秘鲁¶

模块¶

Install the following modules to utilize all the current features of the Peruvian localization.

名称 |

技术名称 |

描述 |

|---|---|---|

秘鲁 - 会计 |

|

为秘鲁本地化添加会计功能,这些功能代表了公司在秘鲁运营以及遵循SUNAT法规和指南所需的最低配置。该模块包含的主要元素包括会计科目表、税种和单据类型。 |

秘鲁 - 电子发票 |

|

包括根据SUNAT法规生成和接收电子发票的所有技术和功能要求。 |

秘鲁 - 财务报表 |

|

包含以下财务报表:

|

秘鲁 - 电子送货单 |

|

添加了交货指南(Guía de Remisión),这是您在A和B之间发送货物时所需的证明文件。只有在交货单被确认后,才能创建交货指南。 |

秘鲁电商 |

|

在电子商务结账表单中启用身份识别类型,并具备生成电子发票的功能。 |

秘鲁 - 带PE文档的销售点 |

|

允许从销售点会话中编辑联系人的税务信息,以生成电子发票和退款。 |

注解

Odoo 会根据创建数据库时选择的国家自动安装相应的公司包。

秘鲁-电子交付指南 模块需要安装 库存 应用程序。

配置¶

安装秘鲁本地化模块¶

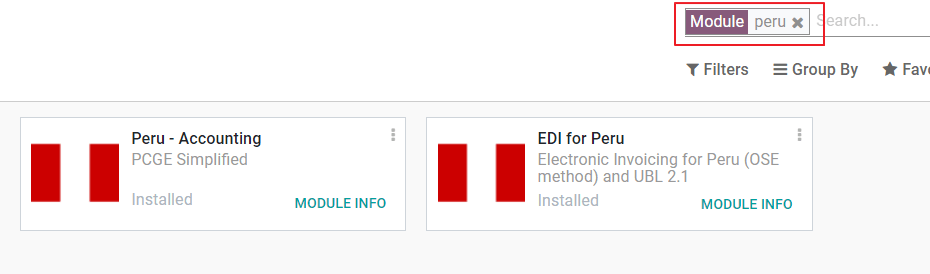

前往 应用 并搜索 "秘鲁",然后在模块 "秘鲁 EDI" 中点击安装。此模块依赖于 秘鲁 - 会计。如果尚未安装此模块,Odoo 会在 EDI 中自动安装它。

注解

当你从头开始安装数据库并选择秘鲁作为国家时,Odoo 会自动安装基础模块:秘鲁 - 会计。

配置您的公司¶

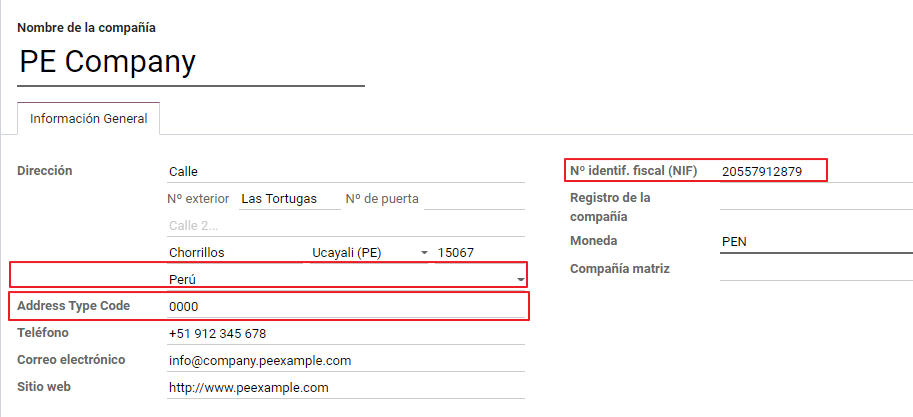

除了公司基本信息外,我们需要将国家设置为秘鲁,这是确保电子发票正常工作的关键。字段 地址类型代码 表示当企业注册其 RUC(唯一纳税人登记)时,由 SUNAT 分配的分支机构代码:

小技巧

如果地址类型代码未知,您可以将其设置为默认值:0000。请注意,如果输入了错误的值,可能会导致电子发票验证出现错误。

注解

应按照RUC格式设置NIF。

会计科目表¶

会计科目表默认作为本地化模块中包含的数据集的一部分进行安装,账户会自动映射到:

税项

默认应付账款账户

默认应收账款账户

秘鲁的会计科目表基于最新的 :abbr:`PCGE (企业通用会计计划) `,该科目表分为多个类别,并与国际财务报告准则 (NIIF) 兼容。

会计设置¶

在模块安装并设置好公司基本信息后,您需要配置电子发票所需的元素。为此,请前往:。

基本概念¶

以下是秘鲁本地化中一些重要的术语:

EDI:电子数据交换,此处指电子发票。

SUNAT:是秘鲁负责执行海关和税收的机构。

OSE:电子服务运营商,OSE SUNAT 的定义。

CDR:收据证书(接收证明)

SOL 凭据:Sunat 在线操作。用户和密码由 SUNAT 提供,用于访问在线操作系统。

签名提供方¶

作为秘鲁电子发票要求的一部分,您的公司需要选择一个签名服务提供商,该提供商将负责文件签署流程并管理SUNAT的验证响应。Odoo提供三种选项:

IAP(Odoo 应用内购买)

数字流程

桑特

请参阅下面的章节,以查看每种选项的详细信息和注意事项。

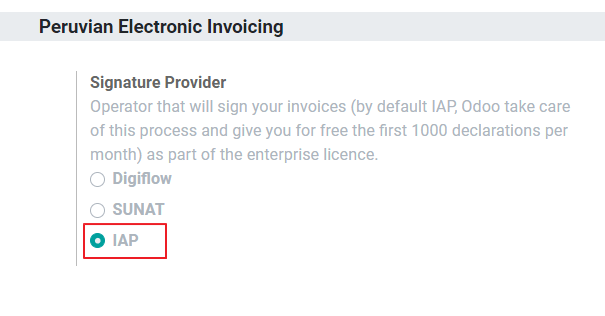

IAP(Odoo 应用内购买)¶

这是默认选项,也是推荐选项,考虑到数字证书已作为服务的一部分包含在内。

什么是 IAP?¶

这是一项由 Odoo 直接提供的服务,该服务将负责后续流程:

提供电子发票证书,因此您无需自行获取。

将文档发送给 OSE,在此情况下为 Digiflow。

接收 OSE 验证和 CDR。

它是如何工作的?¶

该服务需要积分才能处理您的电子文档。Odoo 为新数据库提供 1000 个免费积分。在这些积分用完后,您需要购买积分套餐。

信用额度 |

欧元 |

|---|---|

1000 |

22 |

5000 |

110 |

10,000 |

220 |

20,000 |

440 |

每次将文档发送到 OSE 时,将消耗相应的积分。

重要

如果您遇到验证错误并且需要重新发送文档,将收取额外的信用点。因此,在将文档发送至OSE之前,确保所有信息正确无误至关重要。

你需要做什么?¶

数字流程¶

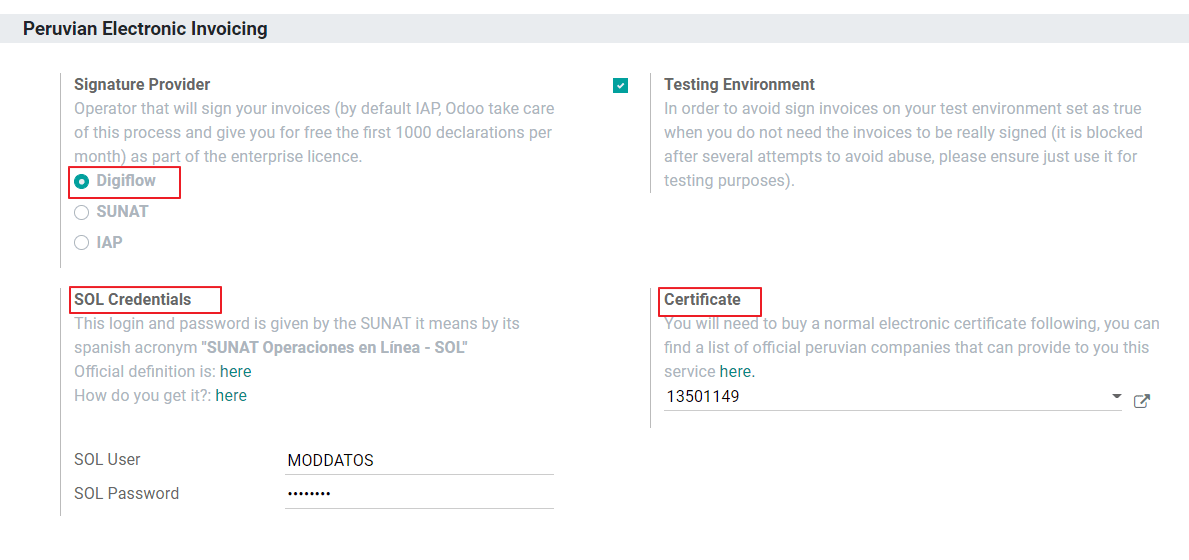

此选项可以作为替代方案,您可以不使用IAP服务,而是直接将文档验证发送至Digiflow。在这种情况下,您需要考虑以下事项:

