意大利¶

配置¶

安装 以下模块以获得意大利本地化的所有功能:

名称 |

技术名称 |

描述 |

|---|---|---|

意大利 - 会计 |

|

默认 财政本地化包装 |

意大利 - 电子发票 |

|

电子发票实施 |

意大利 - 电子发票(代扣) |

|

电子发票扣款 |

意大利 - 财务报表 |

|

特定国家的报告 |

意大利 - 库存 DDT |

|

运输单据 - 运输单据(DDT) |

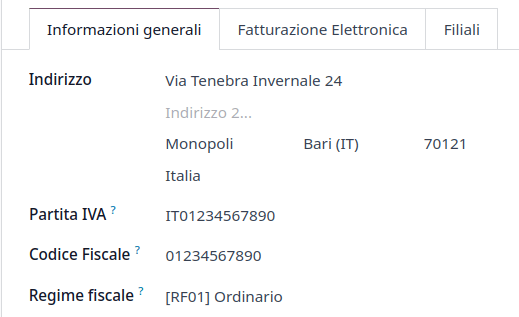

公司信息¶

配置公司的信息可确保您的会计数据库正确设置。要添加信息,请转到 ,在 公司 部分,点击 更新信息。从此处,填写以下字段:

地址:公司的地址;

增值税: 公司的增值税;

税号: 公司的税务代码;

税制: 公司适用的税制;

税金配置¶

许多电子发票功能是通过 Odoo 的税务系统实现的。因此,必须正确配置税务设置,以确保发票能够正确生成并处理其他计费使用场景。

该**意大利**本地化包含针对不同用途的**税项**示例。

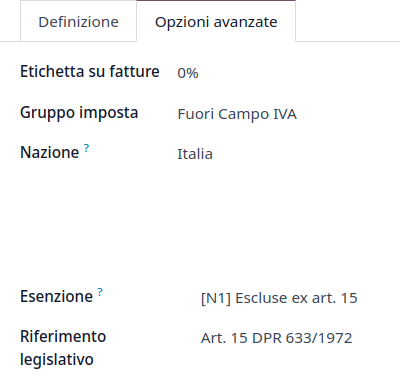

税收豁免¶

根据意大利当局的要求,必须使用税率为**零百分比**(0%)的销售税,以跟踪发票行上所实施免税的准确 免税类型(Natura) 和 法律依据。

Example

欧盟出口税可作为参考(0% EU,发票标签 00eu)。它位于 下。出口免征增值税,因此需要填写 豁免 类型和 法律依据。

另请参见

有许多 免税种类(Natura) 和 法律依据 代码。请确保查看最新版本,以获取以下内容的最新信息:

注解

如果您需要使用其他类型的免税,请转到 ,选择一个类似的税费,然后点击齿轮图标并选择 复制。在 高级选项 选项卡中,添加 免税 和 法律依据。确认后点击 保存。

小技巧

根据其 豁免 情况,在 名称 字段中对您的税项进行重命名,以便轻松区分。

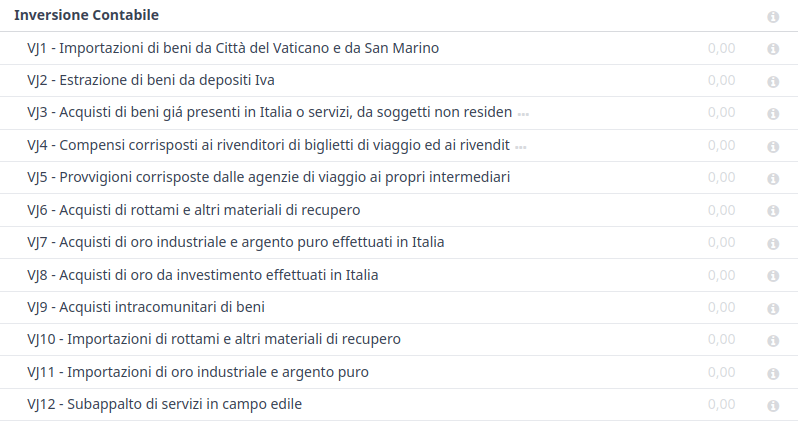

反向收费¶

**反向计税**机制是一种增值税规则,它将缴纳增值税的责任从供应商转移到了客户。客户需要*自行*将增值税支付给 AdE。有不同的类型:

发票¶

**反向计税**客户发票显示无增值税金额,但 AdE 要求卖方指定 税务豁免原因 和 法律依据,以说明反向计税机制的适用性。Odoo 提供了一组特殊的 0% 税种,可以分配给每一张反向计税的发票行,代表最常用的配置。

供应商发票¶

意大利采用反向征税的公司必须将收到的发票中的信息发送至 AdE.

