configuration tab of the selected payment provider and enable Allow Saving Payment Methods.

在这种情况下,Odoo 会创建一个 付款令牌,用于后续付款时作为支付方式,而无需客户再次输入其支付方式的详细信息。这对于电子商务的转化率以及使用定期付款的订阅服务尤其有用。

小技巧

客户可以点击 管理付款方式,以添加或删除其保存的付款方式详情。该选项位于 客户门户 中。

手动捕获¶

如果支付提供商支持此功能,您可以分两步进行付款授权和扣款,而不是一步完成。要启用此功能,请转到所选支付提供商的 配置 选项卡,并启用 手动扣款。

当您授权一笔付款时,资金会在客户的支付方式上被预留,但不会立即扣款。您可以在稍后手动捕获该付款时进行扣款。您也可以取消授权以取消该操作并释放预留的资金。在许多情况下,手动捕获付款非常有用:

收到付款确认后,等待订单发货以完成付款。

在完成付款并开始履行流程之前,审核并确认订单是合法的。

避免因退款而产生高额退费手续费:支付提供商不会对取消授权收取费用。

保留一笔保证金,稍后退还,扣除任何扣除项(例如损坏情况)。

要在授权后捕获付款,请转到相关的销售订单或发票,然后点击 捕获交易 按钮。要释放资金,请点击 取消交易 按钮。

注解

Some payment providers support capturing only part of the authorized amount. The remaining amount can then be either captured or voided. These providers have the value Full and partial in the table above. The providers that only support capturing or voiding the total amount have the value Full only.

资金可能不会永远被预留。经过一定时间后,这些资金可能会自动退还至客户的支付方式。请参阅您的支付服务商的文档,以了解确切的预留时长。

Odoo 不支持所有付款提供商的此功能,但某些付款提供商允许从其网站界面手动捕获付款。

退款¶

如果您的付款提供商支持此功能,您可以直接从 Odoo 退款。无需先进行启用。要退还客户付款,请导航至该笔付款并点击 退款 按钮。

注解

Some payment providers support refunding only part of the amount. The remaining amount can then optionally be refunded, too. These providers have the value Full and partial in the table above. The providers that only support refunding the total amount have the value Full only.

Odoo 不支持所有付款提供商的此功能,但某些提供商允许通过其网站界面进行退款。

快捷结账¶

If the payment provider supports this feature, you can allow customers to use the Google Pay and Apple Pay buttons and pay their eCommerce orders in one click. When they use one of these buttons, customers go straight from the cart to the confirmation page without filling out the contact form. They just have to validate the payment on Google’s or Apple’s payment form.

要启用此功能,请转到所选支付提供商的 配置 选项卡,并启用 允许快速结账。

注解

所有在快速结账付款表单中显示的价格始终包含税款。

可用性¶

你可以通过指定 最大金额 和修改 货币 以及 国家 来调整支付服务商的可用性,这些设置位于 配置 选项卡中。

小技巧

要显示支付提供商和支付方式的可用性报告,并帮助诊断支付表单上的潜在可用性问题,请启用 开发者模式,然后点击支付表单上 选择支付方式 标题旁边的 (错误) 图标。该报告包括已启用的支付提供商和支付方式列表、任何不可用的支付提供商或方式的原因(如适用),以及每种支付方式支持的提供商列表。

货币和国家¶

所有支付提供商都有不同的可用货币和国家列表。它们在支付操作中作为第一道筛选条件,即如果客户的货币或国家不在支持列表中,与支付提供商关联的支付方式将无法被选择。由于可用货币和国家列表可能存在错误、更新或未知情况,因此可以添加或移除支付提供商支持的货币或国家。

注解

付款方式 还有自己的可用货币和国家列表,这在付款操作期间作为另一个过滤条件。

如果支持的货币或国家列表为空,这意味着列表过长无法显示,或者 Odoo 尚未收录该支付提供商的信息。即使如此,该支付提供商仍然可用,但有可能在后续支付过程中因国家或货币不被支持而被拒绝。