购买您自己的数字证书:有关官方供应商列表的详细信息以及获取流程,请参阅 SUNAT 数字证书。

直接与 Digiflow 签订服务协议。

提供您的 SOL 凭据。

桑特¶

如果您的公司希望直接与SUNAT签订协议,可以在您的配置中选择此选项。在这种情况下,您需要注意:- 获得SUNAT认证流程的批准。

购买您自己的数字证书:有关官方供应商列表的详细信息以及获取流程,请参阅 SUNAT 数字证书。

为您提供 SOL 凭据。

重要

当使用与SUNAT的直接连接时,SOL用户必须设置为公司RUT加上用户ID。示例:20121888549JOHNSMITH

测试环境¶

Odoo 提供了一个测试环境,可以在您的公司进入生产阶段之前进行激活。

在使用测试环境和 IAP 签名时,您无需为交易购买测试积分,因为所有交易都会默认被验证。

小技巧

默认情况下,数据库设置为在生产环境中运行,请在需要时启用测试模式。

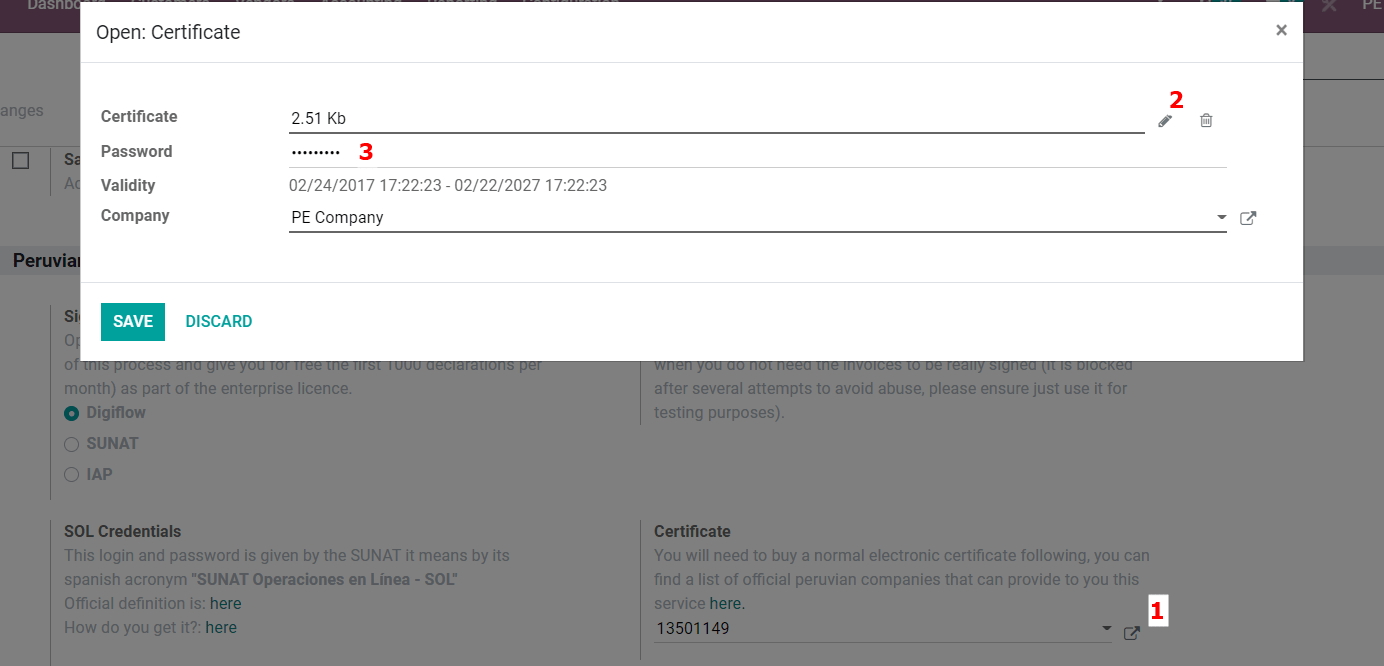

证书¶

如果您不使用 Odoo IAP,为了生成电子发票签名,需要一个扩展名为 .pfx 的数字证书。请前往此部分并上传您的文件和密码。

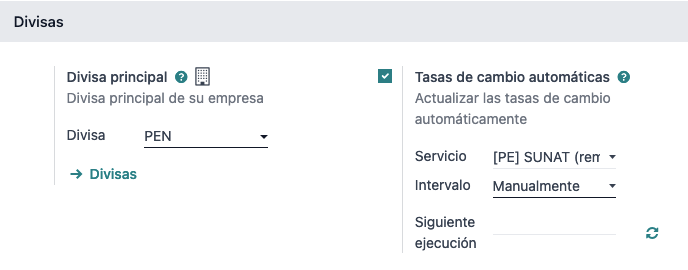

多货币¶

秘鲁的官方汇率由SUNAT提供。Odoo可以直接连接到其服务,并自动或手动获取货币汇率。

有关 多货币 的更多信息,请参阅我们文档的下一节。

配置主数据¶

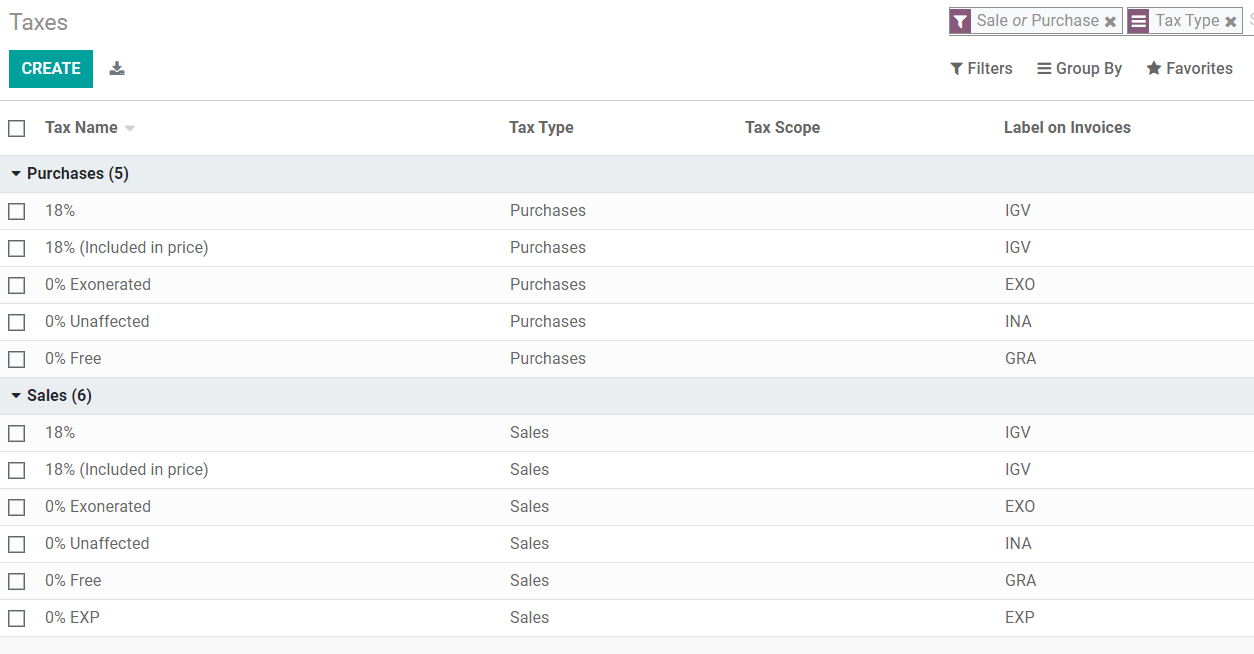

税项¶

作为本地化模块的一部分,税项会自动创建,并关联相应的财务账户和电子发票配置。

EDI 配置¶

作为税务配置的一部分,电子发票需要三个新字段。默认创建的税务条目已包含此数据,但如果您创建新的税务条目,请确保填写以下字段:

财政位置¶

安装秘鲁本地化时,默认包含两种主要的财政位置。

外籍人士 - 出口:在出口交易中,将此税务位置设置为客户的税务位置。

秘鲁本地: 为此类本地客户设置此税务位置。

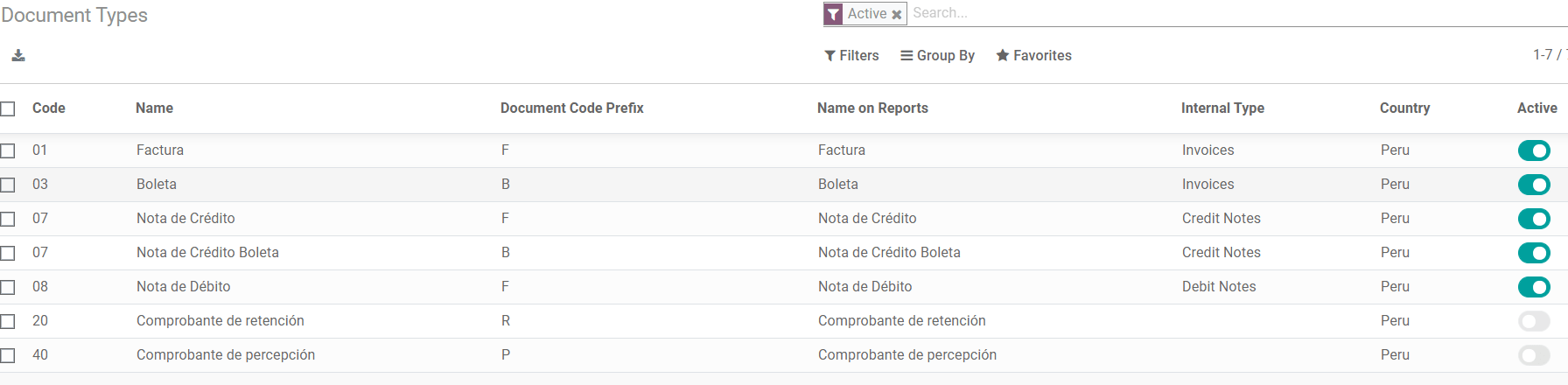

文档类型¶

在一些拉丁美洲国家,包括秘鲁,一些会计交易(如发票和供应商账单)根据政府税务机构定义的文档类型进行分类,在此情况下是由SUNAT定义的。

每种文档类型可以在其被分配的日记账中拥有唯一的编号序列。作为本地化的一部分,文档类型包含该文档适用的国家;当安装本地化模块时,相关数据会自动创建。

该文档类型所需的的信息默认已包含,因此用户无需在此视图中填写任何内容:

警告

目前支持的客户发票文档类型包括:发票、收据、借项通知单和贷项通知单。

凭证类型¶

在创建销售日记账时,除了日记账上的标准字段外,还必须填写以下信息:

使用文档¶

此字段用于定义该日记账是否使用文档类型。该设置仅适用于采购和销售日记账,因为这些是能够与秘鲁提供的不同文档类型相关联的日记账。默认情况下,所有创建的销售日记账都使用文档。

