乌拉圭¶

简介¶

通过乌拉圭本地化功能,您可以生成包含XML、税务序号、电子签名以及通过Uruware与税务机关Dirección General Impositiva (DGI) 连接的电子文件。

支持的文档包括:

电子发票, 电子发票冲销单, 电子发票贷项通知单;

电子票, 电子票贷项通知单, 电子票借项通知单;

导出电子发票, 导出电子发票贷项通知单, 导出电子发票借项通知单。

本地化需要一个 Uruware 账户,该账户可使用户在 Odoo 中生成电子文档。

术语表¶

以下术语在乌拉圭本地化中被广泛使用:

DGI:Dirección General Impositiva 是乌拉圭负责征收税款的政府机构。

EDI:电子数据交换 是指电子文件的发送。

Uruware:是第三方组织,负责在公司与乌拉圭政府之间促进电子文件的交换。

CAE:电子发票授权证明 是从税务机关网站申请的文件,用于启用电子发票的开具。

配置¶

模块安装¶

请安装以下模块以获得乌拉圭本地化的所有功能: 安装

名称 |

技术名称 |

描述 |

|---|---|---|

乌拉圭 - 会计 |

|

默认的 财政本地化包。它为乌拉圭本地化添加了会计特性,这些特性代表了公司在乌拉圭根据 DGI 设定的指南运营所需的最低配置。该模块的安装会自动加载:会计科目表、税种、单据类型和受支持的税务类型。 |

乌拉圭会计 EDI |

|

注解

Odoo 在使用 Uruguay 作为国家安装数据库时会自动安装基础模块 Uruguay - Accounting。然而,要启用电子发票功能,需要手动 安装 Uruguay Accounting EDI (l10n_uy_edi) 模块。

公司¶

要配置您的公司信息,请打开 设置 应用,向下滚动到 公司 部分,点击 更新信息,并进行以下配置:

公司名称

地址,包括 街道、城市、州、邮编 和 国家

税号:输入所选纳税人类型的识别号码。

DGI 主分支代码: 这是创建电子文档时XML的一部分。如果此字段未设置,所有电子文档都将被拒绝。

要找到 DGI 主分支代码,请按照以下步骤操作:

从您的 DGI 账户 中,进入 。

选择 。

打开生成的 PDF,从 税务地址编号 部分获取 DGI 主分支代码。

在数据库设置中配置公司信息后,导航至 ,并搜索您的公司以验证以下内容:

the company type is set to Company.

该 标识号码 类型 为 RUT / RUC。

设置 Uruware 账户¶

要设置 Uruware 账户,请首先确保您拥有有效的 Odoo 订阅。然后按照以下步骤进行操作。

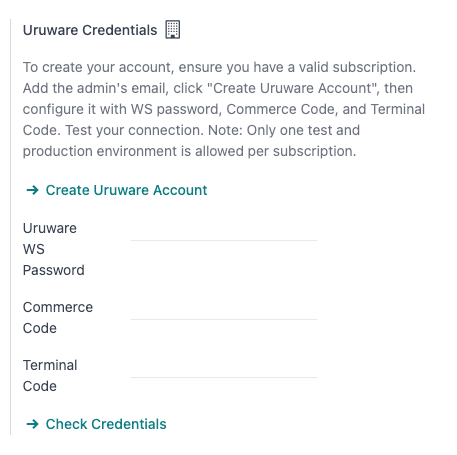

通过导航至 来找到 Uruware 凭据设置。滚动到 乌拉圭本地化 部分,然后点击 创建 Uruware 账户。

这样做之后,会将一封邮件发送到与您的 Odoo 订阅关联的地址,邮件中包含用于登录 Uruware 门户的用户名和密码,以便您设置账户。

小技巧

您的 税号 需要进行设置,才能创建您的账户。

注解

此操作将使用以下信息在 Uruware 上创建一个账户:

法定代表人(公司名称)

公司提供的 RUT

用户名(RUT.odoo)

Odoo 数据库链接

为了确保您的账户正确创建,请补充上述缺失的信息。

账户创建完成后,会向您在 Odoo 订阅中关联的电子邮件发送一封确认邮件,其中包含直接在 Uruware 测试门户 或 生产门户 中配置账户的凭据:

使用邮件中的账户凭据登录门户。

重要

请确保配置两个账户,一个用于测试,一个用于生产环境。电子邮件地址可以在 Uruware 中更改,并且可以在两个环境中使用相同的地址。

电子发票数据¶

要配置电子发票数据,需要配置环境和凭证。为此,请导航至 ,并滚动到 乌拉圭本地化 部分。

首先,选择 UCFE Web Services 环境:

生产:用于生产数据库。在此模式下,电子文件通过 Uruware 发送给 DGI 进行验证。

测试: 用于测试数据库。在此模式下,可以直接测试连接流程,通过 Uruware 将文件发送到 DGI 测试环境。

演示: 在演示模式下,文件会自动创建并被接受,但**不会**发送到 DGI。因此,在此模式下不会出现拒绝错误。可以在演示模式下测试所有内部验证。请避免在生产数据库中选择此选项。

然后,输入 Uruware 数据:

Uruware WS 密码

商业代码

终端代码

注解

此数据可在配置好 Uruware 账户 后,从 Uruware 门户获取。Uruware WS 密码 与您用于登录 Uruware 账户的密码不同。

主数据¶

会计科目表¶

默认情况下,会计科目表(chart of accounts)作为本地化模块中包含的一组数据进行安装,账户会自动映射到税项、默认应付账款和默认应收账款中。

可以根据公司的需求添加或删除账户。

另请参见

会计入门 - 账户结构

联系人¶

要创建联系人,请导航至 并选择 新建。然后输入以下信息:

公司名称

地址:

街道: 确认电子发票所必需。

城市

状态

邮编

国家:用于确认电子发票。

识别编号:

类型:选择一种标识类型。

编号:用于确认电子发票的必填项。

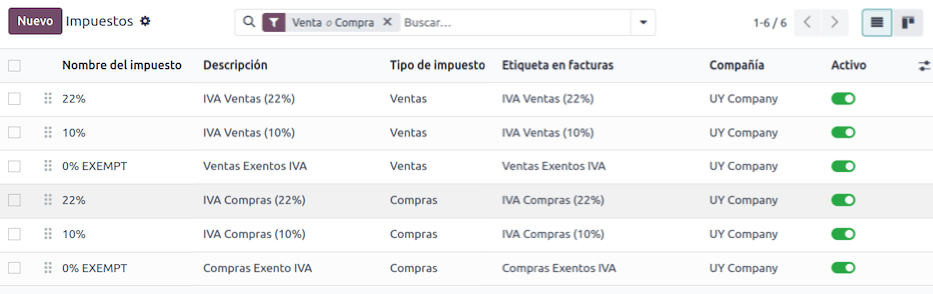

税项¶

作为乌拉圭本地化模块的一部分,税项会自动创建,并配置相关财务账户。

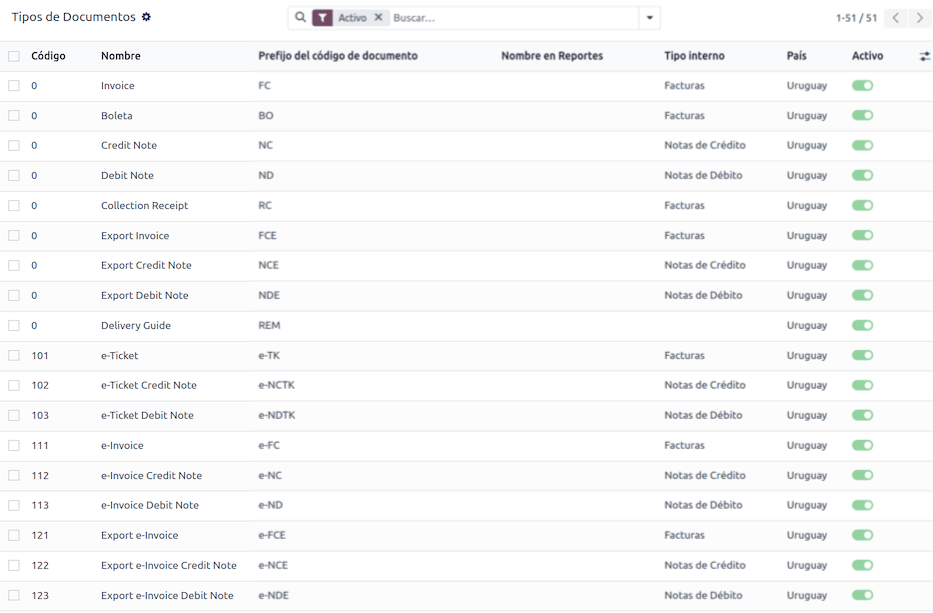

文档类型¶

一些会计交易,如*客户发票*和*供应商发票*,是按单据类型进行分类的。这些类型由政府财政主管部门定义,在此情况下由|DGI|定义。

每种文档类型可以在其被分配的日记账中拥有唯一的编号序列。当安装本地化模块时,数据会自动创建,默认情况下会包含文档类型所需的信息。

要查看本地化中包含的文档类型,请导航至:。

注解

In Uruguay, CAEs must be uploaded in Uruware. Sequences (and PDFs) are received in Odoo from Uruware, based on their CAEs. CAEs are only used in production. When testing, only a range of sequences used in Uruware need to be set.

