菲律宾¶

配置¶

安装 通用 的 🇵🇭 菲律宾 财政本地化包,以获得菲律宾本地化的所有默认会计功能,例如科目表、税种以及BIR 2307报表。这些内容为使用菲律宾会计提供了基础模板。

注解

在创建新数据库并选择

菲律宾作为国家时,财政本地化模块 菲律宾 - 会计 会自动安装。如果在现有公司中安装了该模块,则如果已存在已过账的日记账条目,会计科目表 和 税项 将 不会 被替换。

BIR 2307 报告已安装,但可能需要手动创建预提税。

会计科目表和税项¶

安装了一个最小配置的默认会计科目表,并安装了以下类型的税项,并将其链接到相关科目:

销售与采购 12% 增值税

销售和采购免税

销售和采购增值税零税率

采购预提

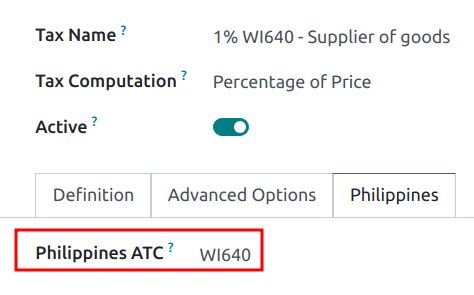

对于预提税(),在 菲律宾 选项卡下有一个额外的 菲律宾 ATC 字段。

注解

税务的ATC代码用于BIR 2307报表。如果手动创建税项,必须添加其ATC代码。

联系人¶

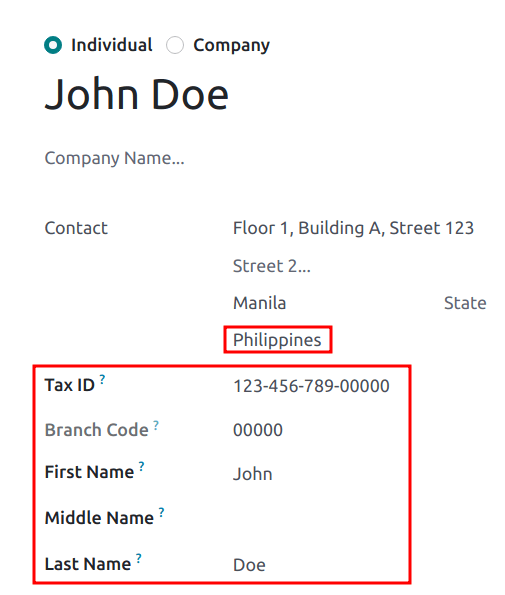

When a company or an individual (not belonging to a company) contact is located in the Philippines,

fill in the Tax ID field with their Taxpayer Identification Number (TIN).

对于不属于任何公司的个人,请使用以下附加字段进行识别:

名字

中间名

姓氏

注解

对于 公司 和 个人,TIN 应该遵循 NNN-NNN-NNN-NNNNN 格式。分支机构代码应遵循 TIN 的最后几位数字,否则可以留空为 00000。

BIR 2307 报告¶

BIR 2307 报告数据,也称为 源泉扣缴税款抵税证明,可以为带有适用预提税的采购订单和供应商付款生成。

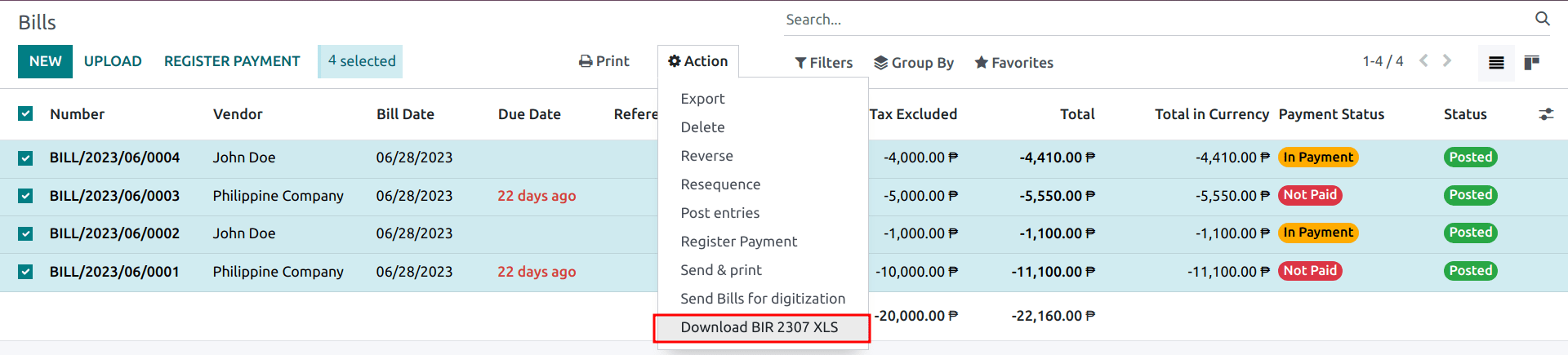

要生成BIR 2307报告,请在列表视图中选择一个或多个供应商发票,然后点击 。

小技巧

可以从供应商发票的表单视图中执行相同的操作。

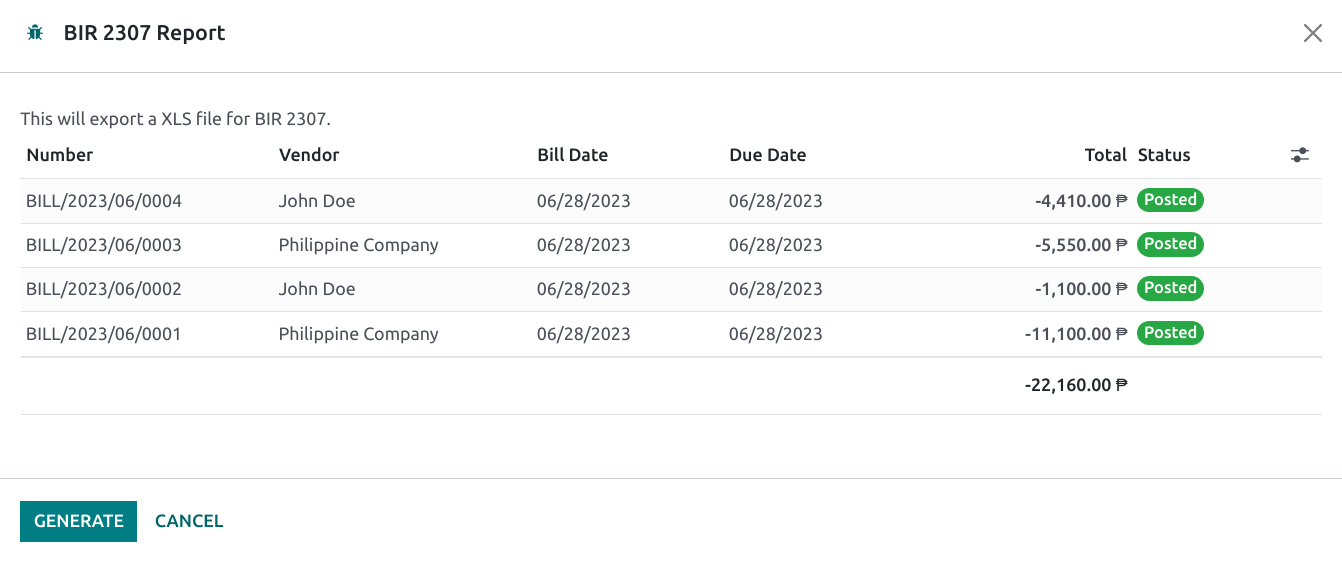

一个弹出窗口用于审查选择,然后点击 生成。

这会生成包含所有供应商发票行及其适用预提税的 Form_2307.xls 文件。

上述流程也可用于*单一*供应商的 付款,如果该付款与一个或多个 供应商发票 相关联,并已应用了预提税。

注解

如果未应用预提税,则 XLS 文件将不会为这些供应商发票行生成记录。

在对多张发票进行付款分组时,Odoo 会根据联系人对付款进行拆分。从付款记录中,点击 会生成一份仅包含该联系人相关供应商发票的报表。

重要

Odoo 无法直接生成 BIR 2307 PDF 报告或 DAT 文件。生成的 Form_2307.xls 文件可以导出到*外部*工具,以将其转换为 BIR DAT 或 PDF 格式。