注解

必须开具并发送自报增值税XML文件至 AdE,用于反向征税发票。

在创建供应商发票时,反向征税 税种可以添加到 税种 字段中。您可以通过进入 来查看可用的税种,可以看到 10% 的商品税和 22% 的服务税已启用,以及其他税种。由于意大利税务地位的自动配置,这些税种会自动在税种列表中启用。

税额表¶

意大利本地化有一个专门的 税表 部分用于 反向收费 税款。这些税表可以通过 VJ 标签进行识别,可以进入 查看。

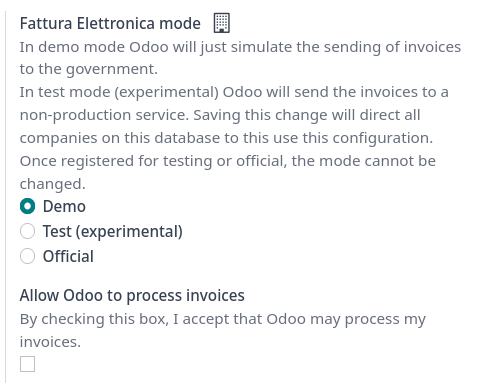

电子发票¶

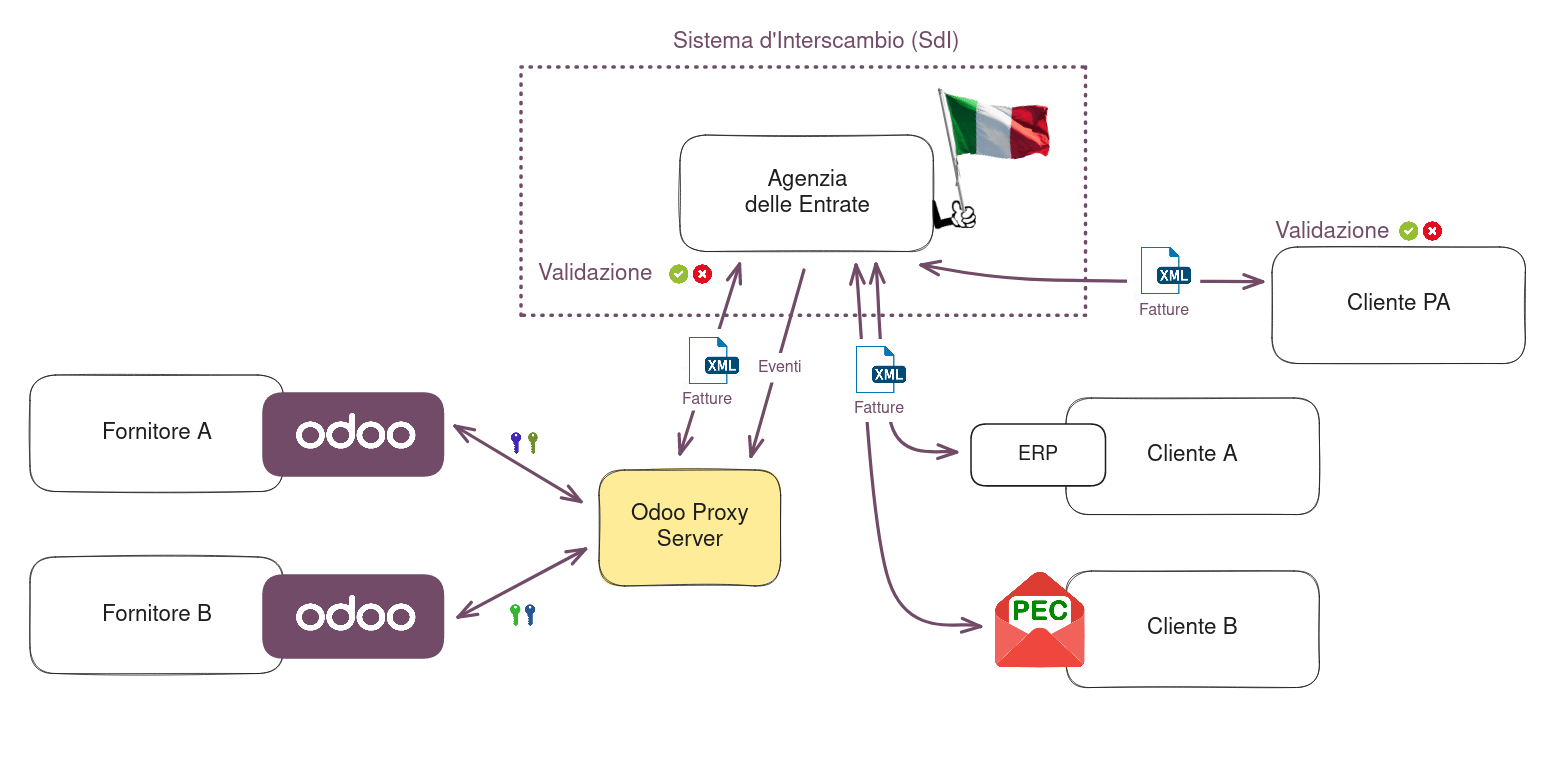

意大利的 SdI 是用于电子发票的 电子发票 系统。它允许向客户发送和接收电子发票。这些文件必须采用名为 FatturaPA 的 XML EDI 格式,并在交付前由系统进行正式验证。

为了能够接收发票和通知,必须通知 SdI 服务,告知其用户的文件需要发送至 Odoo 并由 Odoo 代为处理。为此,您必须在 AdE 门户网站上设置 Odoo 的 目标代码。

前往 意大利当局门户网站 并进行身份验证;

进入菜单项:;

将用户设置为所要配置电子地址的增值税号的法律主体;