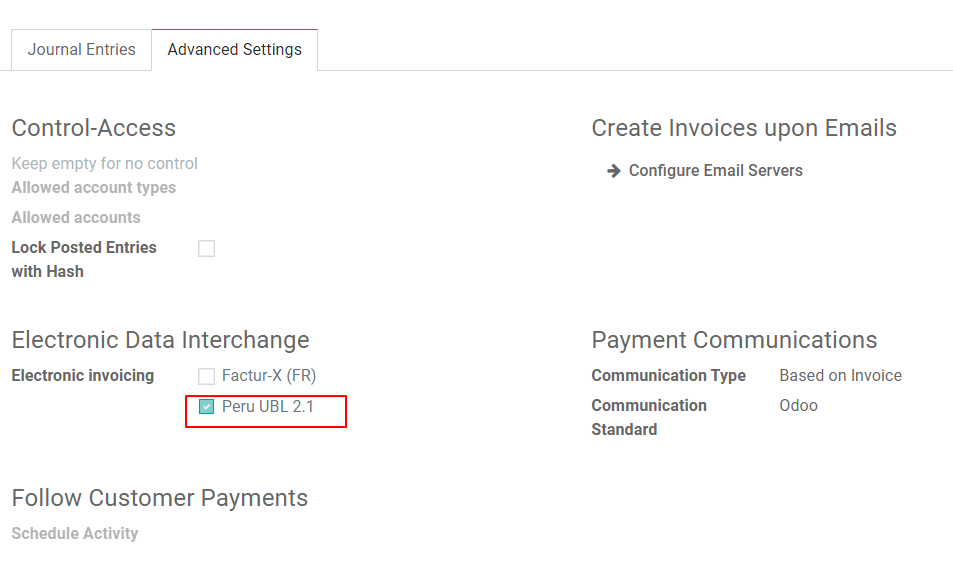

电子数据交换¶

本节说明发票中使用的EDI工作流,对于秘鲁,必须选择“秘鲁 UBL 2.1”。

警告

默认情况下,始终显示值 "Factur-X (FR)",请确保您可以手动取消选中它。

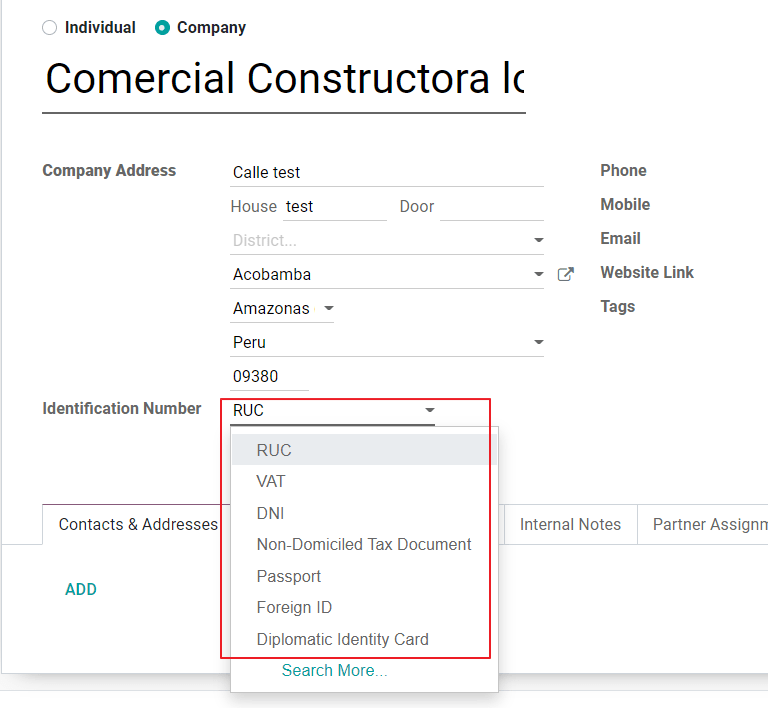

业务伙伴¶

证件类型和增值税号¶

作为秘鲁本地化的一部分,SUNAT 定义的证件类型现已在业务伙伴表单中可用。此信息对于发件公司和客户而言在大多数交易中都是必不可少的,请确保在您的记录中填写此信息。

