税额单位¶

重要

这仅适用于多公司环境。

一个 税务单位 是一组在法律上相互独立的增值税应税企业,但它们在财务、组织和经济上紧密相连,因此被视为同一个增值税应税企业。税务单位 并非强制性的,但如果创建了税务单位,则该单位的组成公司必须属于同一个 国家,使用相同的 货币,并且必须指定一家公司作为 税务单位 的 代表公司。税务单位 会获得一个特定的 税务编号,仅用于 税务申报。组成 公司则保留其用于 商业用途 的 税务编号。

Example

企业 A 欠缴 300,000.00 欧元的增值税,而企业 B 可以抵扣 280,000.00 欧元的增值税。它们组成一个 税务单位,从而使两笔金额相互抵消,共同只需缴纳 20,000.00 欧元的增值税。

配置¶

要创建一个 税费单位,请转到 ,然后点击 新建。输入该单位的 名称,选择一个 国家,选择要纳入该单位的 公司,指定 主公司,以及该税费单位中 组成 公司的 税费编号。

税款归属¶

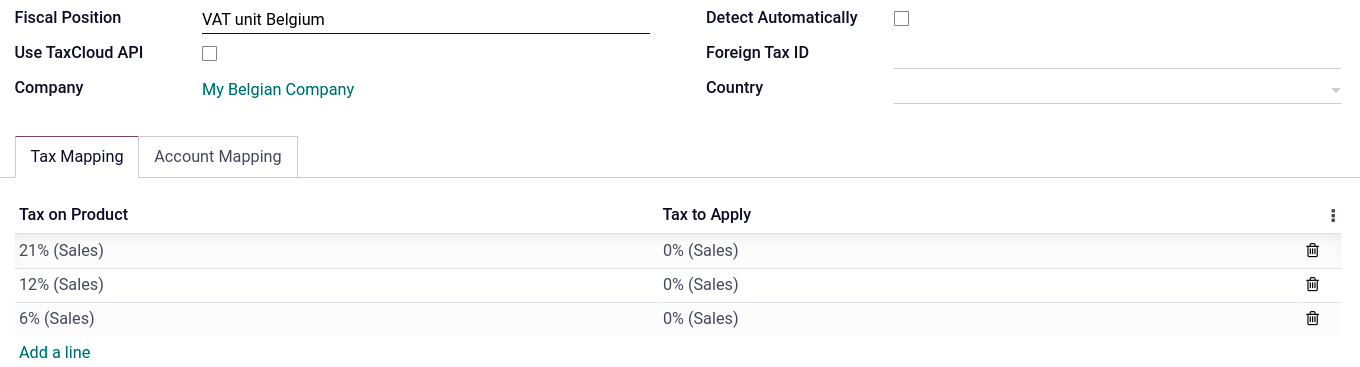

由于同一**税务单位**内的组成部分之间的交易不征收增值税,因此可以创建一个 税务映射(财政地位),以避免对内部组成部分之间的交易应用增值税。

请确保已选择一个关联公司,然后进入 ,并 创建 一个新的 税务位置。点击 税收映射 标签,选择通常用于 非关联 交易的 产品税,并在 应用的税收 中,选择适用于 关联 交易的 0% 税收。

如果需要,对 账户映射 选项卡执行相同的操作,并重复此过程以处理数据库中的**每个**成员单位。

然后,通过打开 联系人 应用程序来分配税务位置。搜索一个 成员单位 公司,并打开联系人的 卡片。点击 销售与采购 选项卡,在 税务位置 字段中,输入为 税单位 创建的 税务位置。在每个 成员单位 公司的卡片表单中,重复此操作,适用于每个公司数据库。

另请参见

财政地位

税款申报表¶

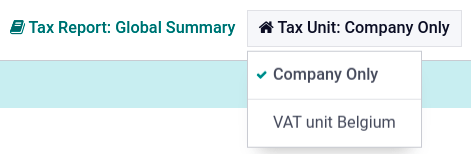

该**代表公司**可以通过进入 ,并在 税务单位 中选择 税务单位 来访问 税务单位 的汇总税务报告。该报告包含所有 组成部分 的汇总交易,.XML 导出文件中包含 主公司 的名称和增值税号。