哥伦比亚¶

Odoo 的哥伦比亚本地化包为哥伦比亚的数据库提供了会计、税务和法律功能,例如科目表、税收和电子发票。

此外,还有一系列相关主题的视频可供参考。这些视频涵盖了从零开始、设置配置、完成常见工作流程,以及对一些具体使用场景的深入讲解。

另请参见

配置¶

模块安装¶

安装 以下模块以获得哥伦比亚本地化的所有功能:

名称 |

技术名称 |

描述 |

|---|---|---|

哥伦比亚 - 会计 |

|

默认 财务本地化包。此模块为哥伦比亚本地化添加了基础会计功能:会计科目表、税项、预提税以及证件类型。 |

哥伦比亚 - 财务报表 |

|

包含用于向供应商发送扣款证明的会计报表。 |

哥伦比亚电子发票(Carvajal) |

|

该模块包含与 Carvajal 集成所需的特性,并根据 DIAN 规定生成与供应商发票相关的电子发票和支持文件。 |

哥伦比亚 - 销售点 |

|

包含哥伦比亚本地化的销售点收据。 |

注解

当为公司的 税务定位 选择 哥伦比亚 时,Odoo 会自动安装某些模块。

公司配置¶

要配置您的公司信息,请转到 应用程序,并搜索您的公司。

或者,激活 开发者模式,并导航至 。然后,编辑联系人表单并配置以下信息:

公司名称。

地址: 包括 城市、部门 和 邮政编码。

身份证号: 选择 身份证类型 (

NIT,公民身份证,出生登记, 等等)。当 身份证类型 为NIT时,身份证号 必须 在 ID 结尾处包含由短横线 (-) 前缀的 校验位。

接下来,在 销售与采购 选项卡中配置 财政信息:

义务和责任: 选择公司的税务责任(

O-13大纳税人,O-15自扣税人,O-23增值税扣缴代理,O-47简易税率制度,R-99-PN不适用)。大纳税人: 如果该公司为 大纳税人,则应选择此选项。

财政制度: 选择公司的税种名称(

IVA、INC、IVA 和 INC或不适用)商业名称: 如果公司使用特定的商业名称,并且需要在发票中显示。

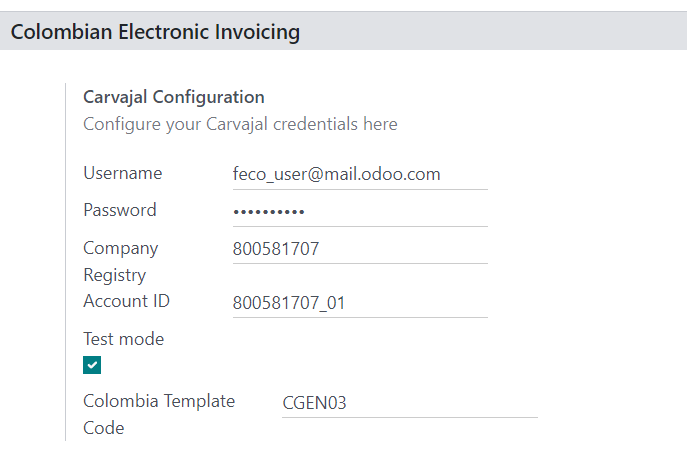

Carjaval 凭据配置¶

模块安装完成后,用户凭证**必须**进行配置,以便与Carvajal Web服务连接。为此,请导航至:,并滚动到:哥伦比亚电子发票 部分。然后,填写由Carvajal提供的所需配置信息:

用户名 和 密码:公司提供的用户名和密码(由 Carvajal 提供)。

Company Registry: Company’s NIT number without the verification code.