销售日记账¶

要生成并确认一个将由 DGI 验证的电子文档,销售日记账需要进行以下配置:

开票类型:默认设置为 电子 选项。这是通过 Uruware 向乌拉圭政府通过网络服务发送电子文件所必需的。另一个选项 手动 用于之前在其他系统中盖章的未结发票,例如在 DGI 中。

使用文档?: 如果此日记账将使用 Odoo 中文档类型列表中的文档,请启用此选项。

工作流¶

配置好数据库后,您可以创建您的文档。

销售文档¶

客户发票¶

客户发票 是电子文档,经验证后通过 Uruware 发送给 DGI。这些文档可以从您的销售订单生成,也可以手动创建。它们必须包含以下数据:

客户: 输入客户的相关信息。

到期日期: 用于判断发票是现在到期还是稍后到期(分别为 现付 或 信用)。

日记账: 选择电子销售日记账。

单据类型: 以这种格式表示的单据类型,例如,

(111) 电子发票。产品: 指定具有正确税项的产品。

注解

每种单据类型都有对应的红字发票和蓝字发票(例如,单据类型 (111) 电子发票 对应 (112) 电子发票红字通知单)。

客户贷项通知单¶

该 客户贷项通知单 是一份电子文档,当其被验证后,会通过 Uruware 发送给 DGI。要登记贷项通知单,必须先有一张已验证(过账)的发票。在发票上,点击 贷项通知单 按钮,以访问 创建贷项通知单 表单,然后填写以下信息:

原因: 输入信用凭证的原因。

日记账: 选择需要电子化的日记账,并且该日记账启用了 使用文档? 选项。

单据类型: 选择贷项通知单单据类型。

冲销日期: 输入日期。

客户贷项通知单¶

该 客户贷项通知单 是一份电子文件,当其被验证后,会通过 Uruware 发送给 DGI。要登记贷项通知单,必须先有一张已验证(过账)的发票。在发票上,点击 (操作菜单) 图标,选择 贷项通知单 选项,以访问 创建贷项通知单 表单,然后填写以下信息:

原因: 输入贷项通知单的原因。

日记账: 选择需要电子化的日记账,并且该日记账启用了 使用文档? 选项。

复制行: 勾选此复选框,将发票行复制到贷项通知单。

贷项通知单日期: 输入日期。

注解

确认发票以使用内部编号创建它。要通过 Uruware 将文件发送到 DGI,请点击 发送并打印 并勾选 生成 CFE 复选框。一旦文件被处理,法律文件序列号(编号)将从 Uruware 获取。请确保在 Uruware 中有 CAEs 可用。

注解

根据乌拉圭政府(DGI)的规定,已验证文件的PDF从Uruware获取。

附加条款和披露信息¶

附加信息 和 披露内容 是添加到电子文档中的附加注释和说明,可能是强制性的也可能是可选的。要创建新的附加信息,请转至 ,然后点击 新建。

请输入以下信息:

名称:附加信息或强制披露的内容名称。

类型: 选择备注的类型,这会将其添加到 XML 中的特定部分。

是否为说明文字: 如果文本是强制性披露信息,请选中此框,如果是附加信息,请留空。

内容:添加附录或披露的完整文本。

图例及产品附加信息¶

要在产品和 XML 中添加 leyenda 或附加信息,需要在发票行中的产品上添加预配置的附加条款和披露内容。在该行中指定的产品的 披露 字段中添加 leyenda。

图例和附加信息¶

要在电子发票和 XML 中添加 说明 或附加信息,请打开发票,进入 其他信息 选项卡,并在 附加信息与披露 字段中选择所需的附加信息。此处添加的附加信息和披露内容将出现在 XML 中,并在 PDF 文档中可见。

这适用于以下类型的 附加信息:

文档

发行方

接收方

附加信息

注解

要在电子文档中添加临时备注,请使用 条款和条件 字段。此信息将随发票的附加信息一同发送,但不会保存用于未来的文档。