产品¶

除了产品中的基本信息外,对于秘鲁本地化,产品上的 UNSPC 编码是一个必须配置的字段。

使用和测试¶

客户发票¶

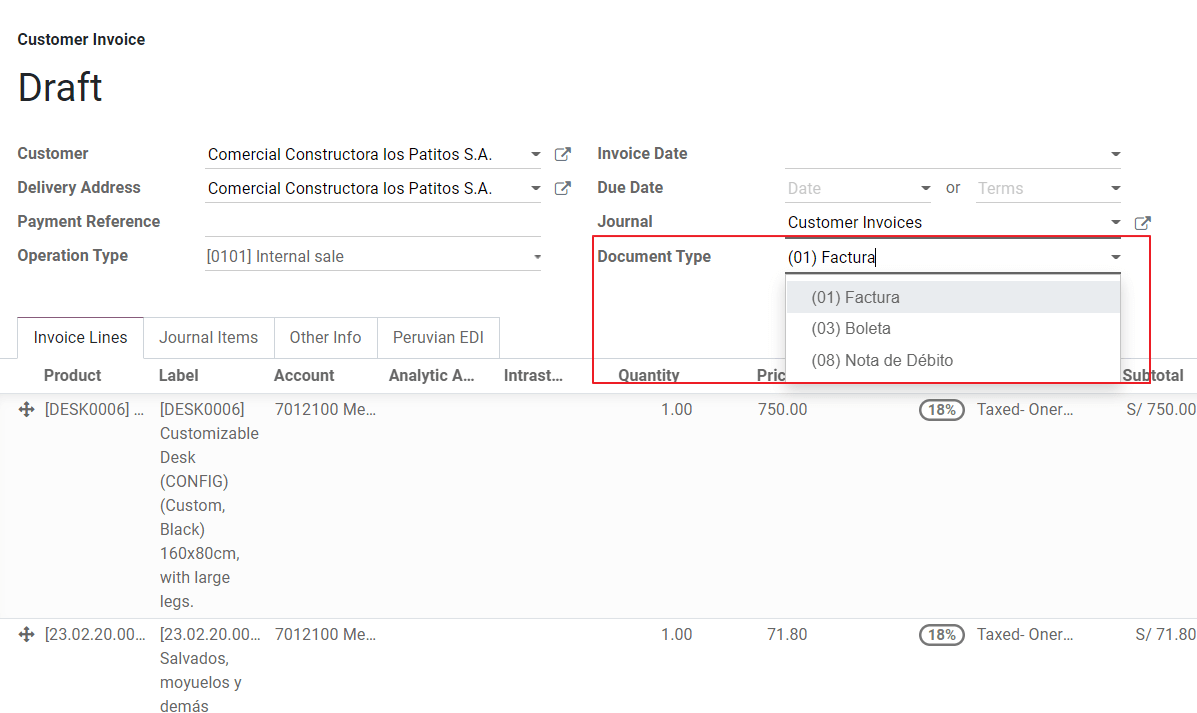

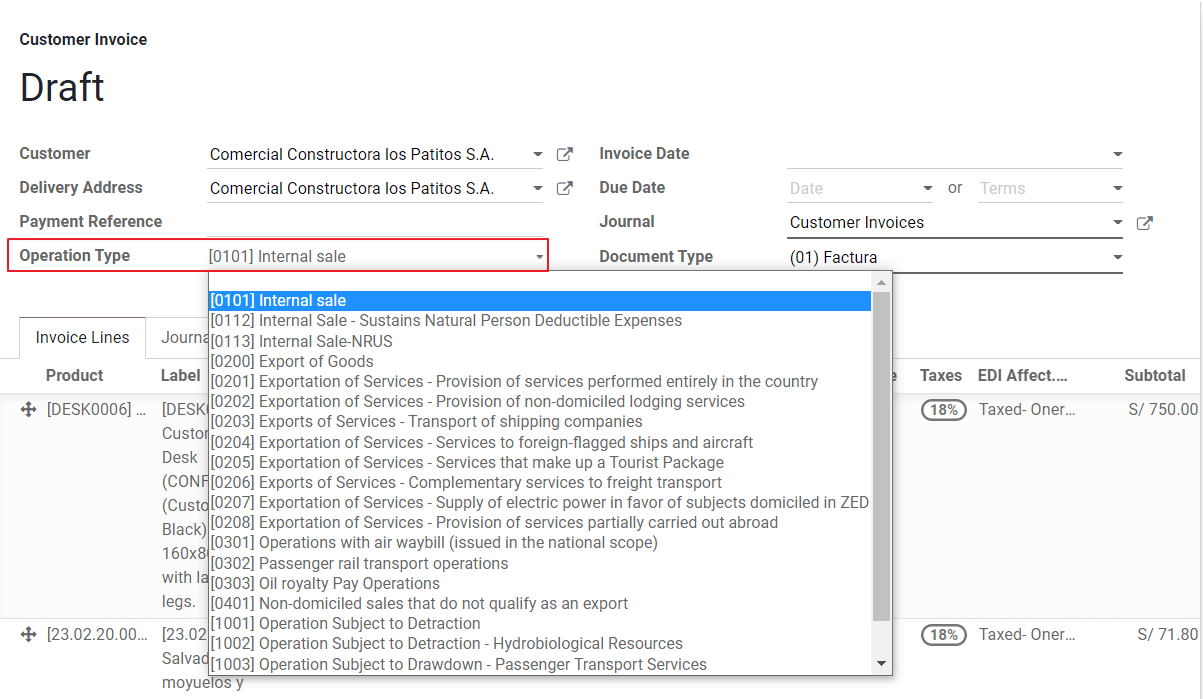

EDI 元素¶

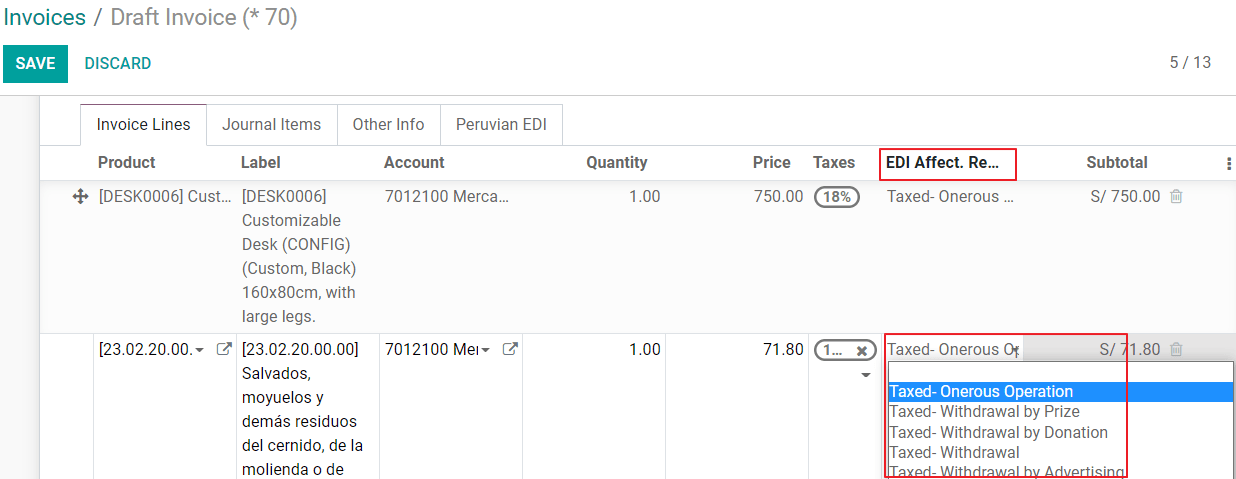

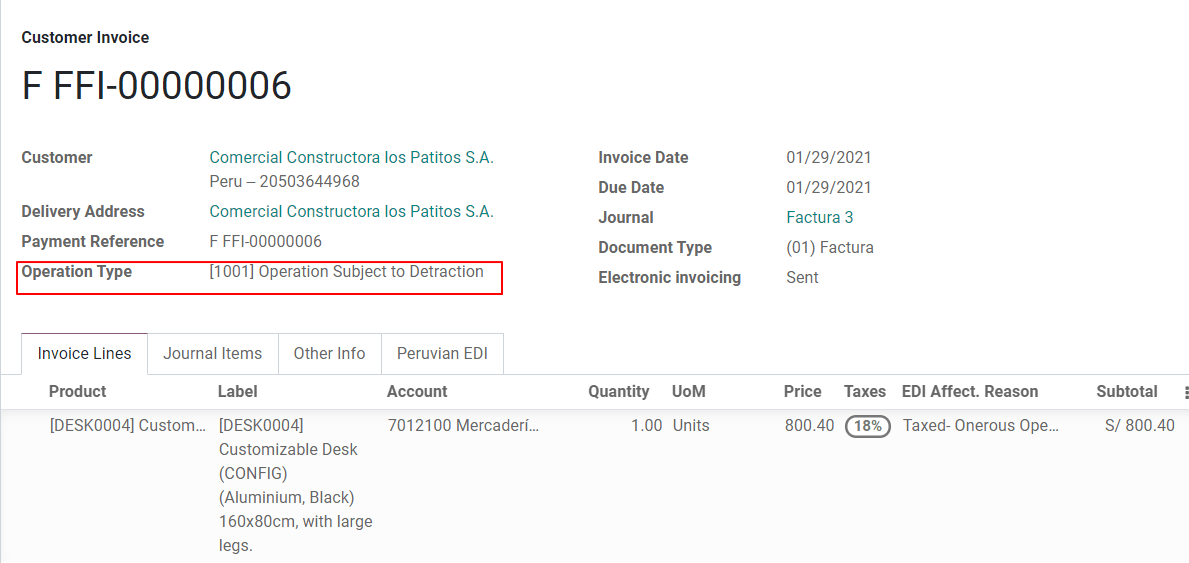

Once you have configured your master data, the invoices can be created from your sales order or manually. Additional to the basic invoice information described on our page about the invoicing process, there are a couple of fields required as part of the Peru EDI:

单据类型:默认值为“电子发票”,但如需更改,您可以手动选择单据类型,例如选择“收据”。

操作类型:此值对于电子发票是必需的,用于指示交易类型,默认值为“内部销售”,但在需要时可以手动选择其他值,例如“货物出口”。

EDI 影响原因:在发票行中,除了税额外,还有一个字段“EDI 影响原因”,该字段根据显示的 SUNAT 列表确定税务范围。所有默认加载的税项都与一个默认的 EDI 影响原因相关联,如需更改,您可以在创建发票时手动选择其他原因。

发票验证¶

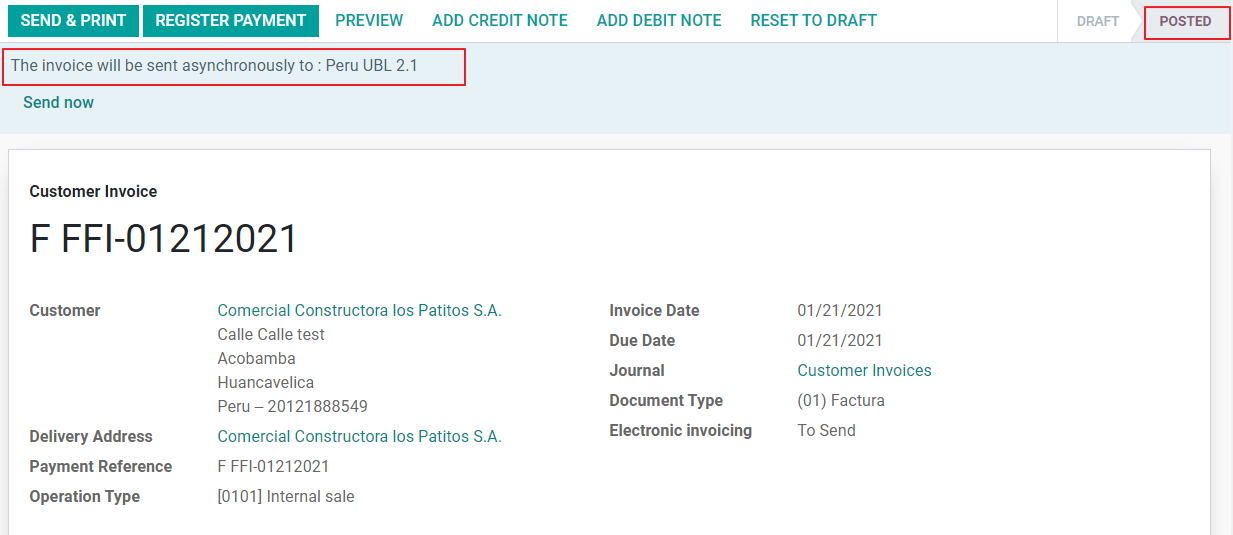

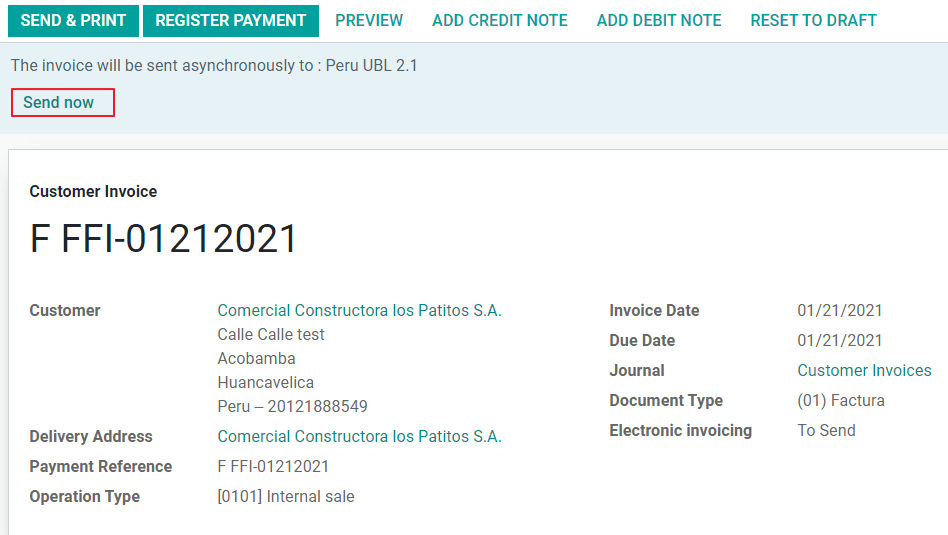

在确认发票中的所有信息正确无误后,您可以继续进行验证。此操作将登记会计分录,并触发电子发票流程,将其发送至OSE和SUNAT。发票顶部将显示以下消息:

异步意味着在发票过账后,文档不会自动发送。

电子发票状态¶

待发送: 表示该文档已准备好发送至 OSE,可以通过 Odoo 每小时运行一次的 cron 任务自动完成,或者用户可以立即点击按钮“立即发送”进行发送。

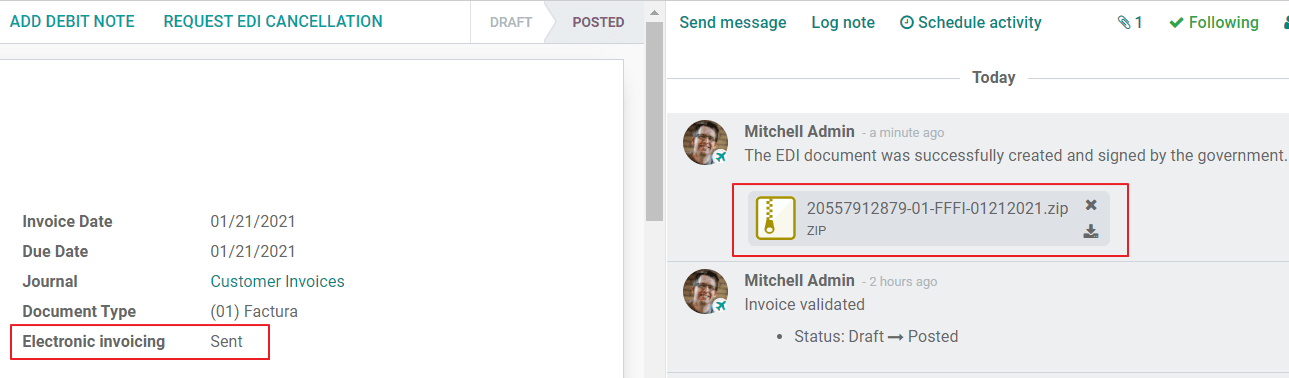

已发送:表示该文件已发送至OSE并成功通过验证。在验证过程中,会下载一个ZIP文件,并在聊天记录中添加一条消息,表明已正确通过政府验证。

如果出现验证错误,电子发票的状态将保持为“待发送”,以便进行修正并重新发送发票。

警告

每次发送文档进行验证时,将消耗一个信用额度。因此,如果在发票中检测到错误并再次发送,则总共将消耗两个信用额度。

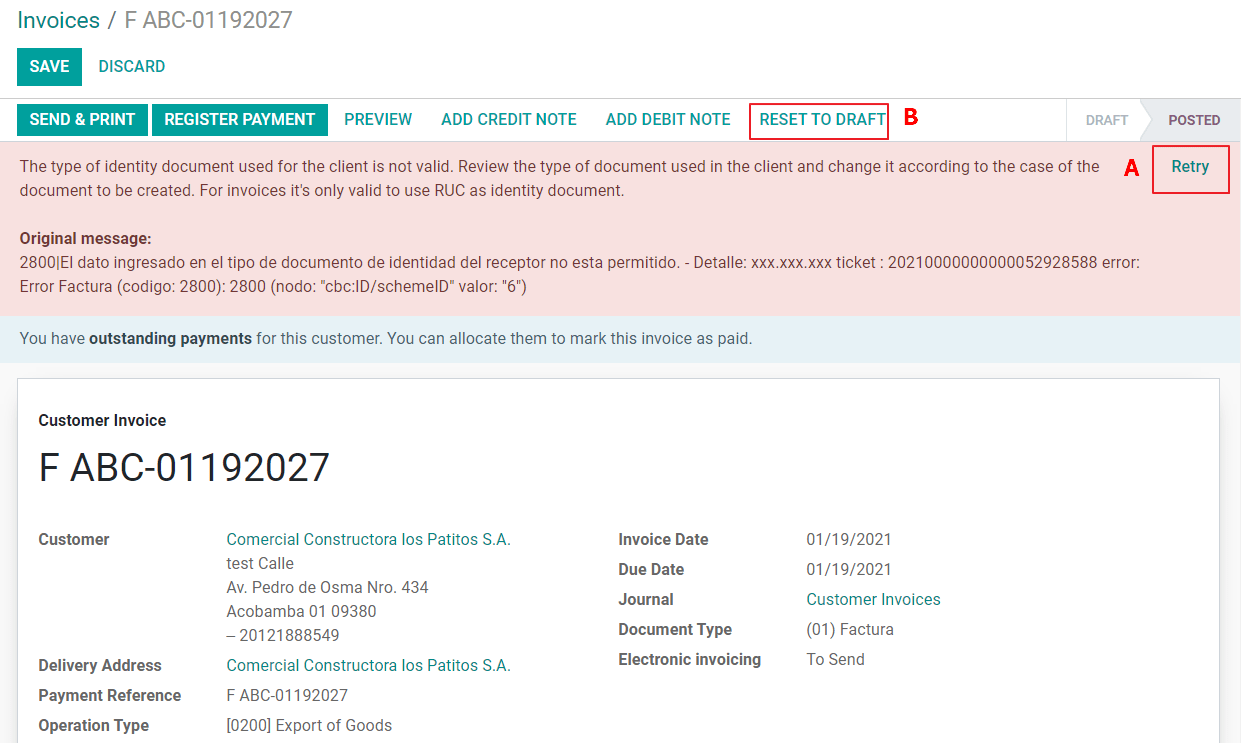

常见错误¶

由于 OSE 或 SUNAT 的拒绝,可能有多种原因。当发生这种情况时,Odoo 会在发票顶部发送一条消息,说明错误详情,并在最常见的情况下提供解决问题的提示。

如果收到验证错误,您有两个选项:

如果错误与业务伙伴、客户或税项的主数据相关,您可以直接在相应记录上进行修改(例如客户身份类型),修改完成后点击“重试”按钮即可。

如果错误是由于发票上直接记录的数据引起的(如业务类型、发票行中缺失的数据),正确的解决方法是将发票重置为草稿状态,应用更改后,再次将发票发送至SUNAT进行重新验证。