在 中,输入 Odoo 的 目的地代码

K95IV18,并确认。

处理过程¶

向意大利的 SdI 提交发票是一项电子流程,用于在企业与 AdE 之间以 XML 格式强制传输税务文件,以减少错误并验证操作的正确性。

注解

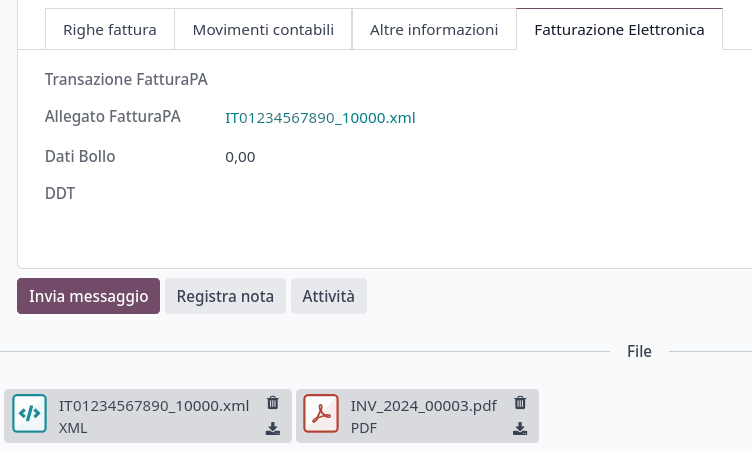

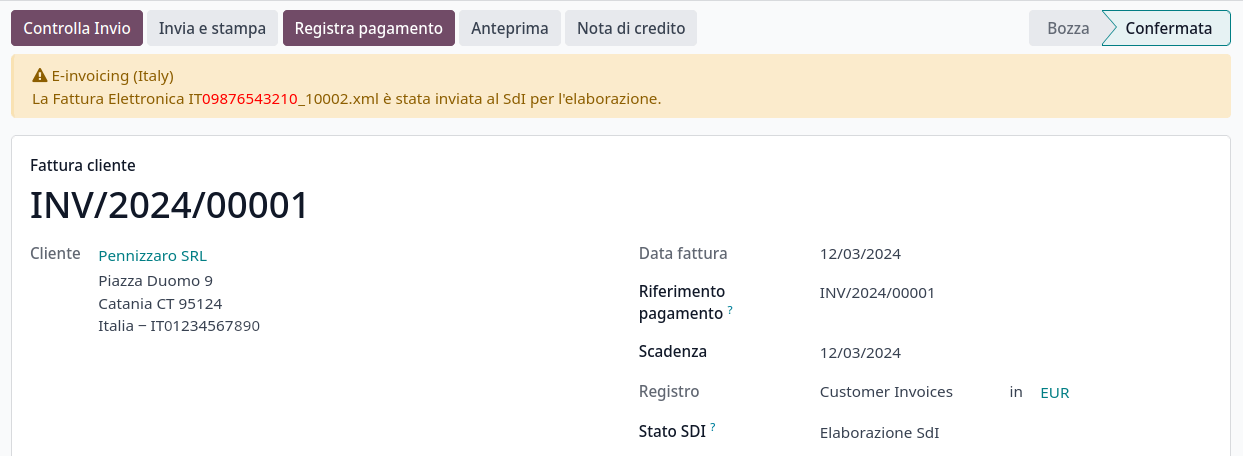

你可以通过 SdI 状态 字段查看发票的当前状态。XML 文件已附加到发票上。

XML 文件创建¶

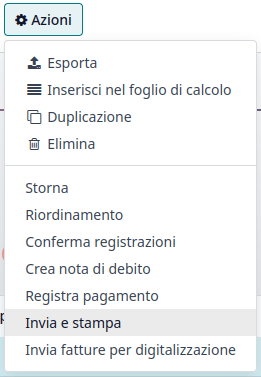

Odoo 会将所需的 XML 文件作为附件生成,格式为 AdE 要求的 FatturaPA 格式。选择所需的发票后,点击 操作,然后单击 发送并打印。

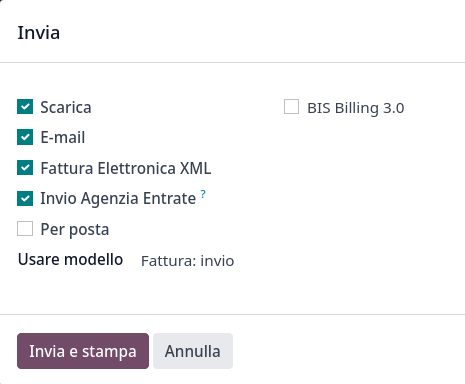

当弹出窗口打开时,会显示一系列可执行的操作。生成 XML 文件 用于生成附件。

发票的 XML 文件和 PDF 文件均可在附件中找到。

提交至 SDI¶