最大金额¶

您可以限制通过所选支付方式可支付的 最大金额。将该字段留空或设置为 0.00,以使支付方式在任何支付金额下都可用。

重要

此功能不适用于允许客户修改付款金额的页面,例如 捐赠 片段以及启用 运费 时的 结账 页面。

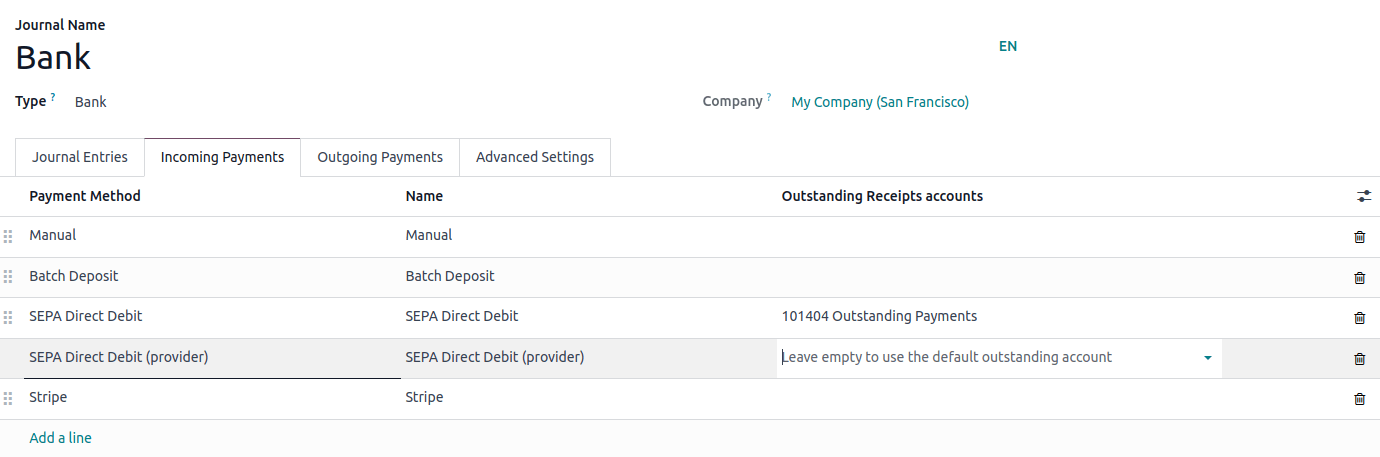

付款日记账¶

必须为支付提供商定义一个 付款日记账,以便在 未结账户 上记录付款。默认情况下,银行 日记账会被添加为所有支付提供商的付款日记账。如需修改,请转到所选支付提供商的 配置 选项卡,并选择另一个 付款日记账。

注解

付款凭证必须为 银行 凭证。

同一本日记账可以用于多个付款提供商。

如果已安装 发票或会计应用,付款日记账才可进行配置。

会计视角¶

从会计角度来看,有两类在线支付流程:一类是直接存入您银行账户的付款,并遵循常规的 对账 流程;另一类来自第三方 在线支付提供商,需要您遵循另一种会计流程。对于这些付款,您需要考虑如何记录付款的凭证。我们建议您咨询您的会计师以获得建议。

默认情况下,将使用为 付款日记账 定义的 银行账户,但您也可以为每个付款提供商指定一个 未结账户,以将供应商的付款与其他付款区分开来。

另请参见

支付方式/电汇

支付网关/adyen

支付网关/Authorize

支付方式/asiapay

支付方式/buckaroo

支付方式/演示

支付方式/mercado_pago

支付网关/mollie

支付网关/PayPal

支付网关/razorpay

支付网关/Stripe

支付方式/世界线

支付网关/xendit

会计/银行