如需了解更多详情,请参阅 SUNAT 常见错误。

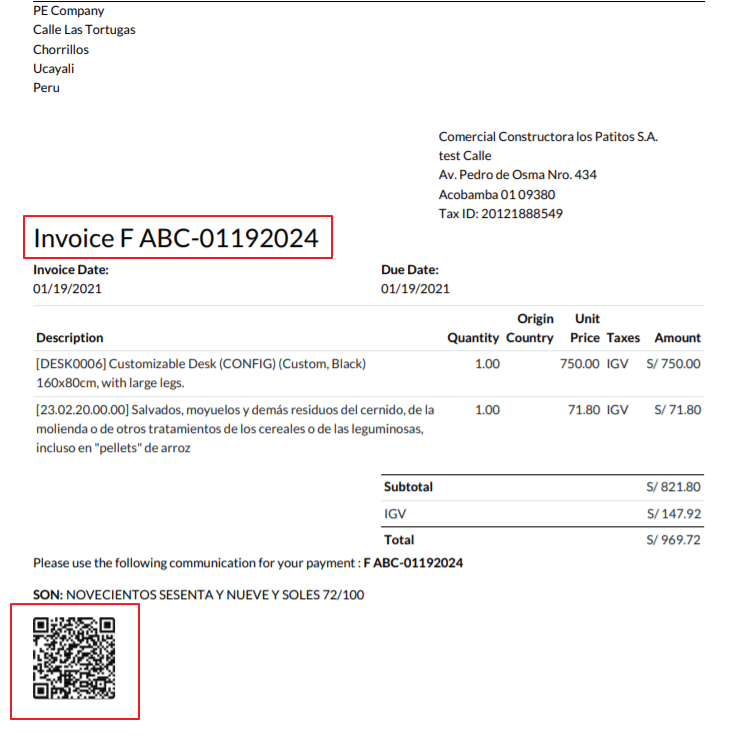

发票PDF报告¶

在发票经 SUNAT 接受并验证后,可以打印发票的 PDF 报告。该报告包含一个二维码,表明该发票是一份有效的财政文件。

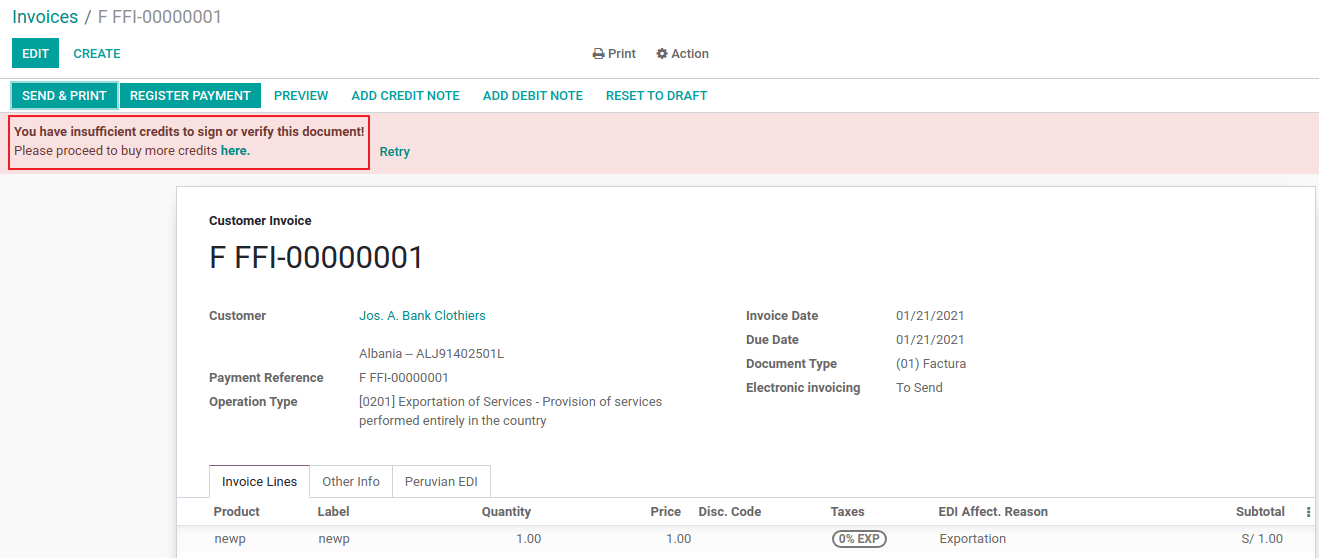

IAP 信用额度¶

Odoo 的电子 IAP 服务提供 1000 个免费积分,当这些积分在您的生产数据库中使用完毕后,您的公司必须购买新的积分以处理您的交易。

一旦信用额度用完,发票顶部会显示一个红色标签,表明需要额外的信用额度,您可以通过访问消息中提供的链接轻松购买。

IAP 服务包含根据积分数量不同而定价的套餐。IAP 中的价格列表始终以欧元 (EUR) 显示。

特殊使用情况¶

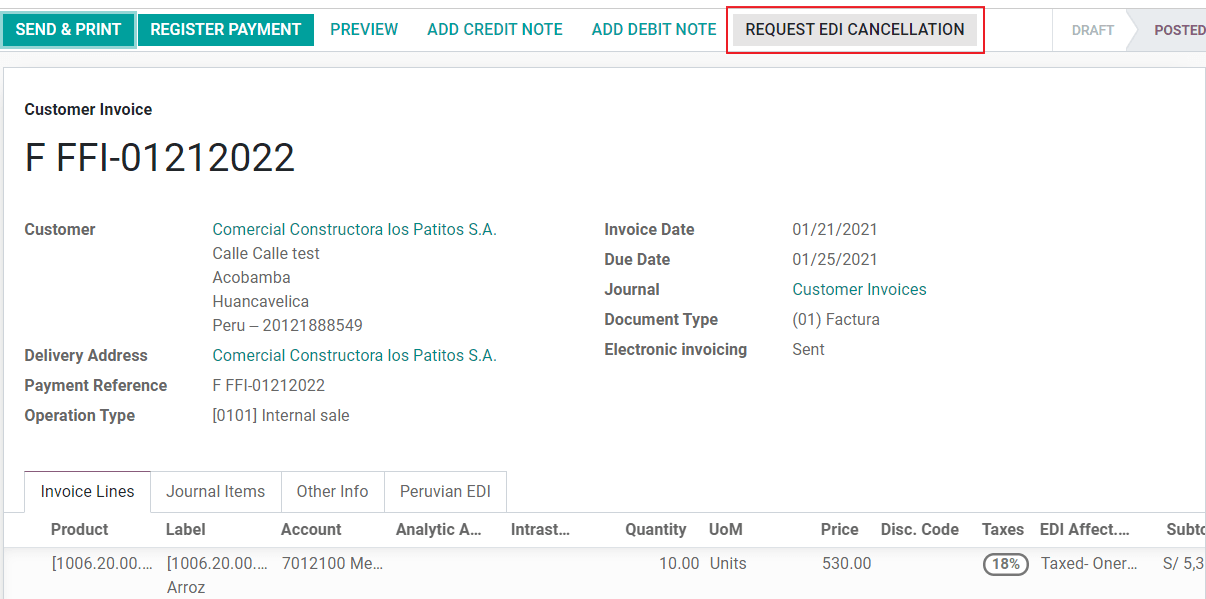

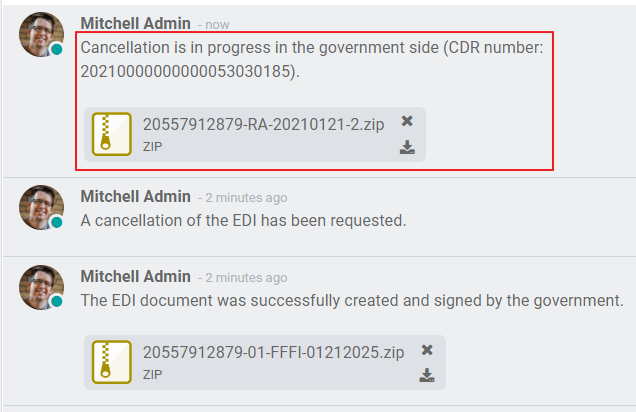

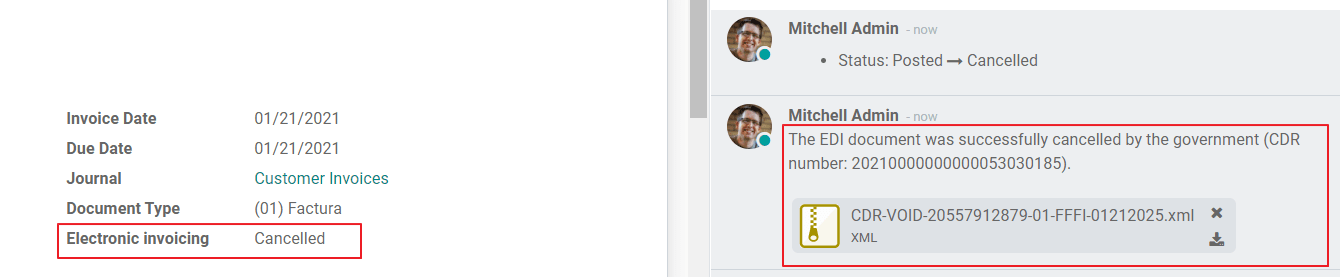

取消流程¶

某些场景需要取消发票,例如发票是错误创建的。如果发票已经发送并经秘鲁税务署(SUNAT)验证,正确的操作方式是点击“请求取消”按钮:

为了取消发票,请提供取消原因。

电子发票状态¶

取消操作:表示取消请求已准备好发送至 OSE,可以通过 Odoo 每小时运行一次的 cron 任务自动完成,或者用户可以立即通过点击按钮“立即发送”来发送。一旦发送,将创建一个取消工单,作为结果,下一条消息和 CDR 文件将在聊天中记录:

已取消:表示取消请求已发送至OSE并成功验证。在验证过程中会下载一个ZIP文件,并在聊天记录中添加一条消息,表明政府验证正确。

警告

每次取消请求消耗一个信用额度。

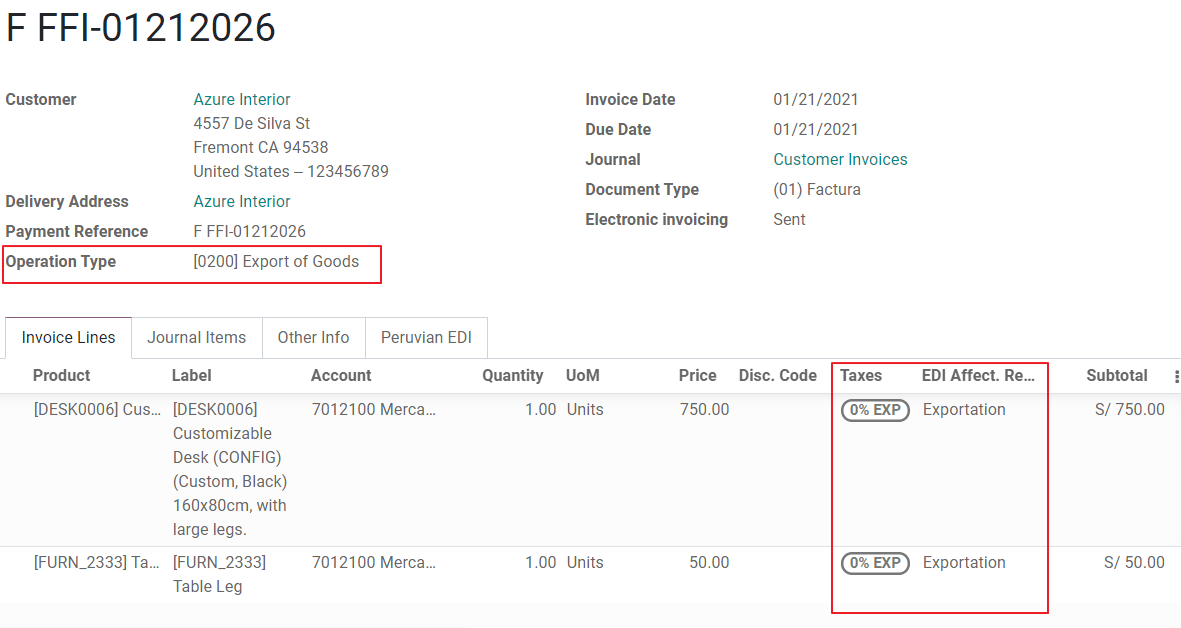

导出发票¶

在创建出口发票时,请注意以下事项:

您的客户的身份类型必须为外国身份证。

您的发票中的业务类型必须为出口类型。

发票行中包含的税款应为应税增值税(EXP税)。

预付款¶

创建预付款发票并应用相关付款。

创建最终发票,不考虑预付款。

为最终发票创建一张贷项通知单,金额等于预付款金额。

将贷项通知单与最终发票进行对账。

最终发票上的剩余余额应通过常规的付款交易进行支付。

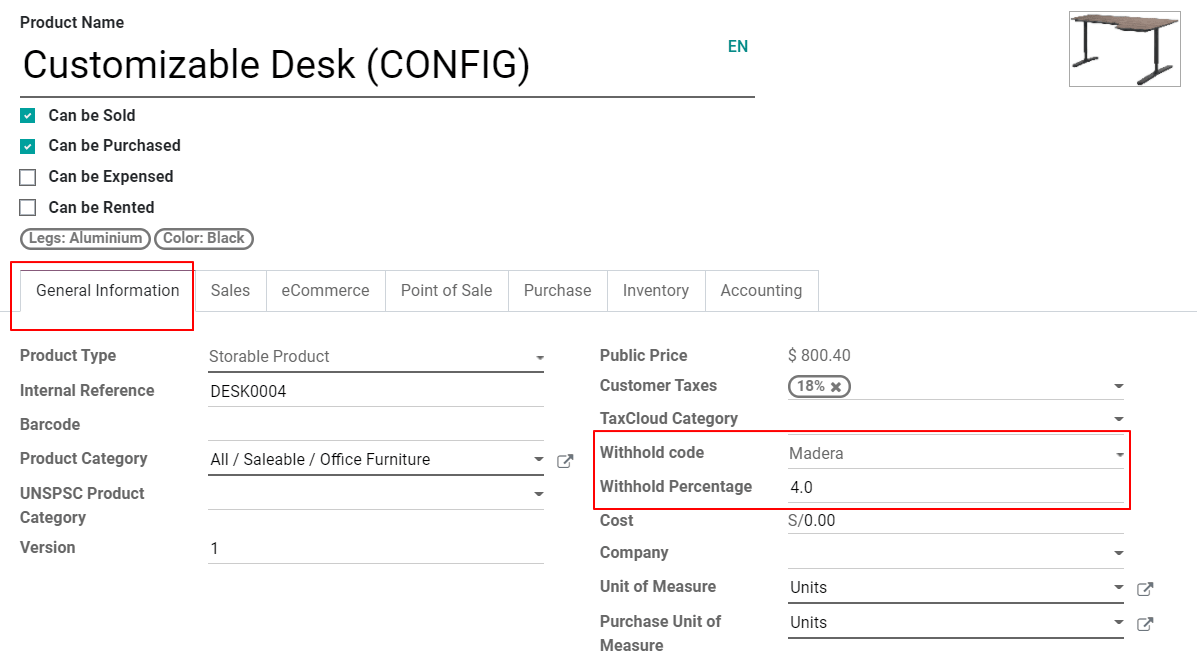

扣款发票¶

在创建需缴纳扣押金的发票时,请注意以下事项:

发票中包含的所有产品必须配置以下字段:

您的发票中的操作类型必须为

1001

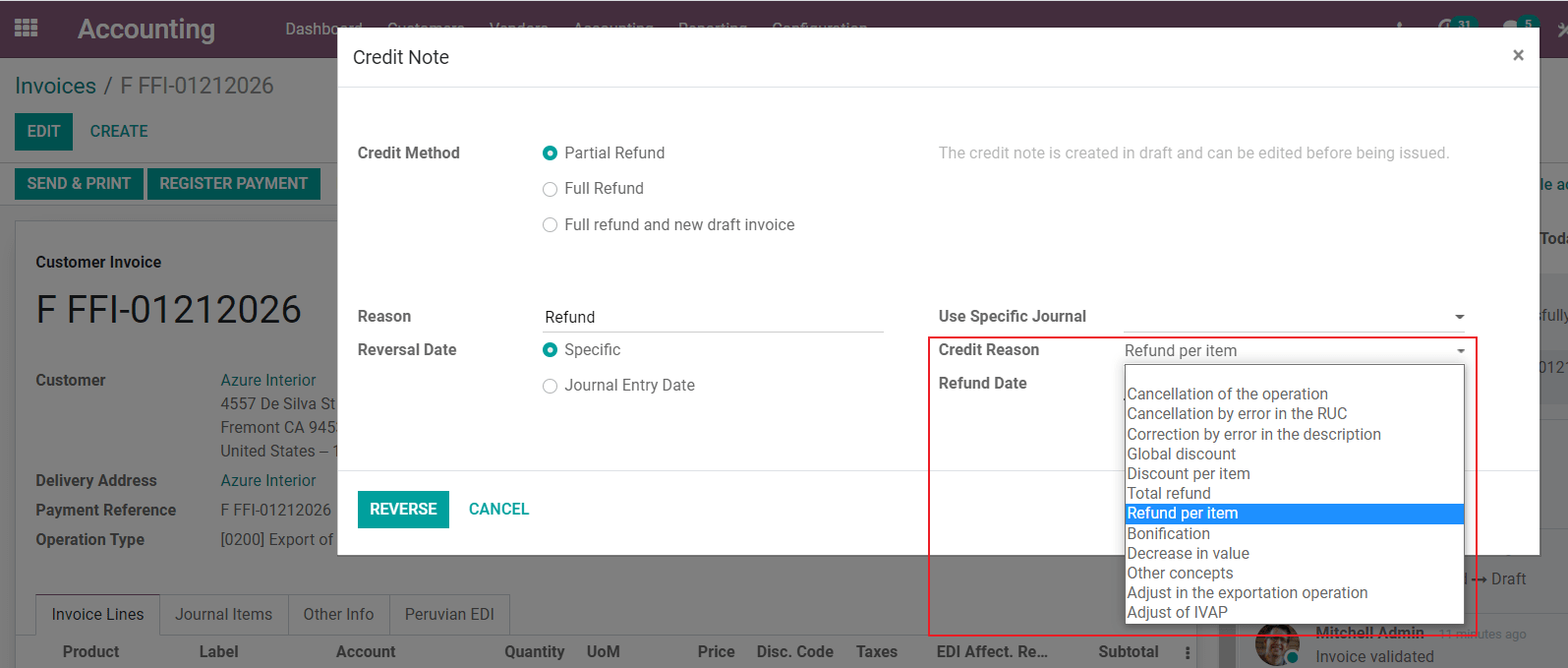

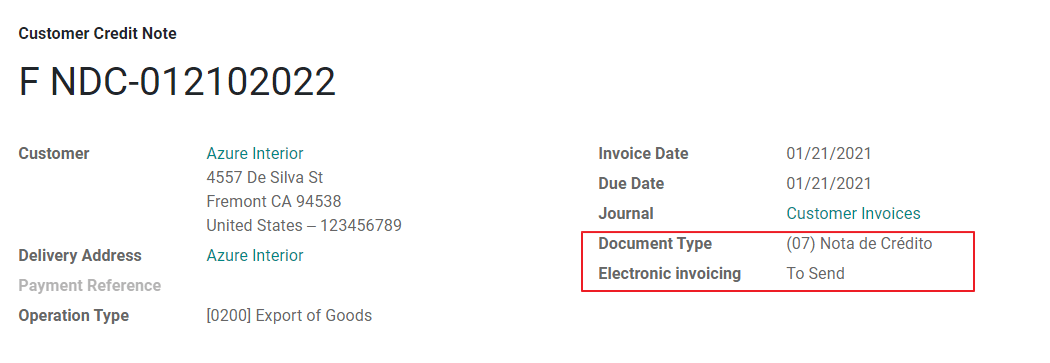

贷项通知单¶

当需要对已验证的发票进行更正或退款时,必须生成一张贷项通知单。只需点击“添加贷项通知单”按钮即可。作为秘鲁本地化的一部分,您需要选择一个原因来证明该贷项通知单,并从列表中选择一个选项。

小技巧

创建您的第一张贷项通知单时,请选择贷项方式:部分退款,这允许您定义贷项通知单的编号序列。

默认情况下,贷项通知单在文档类型中设置为:

如需完成工作流,请参阅我们关于贷项通知单的页面:我们的贷项通知单页面。

注解

信用证的EDI工作流程与发票的工作流程相同。

借项通知单¶

作为秘鲁本地化的一部分,除了从现有单据创建贷项通知单外,您还可以创建借项通知单。只需使用“添加借项通知单”按钮即可。

默认情况下,贷项通知单在文档类型中设置。

电子交付指南 2.0¶

*电子运单指南*(GRE)是由发货人生成的电子文件,用于支持货物从一个地点(如仓库或经营场所)到另一个地点的运输或转移。在 Odoo 中,在成功使用此功能之前,需要进行若干配置步骤。

运输电子凭证 guía de remisión electrónica 的使用是强制性的,根据 SUNAT 的规定,纳税人如需转移其产品必须使用该电子文件,但适用 *单一简化制度*(régimen único simplificado 或 RUS)的纳税人除外。

配送指南类型¶

发件人¶

当进行销售、提供服务(包括处理过程)、将货物用于指定用途,或在同一家公司的不同场所之间转移货物时,会发出*发货人*类型的配送指南。

此发货指南由货物的所有者(即发货人)在运输开始时签发。Odoo 支持发货人提供的发货指南。

另请参见

承运商¶

承运商 运输指南类型用于说明司机(或承运商)提供的运输服务。

此运输指南由承运人签发,当货物通过公共交通运输时,必须向每个发货人提供。

重要

承运商交付指南在 Odoo 中**不**受支持。

另请参见

运输类型¶

私有¶

当所有者使用自有车辆运输货物时,使用“私有”运输类型选项。在这种情况下,必须开具发货人的交付指南。

公共¶

当外部承运商运输货物时,使用“公开”运输类型选项。在这种情况下,必须签发两份交付指南:发货人的交付指南和承运人的交付指南。

直接提交至秘鲁税务署¶

在 Odoo 中创建 GRE 交货指南 必须 直接发送至 SUNAT,无论电子文档提供商是 IAP、Digiflow 还是 SUNAT。

所需信息¶

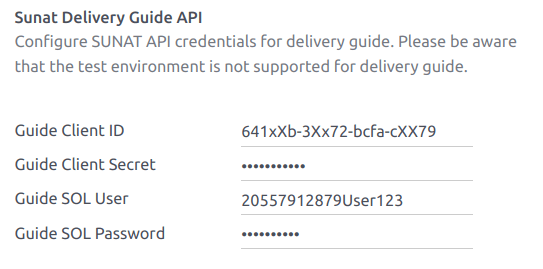

电子交付指南版本 2.0 要求在通用配置、车辆、联系人和产品方面提供更多信息。在通用配置中,需要添加新的凭据,您可以通过访问 SUNAT 门户获取这些凭据。

取消¶

只要满足以下条件,发件人和承运人都可以取消电子运单:

运输尚未开始。

如果已启动运输,必须在到达最终目的地之前更改收件人。

重要

SUNAT 现不再使用“Anula”这一术语,而是现在使用“Dar de baja”来表示注销。

测试¶

SUNAT 不支持测试环境。这意味着任何错误生成的交付指南 将 被发送至 SUNAT。

如果由于错误在此环境中创建了运单,有必要从 SUNAT 门户中删除它。

配置¶

重要

目前 Odoo 中唯一支持的运单类型是电子发送方的 GRE。

配送指南依赖于 Odoo 库存 应用,以及 l10n_pe_edi 和 l10n_pe 模块。

必须添加第二个用户以创建电子文档。

在完成 电子发票 和 主数据 的配置步骤后,安装 秘鲁 - 电子送货单 2.0 模块(l10n_pe_edi_stock_20)。

接下来,你需要从 SUNAT 获取 客户端ID 和 客户端密钥。为此,请参考 新平台GRE网络服务手册。

注解

在 SUNAT 门户中,启用正确的访问权限非常重要,因为这些权限可能与电子发票使用的用户权限不同。

这些凭据应用于从 配置发货指南的通用设置。

注解

需要根据在 SUNAT 门户中生成 GRE API 凭据时所选的用户,按照 RUC + UsuarioSol 的格式(例如:20557912879SOLUSER)填写 SOL 用户指南 字段。

操作员¶

在配送单通过*私人*运输的情况下,*操作员*是指车辆的驾驶员。

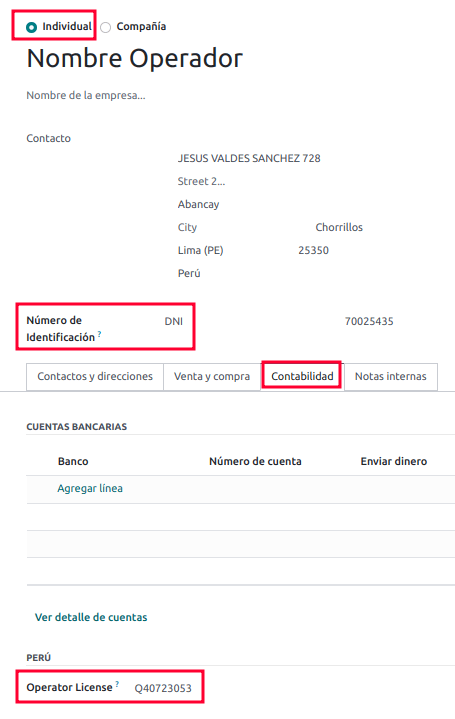

要创建一个新操作员,请导航至 并填写联系人信息。

首先,选择 个人 作为 公司类型。然后,在联系人表单的 会计 选项卡中添加 运营商许可证。

请确保以下字段在客户地址中填写完整:

地区

税号 (身份证号/税务登记号)

税务编号

承运商¶

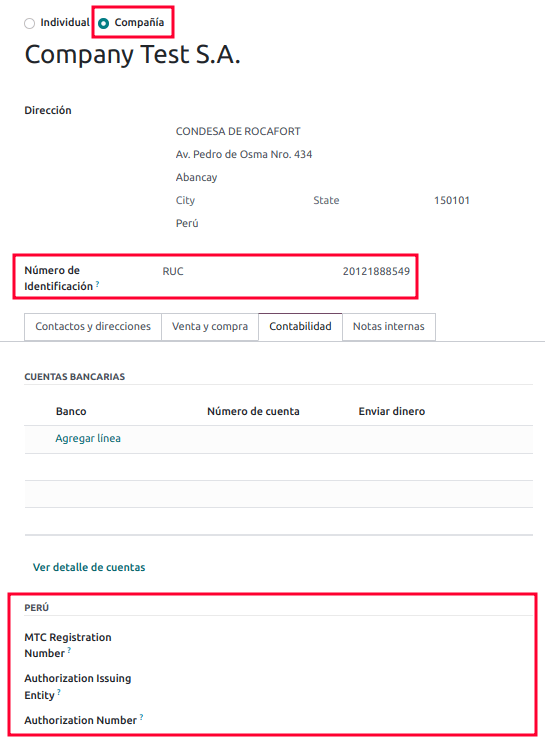

当通过*公共交通*进行配送时,使用*承运商*。

要创建一个新的承运商,请导航至 并填写联系人信息。

首先,将 公司 选择为 公司类型。然后,添加 MTC 注册编号、授权发放机构 和 授权编号。

请确保以下字段已填写完整:公司地址

地区

税号 (身份证号/税务登记号)

税务编号

车辆¶

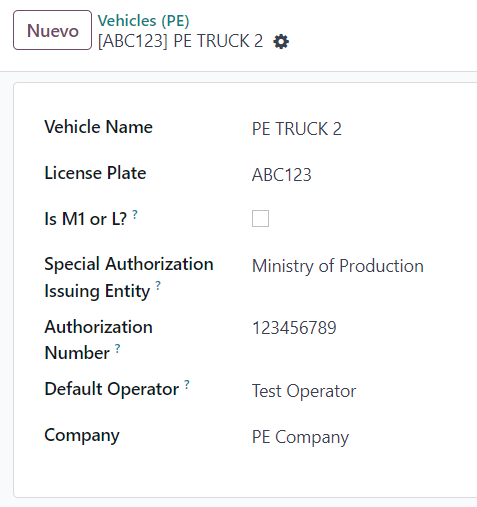

要配置可用的车辆,请导航至:,并填写车辆表单以输入车辆所需的信息:

车辆名称

车牌号

是 M1 还是 L?

特殊授权发证机构

授权编号

默认操作员

公司

重要

如果车辆的轮子少于四个或座位少于八个,需要勾选 是否为M1或L类 复选框。

产品¶

要配置可用产品,请导航至 ,并打开要配置的产品。

请确保产品表单中适用的信息已完全配置。需要填写 :guilabel:`海关税则号`(关税项目)字段。

生成 GRE¶

在销售流程中创建库存发货后,请确保在调拨单表单的右上角部分填写 GRE 字段,对应字段为:

运输类型

调拨原因

出发开始日期

It is also required to complete the Vehicle and Operator fields under the Guia de Remision PE tab.

配送调拨必须标记为 完成,以便在调拨表单的左侧菜单中显示 生成运单 按钮。

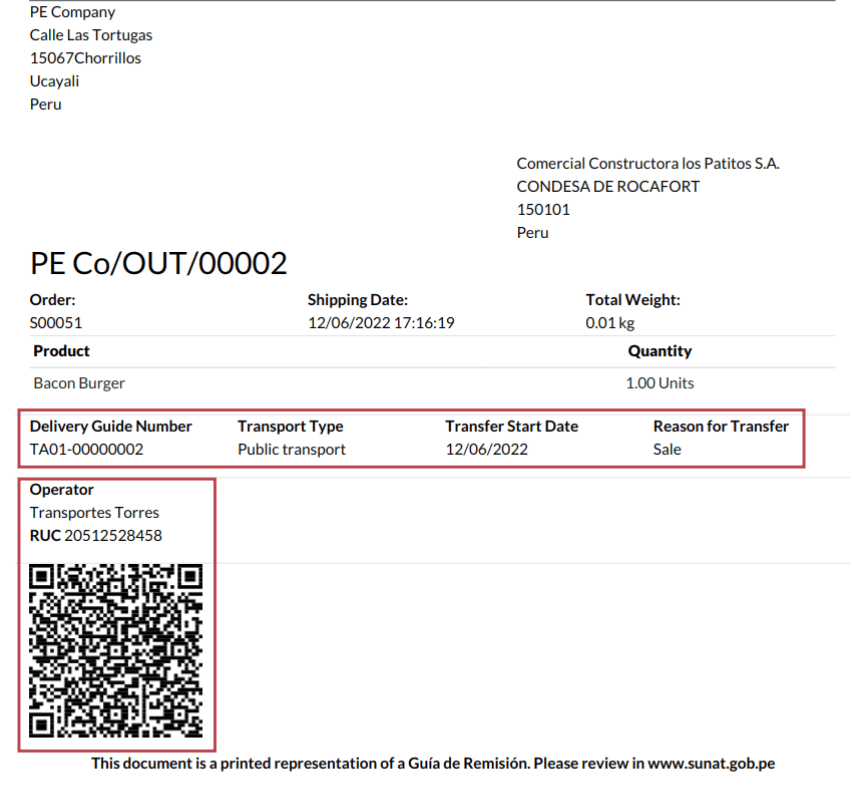

一旦运输表单经 SUNAT 正确验证,生成的 XML 文件将出现在聊天栏中。现在您可以打印显示运输详情和经 SUNAT 验证的二维码的发货单。

常见错误¶

不同产品的前缀(某些为 T001,其他为 T002)目前,Odoo 尚不支持对产品的前缀进行自动化处理。可以手动为每个产品输出设置前缀。也可以对不可存储的产品进行此操作。但请注意,这样将无法实现追溯性。

2325 - 毛重测量 - 该数据不符合指定格式 "缺少字段" "重量" 在产品中当产品的重量设置为

0.00时,会触发此错误。要解决此问题,您需要取消运单并重新创建。在创建新的运单之前,请确保已修复产品的重量,否则将会导致相同的错误。JSONDecodeError: Expecting value: line 1 column 1 (char 0) when creating a Delivery Guide此错误通常是由于 SOL 用户问题引起的。请验证用户与 SUNAT 的连接;SOL 用户必须使用公司 RUT 加上用户 ID 进行创建。例如

2012188549JOHNSMITH。与货物运输相关的单据编号不符合规定格式:错误:相关单据关联文档类型 和 关联文档编号 字段仅适用于发票和收据。

400 Client error: Bad Request for URL此错误无法通过 Odoo 解决;建议您联系 SUNAT 并核实用户信息。可能需要创建一个新用户。

在元素 'cac:BuyerCustomerParty' 开始处发现了无效内容当调拨原因设置为“其他”时,会触发此错误。请选择其他选项。根据 SUNAT 的运单指南官方文档,调拨原因 03(销售并发送至第三方) 或 12(其他) 在 Odoo 中无法使用,因为您不应拥有空的或空白的客户。

客户疑问:使用 GRE 2.0 时 IAP 信用额度的消耗对于使用 IAP 的实时客户,理论上不会消耗信用额度,因为这些文档不经过 OSE,即这些文档直接发送至 SUNAT。

GRE 2.0 凭据格式错误(跟踪错误)Odoo 当前在数据库中的凭据未正确配置时,会抛出带有回溯信息的错误,而不是显示提示消息。如果您的数据库出现此情况,请检查您的凭据。

电子商务电子发票¶

首先,安装 秘鲁电商 (l10n_pe_website_sale) 模块。

**秘鲁电商平台**模块可启用以下功能和配置:

允许客户为 电子商务 目的创建在线账户;

需要在 电子商务 应用程序中支持财务字段;

在线接收销售订单的付款;

从 电子商务 应用生成电子文档。

注解

秘鲁电子商务 模块依赖于之前安装的 发票 或 会计 应用,以及 网站 应用。

配置¶

在配置完秘鲁的 电子发票 流程后,完成以下 电子商务 流程的配置:

产品: 将 开票政策 设置为 订购数量,并定义所需的 客户税项。

支付方式;

运输方式: 对于每种配送方式,请将 供应商 字段设置为 固定价格。然后,设置一个大于

0.00`(非零)的 :guilabel:`固定价格金额,因为配送方式的价格会添加到发票行中。

注解

Mercado Pago 是 Odoo 支持的在线支付提供商,覆盖拉丁美洲的多个国家、货币和支付方式。

请确保在运输方式的 配送产品 上定义 销售价格,以防止在使用 SUNAT 验证发票时出现错误。

要提供免费配送,请手动移除 配送产品,或者至少在发票中使用 `$0.01`(一美分),以便通过 SUNAT 验证。

电子商务的开票流程¶

一旦完成 配置,已登录的客户在结账过程中将可以使用税务输入字段。

当客户在结账时输入其财政数据并完成成功购买后,将生成包含相应 EDI 元素的发票。文档类型(小票/发票)根据其税务编号(RUC/DNI)进行选择。然后必须 将发票发送至 OSE 和 SUNAT。默认情况下,所有已发布的发票每天通过计划任务自动发送,但如需也可以手动发送每张发票。

一旦发票通过 SUNAT 验证,客户可以通过点击 下载 按钮,直接从客户门户下载包含 CDR、XML 和 PDF 文件的 .zip 文件。