在 发送和打印 对话框中的 发送至税务机关 选项会将附件发送至 代理服务器,该服务器会收集所有请求,然后通过 WebServices 通道将它们转发至 SdI。可以通过发票视图顶部的 检查发送状态 按钮查看发票的发送状态。

通过 SDI 处理¶

该 SdI 接收文档并检查是否存在错误。在此阶段,发票处于 SdI 处理中 状态,如发票上所示。该发票还会被分配一个 FatturaPA 交易 编号,该编号显示在 电子发票 选项卡中。检查所需时间可能有所不同,从几秒到一天不等,具体取决于意大利全国发送的发票队列情况。

验收¶

如果文档有效,它将被记录并被视为由 AdE (Agenzia delle Entrate)`(意大利税务局)认可的财政有效性文档,如果在该机构门户网站上明确请求,则会将其归档至 :guilabel:`替代存储(Conservazione Sostitutiva)。

警告

Odoo 不提供 替代保存 要求。其他供应商和 AdE 提供免费且经过认证的存储服务,以满足法律要求的规范。

该 SdI 目标代码 会尝试将发票发送至客户提供地址,无论是 PEC 邮件地址,还是其 ERP 系统的 SdI 目标代码 对应的 WebServices 通道。每 12 小时最多尝试 6 次,因此即使未成功,此过程也可能持续多达三天。发票状态为 由 SDI 接收,正在转发给业务伙伴。