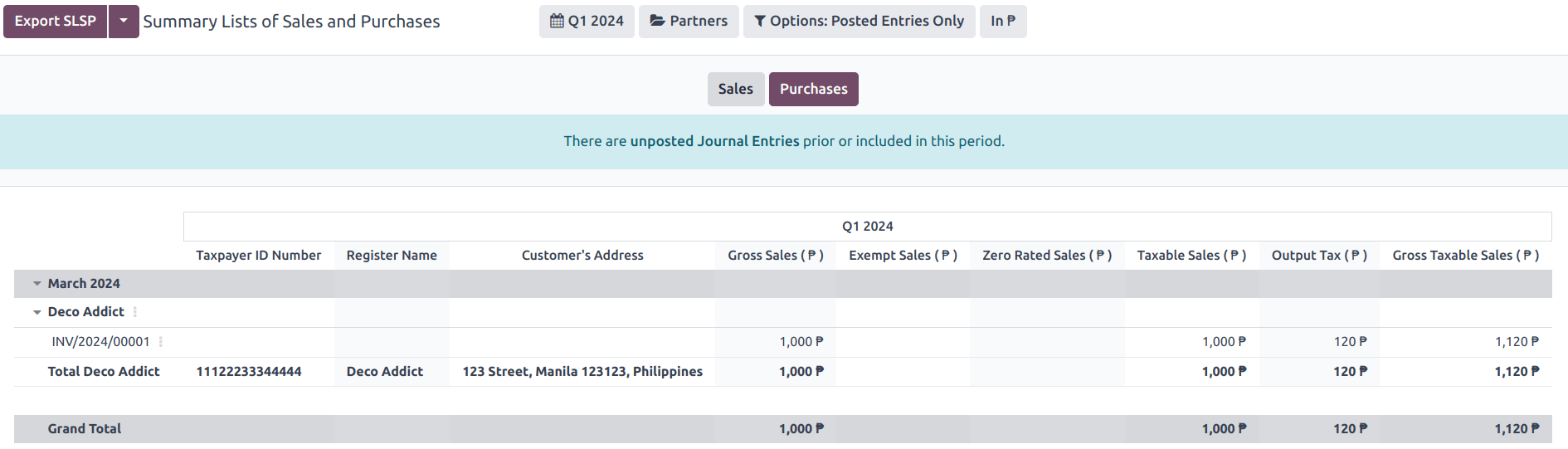

SLSP 报告¶

SLSP 报告,也称为 销售与采购汇总清单,可以查看并导出(以 XLSX 格式)。该报告可以从 查看。

报表分为两个部分,可以通过顶部的相应按钮进行访问:

- 销售 用于 SLS 报告此报表中显示所有已应用相关销售税的客户发票。

- 采购 用于 SLP 报告此报表显示所有已应用相关采购税的供应商账单。

默认情况下,这两个报表会排除包含未设置TIN编号的合作伙伴以及设有进口税的分录。要查看或隐藏这些分录,选项: 按钮提供了其他过滤条件,可用于包含这些分录:

包含无TIN的合作伙伴包含进口

重要

Odoo 无法直接生成 DAT 文件。导出 SLSP 和 XLSX 按钮会导出一个 XLSX 文件,该文件可以使用*外部*工具转换为 DAT 格式。

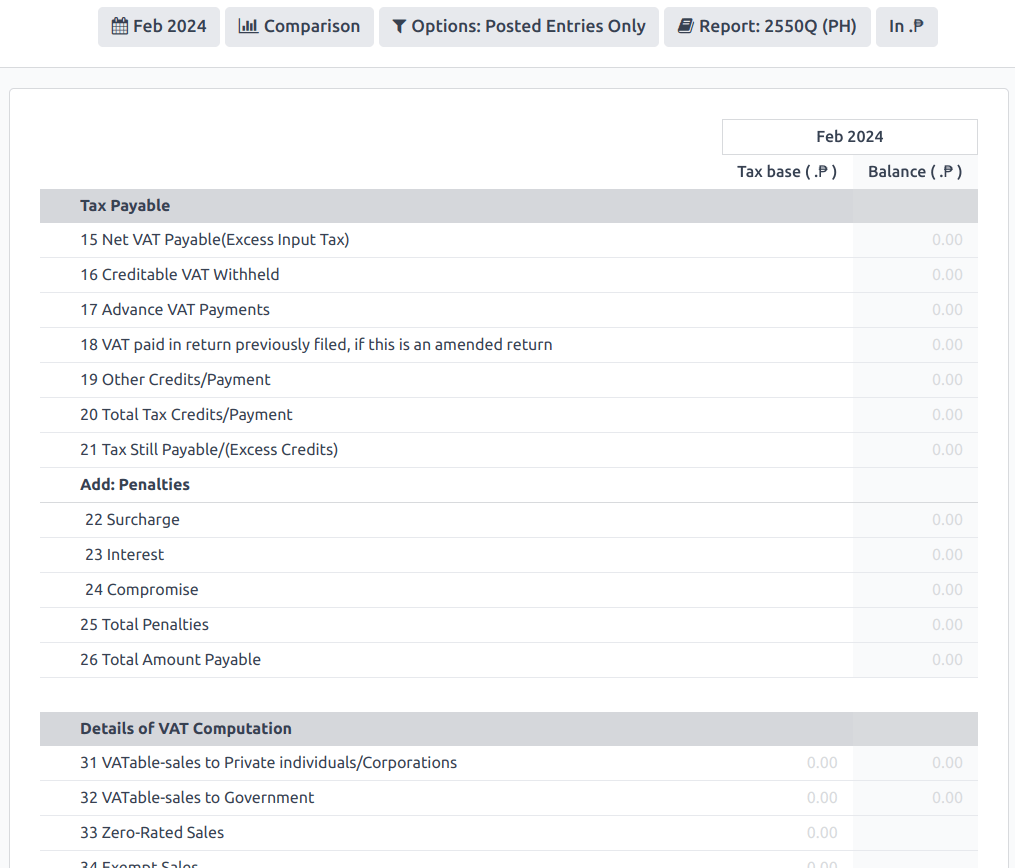

2550Q 税务申报表¶

税务报表可通过导航至 进行访问。该表单基于最新的 2550Q(季度增值税申报表) 2023年1月版本。

小技巧

税务报表中的大多数行都是根据税款自动计算的。为了更准确地编制和提交税务报表,还可以通过为每条税务报表行预先配置的**税表网格**,将手动分录映射到税务报表中。

重要

Odoo 无法直接生成符合 2550Q BIR 格式的 PDF 报告。在手动或在线外部提交表格时,应将其作为参考。