英国¶

配置¶

安装 通用安装 模块中的 英国 - 会计 和 英国 - 会计报表 模块,以获得英国本地化的所有功能。

名称 |

技术名称 |

描述 |

|---|---|---|

英国 - 会计 |

|

|

英国 - 财务报表 |

|

|

英国BACS付款文件 |

|

允许生成用于账单和发票付款的 BACS 文件 |

注解

只有位于英国的公司才能向英国税务海关总署(HMRC)提交报告。

安装模块 英国 - 财务报表 会同时安装这两个模块。

会计科目表¶

英国的会计科目表包含在 英国 - 会计 模块中。转到 以访问它。

通过前往 来设置您的 科目表,并选择手动审核 (手动审核) 或导入初始余额 (导入(推荐))。

税项¶

作为本地化模块的一部分,英国税项会自动创建其相关的财务账户和配置。

前往 以更新 默认税收、税务申报周期 或 配置您的税务账户。

要编辑现有税项或单击 创建 新的税项,请转到 。

数字征税(MTD)¶

在英国,所有已注册增值税(VAT)的企业都必须通过使用软件提交其增值税申报表,以遵守MTD规则。

**英国会计报表**模块可帮助您满足 HM税务与海关总署 关于 数字化纳税 的要求。

重要

如果您的定期申报超过三个月逾期,就无法通过 Odoo 提交,因为 Odoo 仅会检索过去三个月内的未结债券。您必须通过联系 HMRC 手动完成申报。

在首次提交之前,将您的公司注册至英国税务海关总署(HMRC)¶

进入 ,然后点击 连接到HMRC。在HMRC平台上输入您的公司信息。您只需操作一次。

定期向HMRC提交¶

您可以通过点击 发送至HMRC 将您的义务信息导入HMRC,筛选您希望提交的期间,并发送您的税务报告。

小技巧

你可以使用示例凭证来演示 HMRC 流程。为此,激活 开发者模式,然后进入 。在此处,搜索 l10n_uk_reports.hmrc_mode 并将值行更改为 demo。你可以从 HMRC 开发者中心 获取此类凭证。

向HMRC定期申报的多公司情况¶

同一时间只能有一家公司和一个用户连接到HMRC。如果同一数据库中包含多家英国公司,提交HMRC报告的用户在每次提交前必须遵循以下说明:

登录到需要提交申请的公司。

进入 常规设置,在 用户 部分,点击 管理用户。选择与 HMRC 关联的用户。

进入 英国税务海关总署集成 选项卡,然后点击 重置认证凭据 或 删除认证凭据 按钮。

你现在可以 将你的公司注册到HMRC 并为该公司提交税务报告。

重复上述步骤以处理其他公司的HMRC申报。

注解

在此过程中,其他基于英国的公司将不再显示 连接到 HMRC 按钮。

BACS 文件¶

Bacs(银行自动清算服务) 文件是英国用于在银行账户之间处理支付和转账的电子文件。

要使用 Bacs 文件,请确保已安装 UK BACS Payment Files 模块,然后:

配置您的 Bacs 服务用户编号:

进入 ,并向下滑动到 客户付款 部分。

在 BACS 下输入您的 服务用户编号,并手动保存。

配置您的 银行 日记账簿:

进入 并选择您的 银行 日记账。

在 分录 选项卡中,配置 账户编号 和 银行 字段。

在 收款 和 付款 选项卡中,确保启用了 BACS 直接扣款 支付方式。

配置您希望使用 Bacs 文件的联系人:访问联系人表单,在 会计 选项卡中,点击 添加一行,并填写 账户号码 和 银行 字段。

付款账单¶

要生成用于账单付款的BACS文件,请在 注册供应商付款 时将 付款方式 设置为 BACS 直接扣款。

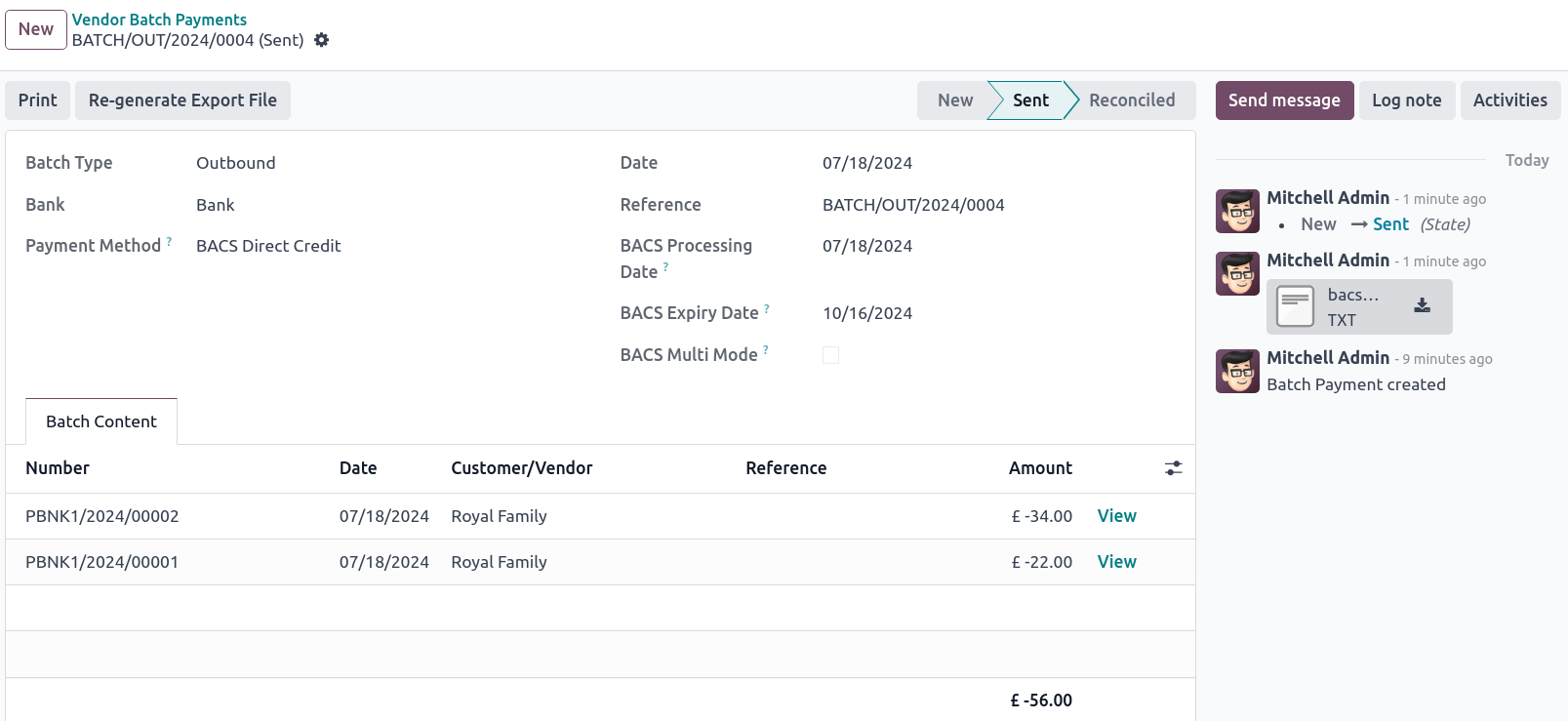

然后,创建供应商批量付款:

进入 ,然后点击 新建。

在 银行 字段中选择银行日记账,将 付款方式 设置为 BACS 直接入账,并选择一个 BACS 处理日期。

可选地,您还可以:

选择一个 BACS 到期日期;

启用 BACS 多模式 以在各自的日期处理付款。

点击 添加一行,选择您要包含的付款项,点击 选择,然后点击 验证。

验证后,Bacs 文件会出现在聊天栏中。如果需要为该批次付款生成新的 Bacs 文件,您也可以 重新生成导出文件。

发票付款¶

在生成用于发票付款的 Bacs 文件之前,您必须首先创建一个 BACS 直接扣款指令:进入 ,然后点击 新建。选择一个 客户、其 IBAN 以及您希望使用的 日记账簿。

要生成用于发票付款的Bacs文件,请在 注册发票付款 时将 付款方式 设置为 BACS 直接借记。

小技巧

如果您通过 注册与订阅相关发票的付款,您可以选择 BACS 付款类型:

直接借记-系列收款的第一笔;

直接借记单次收款;

系列中的直接借记重复收款;

直接借记 - 系列收款的最终收取

然后,创建一个客户批量付款:

进入 ,然后点击 新建。

在 银行 字段中选择银行日记账,将 付款方式 设置为 BACS 直接入账,并选择一个 BACS 处理日期。

可选地,您还可以:

选择一个 BACS 到期日期;

启用 BACS 多模式 以在各自的日期处理付款。

点击 添加一行,选择您要包含的付款项,点击 选择,然后点击 验证。

验证后,Bacs 文件会出现在聊天栏中。如果需要为该批次付款生成新的 Bacs 文件,您也可以 重新生成导出文件。

就业英雄薪资管理¶

如果您已经通过 Employment Hero 开始运营您的业务,可以使用我们的连接器作为替代的薪资解决方案。

重要

To configure the Employment Hero API for United

Kingdom, use the following value as Payroll URL: https://api.yourpayroll.co.uk/.