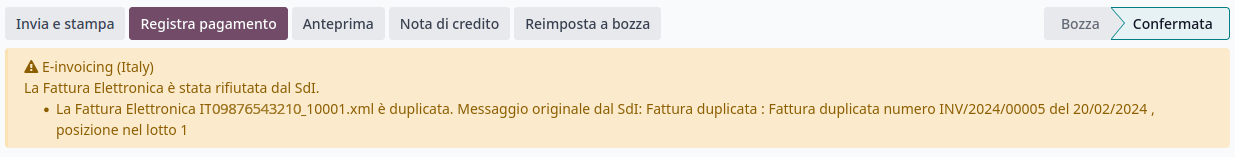

可能的拒绝¶

The SdI may find inaccuracies in the compilation, possibly even formal ones. In this case, the invoice is in the SDI Rejected state. The SdI’s observations are inserted at the top of the Invoice tab. To resolve the issue, it is sufficient to delete the attachments of the invoice, return the invoice to Draft, and fix the errors. Once the invoice is ready, it can be resent.

注解

要重新生成 XML,必须同时删除 XML 附件和 PDF 报告,以便它们能够一起重新生成。这确保了两者始终包含相同的数据。

已转发完成¶

发票已发送给客户;不过,您仍可以通过电子邮件或邮寄方式将PDF格式的副本发送给客户。其状态为:由SDI接受,已发送给业务伙伴。

如果 SdI 无法联系到您的客户,可能是因为该客户尚未在 AdE 门户网站上注册。在这种情况下,请确保通过电子邮件或邮寄方式发送发票的 PDF 文件。此时,发票将处于 由 SdI 接收,业务伙伴投递失败 状态。

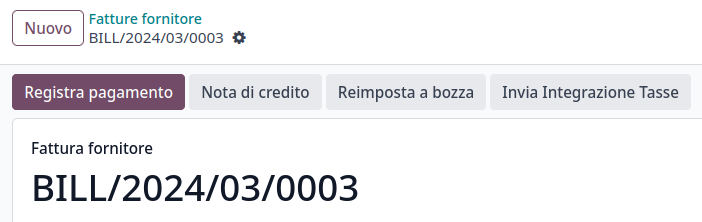

税款集成¶

当你收到供应商发票时,无论是来自 SdI、纸质发票还是从导入的 XML 文件中获得的,税务机关可能会要求你将一些税务信息整合后返回至 SdI。这种情况发生在原本免税的交易由于任何原因变为应税交易时。

Example

以下是一个非详尽的列表:

- 意大利/反向收费作为采购方,您需要对所购买的商品缴纳相关税款并整合税务信息。 反向征税 税款。

- 意大利/分拆付款作为 PA 业务采购方,您需要缴纳税款并整合税务信息。请确保将您收到的供应商发票上的 0% 销售税 替换为正确的 分拆付款 税款。

- 自用电量当你作为企业主将原本用于商业用途的资产用于个人用途时,你需要为该资产原先作为业务成本抵扣的税款进行缴纳。

Odoo 可能会检测到您的供应商发票可以被解释为一种需要税务集成的文档类型,具体请参见 文档类型 章节。

重要

请确保将您收到的供应商发票上的 0% 销售税 替换为您应支付给 AdE 的税率。然后,在单个供应商发票表单的顶部会出现一个按钮,用于发送它们。

点击 发送税务集成 按钮时,会生成相应 文档类型 的 XML 文件,将其附加到账单上,并像发票一样进行发送。

文档类型¶

该 SdI 要求企业通过 EDI 发送客户发票和其他文件。

以下 单据类型 代码在技术上分别代表不同的业务应用场景。

TD01 - 发票¶

这代表了通过 SdI 交换的所有发票的典型 国内 场景。任何不属于特定特殊情形的发票都被归类为常规发票,由 文档类型 TD01 进行标识。

TD02 - 预付款¶

预付款 发票与普通发票使用不同的 文档类型 代码 TDO2 进行导入/导出。在导入发票时,会生成一张普通的供应商账单。

Odoo 在满足以下条件时会将交易导出为 TD02:

这是一张发票;

所有发票行都与预付款销售订单行相关。

TD04 - 信用证¶

它是针对所有**贷方**(credit notes)向**国内**客户发出的标准场景,当需要正式确认卖方正在减少或取消之前开具的**发票**(invoice)时,例如在多收费、错误商品或超额付款的情况下。与**发票**(invoices)一样,它们必须发送到 SdI,其 文档类型 为 TD04。