账户ID: 公司的NIT编号后跟

_01。哥伦比亚模板代码: 选择两个可用模板之一(

CGEN03或CGNE04),用于电子发票的 PDF 格式。

启用 测试模式 复选框以连接到 Carvajal 测试环境。

一旦 Odoo 和 Carvajal 完全配置并准备好用于生产环境,请取消勾选 测试模式 复选框以使用生产数据库。

重要

测试模式 只能用于复制的数据库,**不能**用于生产环境。

报表数据配置¶

报告数据可以针对PDF中的财政部分和银行信息进行定义,作为通过XML发送的可配置信息的一部分。

导航至 ,并向下滑动以找到 哥伦比亚电子发票 部分,以便找到 报告配置 字段。在此处可以配置每种报告类型的标题信息。

大纳税人

制度类型

增值税扣缴人

自动扣款

适用分辨率

经济活动

银行信息

主数据配置¶

业务伙伴¶

业务伙伴联系人可以在 联系人 应用中创建。为此,请导航至 ,然后点击 创建 按钮。

然后,输入联系人名称,并使用单选按钮选择联系人类型,可以是 个人 或 公司。

请完整填写 地址,包括 城市、州 和 邮政编码。然后填写身份和税务信息。

身份信息¶

由 DIAN 定义的证件类型,在业务伙伴表单中可用,作为哥伦比亚本地化的一部分。哥伦比亚的业务伙伴 必须 设置其 识别号码`(增值税号)和 :guilabel:`证件类型。

小技巧

当 文档类型 为 NIT 时,需要在 Odoo 中配置 身份证号,包括 身份证末尾的校验码,前面用短横线 (`-`) 进行标识。

财政信息¶

业务伙伴的责任代码(参见 RUT 文件第 53 节)已作为电子发票模块的一部分包含在内,这是 DIAN 的要求。

必填字段可在 中找到。

义务和责任: 选择公司的税务责任(

O-13大纳税人,O-15自扣税人,O-23增值税扣缴代理人,O-47简易税率制度,或R-99-PN不适用)。大纳税人: 如果该公司为 大纳税人,则应选择此选项。

财政制度: 选择公司的税种名称(

IVA、INC、IVA 和 INC或不适用)商业名称: 如果公司使用特定的商业名称,并且需要在发票中显示。

产品¶

要管理产品,请导航至:,然后点击一个产品。

在产品表单中添加通用信息时,必须配置 UNSPSC 分类 (会计 选项卡) 或 内部参考 (通用信息 选项卡) 字段。配置完成后,请务必 保存 产品。

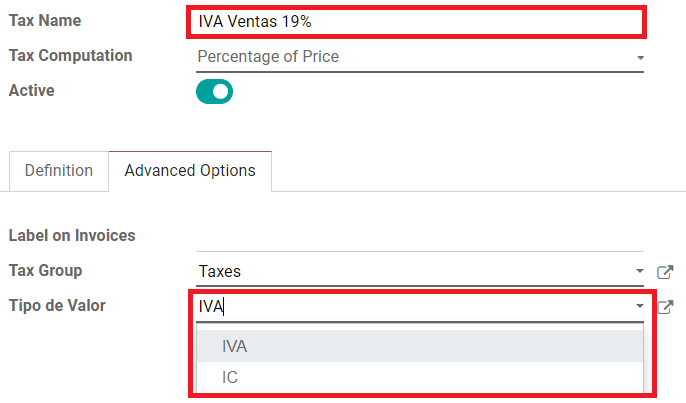

税项¶

要创建或修改税费,请转到 ,并选择相关税费。

如果销售交易包含带有税项的产品,则需要在 高级选项 选项卡中的 类型 字段中为每种税进行配置。保留税类型(ICA、IVA、源泉)也包括在内。此配置用于在发票 PDF 中正确显示税项。

销售日记账¶

一旦 DIAN 为电子发票的官方序列和前缀分配完成,与发票文档相关的销售日记账 必须 在 Odoo 中进行更新。为此,请导航至 ,并选择一个现有的销售日记账,或使用 创建 按钮创建一个新的日记账。

在销售日记账表单中,输入 日记账名称、类型,并在 日记账条目 选项卡中设置一个唯一的 简称。然后,在 高级设置 选项卡中配置以下数据:

电子发票: 启用 UBL 2.1 (哥伦比亚)。

开票决议: 由 DIAN 发给公司的决议编号。

决议日期: 决议的初始生效日期。

解决结束日期: 解决方案的有效期结束日期。

编号范围(最小值): 首张授权发票号码。

编号范围(最大值): 最后授权的发票号码。

注解

日记账的顺序和解决方式**必须**与Carvajal中配置的一致,并且与|DIAN|相符。

发票序列¶

当创建第一份文档时,发票序列和前缀**必须**正确配置。

注解

Odoo 会自动为以下发票分配前缀和序号。

采购日记账¶

一旦 DIAN 为与供应商发票相关的 支持文档 分配了官方序列号和前缀,就需要在 Odoo 中更新与其支持文档相关的采购日记账。此过程类似于 销售日记账 的配置。

会计科目表¶

该 会计科目表 默认作为本地化模块的一部分进行安装,科目会自动映射到税项、默认应付科目和默认应收科目中。哥伦比亚的会计科目表基于 PUC(统一科目表)。

主要工作流程¶

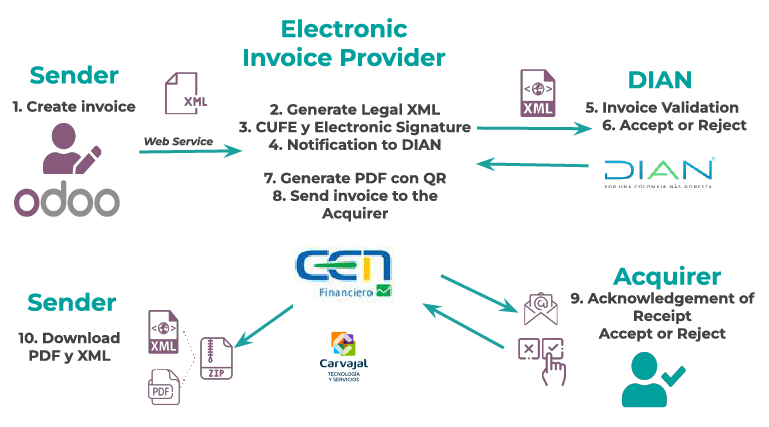

电子发票¶

以下是哥伦比亚本地化电子发票主要工作流程的说明:

发送方创建一张发票。

电子发票提供商生成合法的 XML 文件。

电子发票提供商使用电子签名生成 CUFE(电子发票代码)。

电子发票提供商向 DIAN 发送通知。

DIAN 验证发票。

DIAN 接受或拒绝发票。

电子发票提供商生成带有二维码的PDF发票。

电子发票提供商将发票发送给收单机构。

收单方发送确认回执,并接受或拒绝发票。

发件人下载包含 PDF 和 XML 的

.zip文件。

发票创建¶

注解

在发票验证之前进行的功能流程**不会**改变与电子发票相关的主要更改。

电子发票通过 Carvajal 的网页服务集成生成并发送给 DIAN 和客户。这些文件可以从您的销售订单生成,也可以手动创建。要创建新发票,请转到 ,然后选择 创建。在发票表单中配置以下字段:

客户: 客户的信息。

日记账: 用于电子发票的日记账。

电子发票类型: 选择文档类型。默认情况下,选择 销售发票。

发票行: 指定带有正确税项的产品。

完成后,点击 确认。

发票验证¶

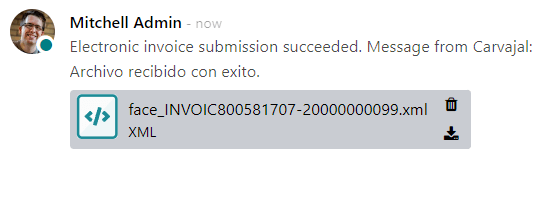

发票确认后,将自动生成一个 XML 文件并发送至 Carvajal。随后,该发票将由 E-invoicing 服务 UBL 2.1(哥伦比亚)异步处理。该文件也会在聊天栏中显示。