TD07、TD08、TD09 - 简化开票¶

可以使用简化的发票(TD07)、红字冲销单(TD08)和贷项通知单(TD09)来证明金额不超过 400 欧元(含增值税)的国内交易。其状态与普通发票相同,但所需信息要求更少。

为了建立一份简化的发票,它必须包含:

客户发票 编号:唯一**的编号序列,**无间断;

发票日期: 发票的 日期;

公司信息:在 下,**卖方**的完整资质信息(增值税号/税号、名称、详细地址);

增值税: **买方**的增值税/税号(在业务伙伴表单中);

总计: 发票的总 **金额**(含增值税)。

在 EDI 中,Odoo 会以简化形式导出发票,当满足以下条件时:

这是一项国内交易(即,业务伙伴来自意大利);

您公司的 必填字段**(:guilabel:`增值税号` 或 :guilabel:`税号`,:guilabel:`财政制度`,以及完整的 **地址)已提供;

该业务伙伴的地址未完整填写(即缺少城市或邮编);

包含的增值税总额 小于 400 欧元。

注解

400 欧元的阈值是在 2019 年 5 月 10 日的法令中规定的。我们建议您核实当前的官方数值。

TD16 - 内部逆向征税¶

如果满足以下条件,内部反向收费交易(参见 税收豁免 和 反向收费)将被导出为 TD16:

这是一张供应商发票;

它至少在发票行中包含**一种税**,该税针对以下任意一种 税率表:

VJ6、VJ7、VJ8、VJ12、VJ13、VJ14、VJ15、VJ16、VJ17

TD17 - 从国外购买服务¶

When buying services from EU and non-EU countries, the foreign seller invoices a service with a VAT-excluded price, as it is not taxable in Italy. The VAT is paid by the buyer in Italy.

在欧盟范围内:买方 将收到的发票与意大利应缴纳的 增值税信息 进行整合(即 供应商发票税务整合);

非欧盟地区:买方 为自己开具发票(即 自开发票)。

Odoo 在满足以下条件时会将交易导出为 TD17:

这是一张供应商发票;

它至少有一项税费位于发票行上,该税费针对税 grid VJ3;

所有发票行要么将 服务 作为 产品,要么将 服务 作为 税项范围 的税。

TD18 - 从欧盟购买商品¶

在欧盟内开具的发票遵循**标准格式**,因此只需对现有发票进行集成即可。

Odoo 在满足以下条件时会将交易导出为 TD18:

这是一张供应商发票;

该 业务伙伴 来自 欧盟 国家;

它至少有一项税款适用于发票行,该税款针对税金表 VJ9;

所有发票行要么将 消耗品 作为 产品,要么将具有 货物 作为 税项范围 的税。

TD19 - 从增值税保证金购买商品¶

从国外供应商处购买**商品**,但这些**商品**已经位于**意大利**的**增值税保证金仓库**中。

从欧盟:买方 将收到的发票与在意大利应缴纳的 增值税信息 进行整合(即 供应商发票税务整合);

非欧盟地区:买方 向 自己 发送发票(即:自开发票)。

Odoo 在满足以下条件时会将交易导出为 TD19:

这是一张供应商发票;

它至少有一项税款适用于发票行,该税款针对税金表 VJ3;

所有发票行要么以 消耗品 作为产品,要么具有 货物 作为 税项范围 的税。

TD24 - 递延发票¶

**递延发票**是指在商品销售或服务提供之后**较晚时间**开具的发票。**递延发票**最迟必须在所涵盖单据中所述交付的**下一个月的第15天**之前开具。

它通常是一张**汇总发票**,包含当月发生的多项商品或服务销售的清单。企业可以将销售**合并**到**一张发票**中,通常在**每月末**开具,用于会计目的。延期发票默认适用于有经常性客户的**批发商**。

如果货物由**承运商**运输,每次配送都会关联一个**运输单据(DDT)**,或称为**运输文件**。延迟开具的发票**必须**注明所有**DDT**的信息详情,以便更好地进行追踪。

注解

延期发票的电子发票功能需要安装 l10n_it_stock_ddt 模块。在这种情况下,电子发票中会使用专用的 单据类型 TD24。

Odoo 在满足以下条件时会将交易导出为 TD24:

这是一张发票;

它关联的交货单中,DDT 的日期与发票的开票日期**不同**。

TD28 - 马尔他(圣马力诺)¶

发票¶

圣马力诺和意大利在电子发票操作方面有特殊协议。因此,**发票**遵循常规的**反向收费**规则。您可以根据发票类型使用适当的 文档类型:TD01、TD04、TD05、TD24、TD25。Odoo 不强制执行其他要求。然而,**国家**要求用户进行以下操作:

选择一个税种,其 税务豁免类型 设置为

N3.3;使用通用的 SdI 目标代码

2R4GT08。

发票随后由圣马力诺的一个专门办公室转发至相应的业务部门。

供应商发票¶

当一家意大利公司收到来自圣马力诺的**纸质账单**时,必须将该发票提交给 AdE,并在电子发票的 文档类型 字段中填写特殊值 TD28。

Odoo 在满足以下条件时会将交易导出为 TD28:

这是一张供应商发票;

它至少有一项税款适用于发票行中的税金表 VJ;

该**业务伙伴**的**国家**是**圣马力诺**。

公共行政企业(B2G)¶

PA 企业比私人企业受到更多的监管,因为它们处理的是来自纳税人的公共资金。EDI 流程为 常规流程 增加了一些步骤,因为 PA 企业可以 接受 或 拒绝 发票。

注解

PA 企业拥有一个6位长度的 目的地代码,也称为 CUU,该代码是 必填项,在这种情况下不能使用 PEC 地址。

CIG、CUP、采购订单数据¶

为确保公共管理部门对付款的有效可追溯性,向公共管理部门开具的电子发票必须包含:

除法律第136号法令(2010年8月13日)规定的免于追溯义务的情况外,CIG。

在涉及与公共工程相关的发票时,使用 CUP。

如果 XML 文件有此要求,AdE 只能在 XML 文件包含 CIG 和 CUP 时,才能处理电子发票的付款。

注解

其中必须包含 CUP 和 CIG 的 XML 标签为 DatiOrdineAcquisto、DatiContratto、DatiConvenzione、DateRicezione 或 DatiFattureCollegate 中的任意一个。

这些对应于电子发票 XML 文件中名为 CodiceCUP 和 CodiceCIG 的元素,其对应的表格可以在政府 网站 上找到。

分拆付款¶

该 拆分付款 机制的行为与 反向收费 非常相似。

Example

当一家意大利公司向 PA 企业开票——例如为公共建筑提供清洁服务——该 PA 企业会自行向税务机关申报增值税,供应商只需在发票行中选择适当的税种,并正确填写 税收豁免。

特定的 付款拆分 税务位置可用于处理属于 PA(公共管理部门) 的合作伙伴。

处理过程¶

数字合格签名¶

对于面向 PA 的发票和账单,通过 SdI 发送的所有文件都需要 数字合格签名。XML 文件必须使用以下证书之一进行认证:

一种 智能卡;

一个 USB 智能卡;

一个 HSM。

警告

Odoo **无法**为您对文档进行数字签名。当检测到一个6位长的 收件人代码 时,那么 EDI 过程将停止,发票将被设置为 需要用户签名 状态。您可以将文档以 XML 格式下载,使用任何 合格数字签名 提供商的外部程序进行签名,并通过 AdE 门户发送。

接受或拒绝¶

警告

由于 Odoo 不处理将已签署的发票发送至 PA 企业,因此这些状态无法由 Odoo 直接触发。当您在 AdE 门户网站上上传发票时,Odoo 会收到相关通知,从而在发票上正确显示 SdI 状态。

在通过 SdI 接收到发票后,PA 业务方有 15 天时间接受该发票。如果接受,则流程在此结束。如果 PA 业务方拒绝该发票,一旦被 SdI 接受,该发票仍被视为有效。此时,您需要开具一张贷项通知单进行补偿,并将其发送至 SdI。

过期条款¶

如果 PA 业务方在15天内未回复,您需要直接联系 PA 业务方,并通过电子邮件同时发送发票和收到的截止日期通知。您可以与他们协商,并在发票上手动设置正确的 SdI 状态。