电子发票名称 字段现在显示在 EDI 文档 选项卡中,显示的是 XML 文件的名称。此外,电子发票状态 字段显示的初始值为 待发送。要手动处理发票,请点击 立即处理 按钮。

法律 XML 和 PDF 的接收¶

电子发票供应商(Carvajal)接收 XML 文件,并对其进行结构和信息的验证。

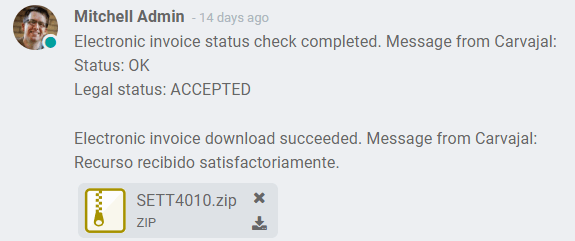

在验证电子发票后,继续生成包含数字签名和唯一代码(CUFE)的合法XML文件,并生成包含二维码的PDF发票,CUFE也会一并生成。如果一切正确,电子开票 字段的值将变为 已发送。

一个包含合法电子发票(XML 格式)和发票(PDF 格式)的 .zip 文件会被下载并显示在发票聊天区域中:

电子发票状态更改为:已接受。

贷项通知单¶

信用凭证的处理流程与发票相同。要创建一张参考发票的信用凭证,请转至 。在发票上,点击 添加信用凭证,并填写以下信息:

信用方式: 选择信用方式类型。

部分退款:当退款金额为部分金额时使用此选项。

全额退款:如果贷项通知单金额为全额,请使用此选项。

全额退款并生成新的草稿发票:如果贷项通知单已自动验证并与发票核对,可使用此选项。原始发票将被复制为新的草稿发票。

原因: 输入信用凭证的原因。

冲销日期: 选择是否为贷项通知单指定特定日期,或使用分录日期。

使用特定凭证簿: 选择您的贷项通知单的凭证簿,如果希望使用与原始发票相同的凭证簿,请留空。

退款日期: 如果您选择了特定日期,请选择退款日期。

审核完成后,点击 反向 按钮。

借项通知单¶

单据的处理流程与贷项通知单类似。要根据发票创建借项通知单,请转至:。在发票上,点击 添加借项通知单 按钮,并输入以下信息:

原因: 输入贷项通知单的原因。

贷项通知单日期: 选择具体选项。

复制行: 如果需要使用发票的相同行来登记贷项通知单,请选择此选项。

使用特定凭证簿:选择您的贷项通知单的打印点,或留空以使用与原始发票相同的凭证簿。

完成后,点击 创建贷项通知单。

供应商发票支持文档¶

通过配置与供应商账单相关的支持文档的主数据、凭据和采购日记账,您可以开始使用 支持文档。

供应商发票的支持文件可以从采购订单创建,也可以手动创建。转到 并填写以下数据:

供应商: 输入供应商的信息。

账单日期: 选择账单的日期。

日记账: 选择与供应商发票相关的支持文档的账簿。

已开票行: 指定带有正确税项的产品。

审核完成后,点击 确认 按钮。确认后,将生成一个 XML 文件并自动发送至 Carvajal。

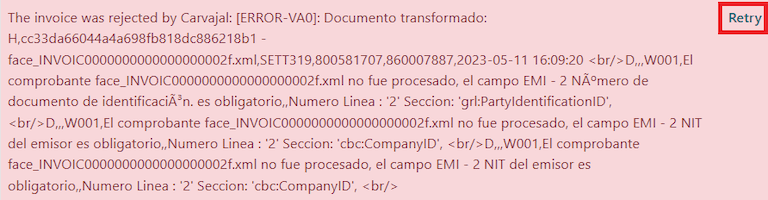

常见错误¶

在 XML 验证过程中,最常见的错误与缺失的主数据有关(联系人税号、地址、产品、税费)。在这种情况下,错误信息会在更新电子发票状态后显示在聊天栏中。

在主数据更正后,可以使用 重试 按钮,用新数据重新处理 XML 并发送更新版本。

财务报表¶

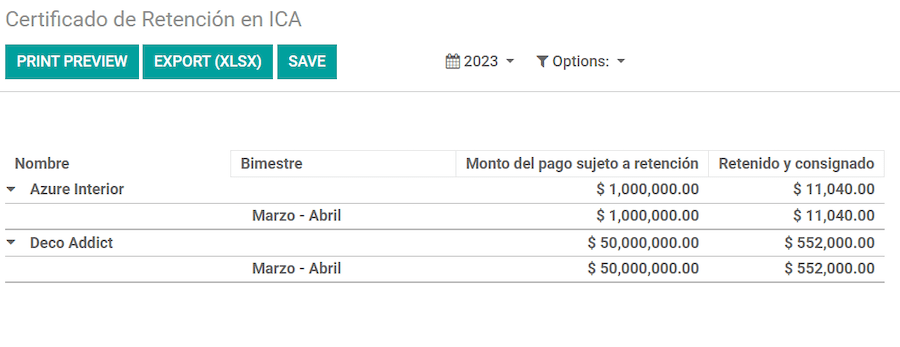

ICA 代扣证明¶

此报告是为哥伦比亚工业和商业(ICA)税的预扣税向供应商出具的证明。该报告可在以下路径下找到:。

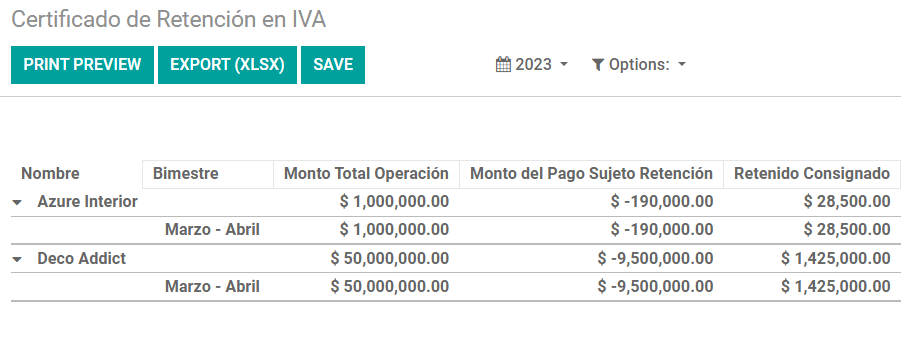

增值税扣缴证明¶

该报告会出具一份证明,说明从供应商处扣除的增值税(VAT)金额。该报告位于:。

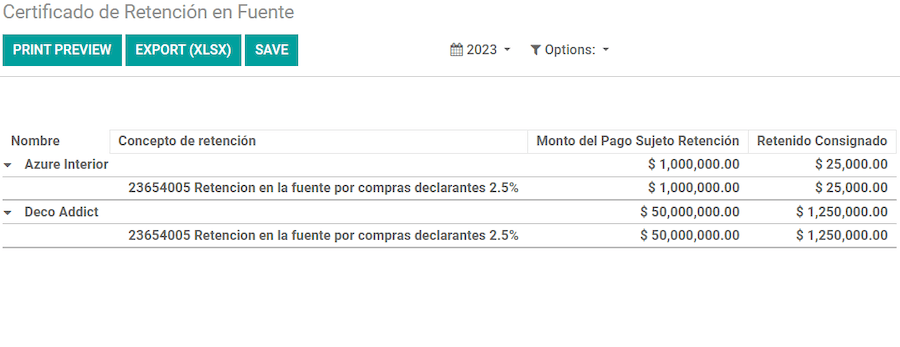

源泉扣缴证书¶

此证书是为已代扣税款的合作伙伴颁发的。该报表可在以下路径下找到:。