比利时¶

配置¶

安装 🇧🇪 比利时 财务本地化包,以获得符合 IFRS 规则的比利时本地化默认会计功能。

会计科目表¶

你可以通过进入 来访问 科目表。

比利时的会计科目表包含如 PCMN 所描述的预配置账户。要添加一个新账户,请点击 新建。将出现一行新内容。填写该行,然后点击 保存,接着点击 设置 以进一步配置。

另请参见

会计入门 - 账户结构

税项¶

当安装 比利时 - 会计 和 比利时 - 会计报表 模块时,将自动创建默认的比利时税种。每种税都会影响比利时的 税务报告,可通过进入 来查看。

在比利时,标准增值税率为 21%,但某些类别的商品和服务适用较低的税率。社会住房以及餐厅提供的食品适用 12% 的中间税率,而大多数基本商品(如食品、供水、书籍和药品)适用 6% 的减免税率。一些特殊的商品和服务(如每日和每周出版物以及回收商品)适用 0% 的税率。

不可抵扣税项¶

在比利时,某些税款无法全额抵扣,例如汽车维护相关的税款。这意味着其中一部分税款被视为费用。

在 Odoo 中,您可以通过为这些不可抵扣税款创建税收规则,并将它们与相应的会计科目关联起来,来配置不可抵扣税款。这样,系统会自动计算税款并将它们分配到合适的会计科目中。

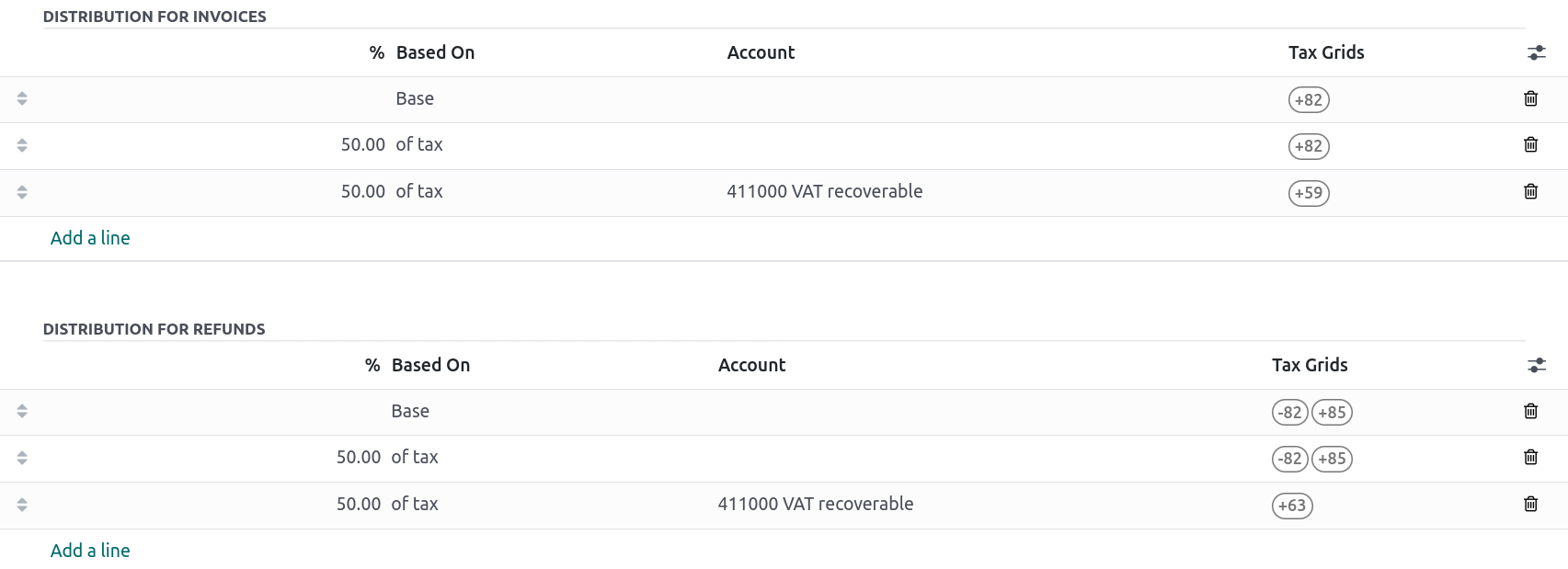

要配置新的不可抵扣税费,请转至 ,然后点击 新建:

添加一行,并在 基于 列中选择 基础;

添加一行,然后在 基于 列中选择 含税,并在 % 列中输入 不可抵扣 的百分比;

在 税项 行中,选择与您的税项相关的 税额表;

添加一行,在 % 列中输入 可抵扣 百分比;

将 税 设置在 基于;

选择 411000 可抵扣增值税 作为会计科目,并选择相关的税表。

一旦您创建了不可抵扣的税项,就可以在录入发票和贷项通知单时选择相应的税项来应用到您的交易中。系统会自动计算税额,并根据配置的税项规则将其分配到相应的会计科目中。

另请参见

会计/报表/税务申报

报表¶

以下是可用的比利时特定报告列表:

资产负债表;

损益表;

税款申报;

业务伙伴增值税清单;

欧洲销售清单;

进出口统计

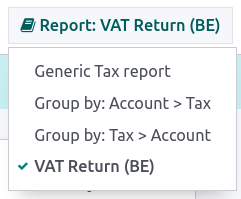

你可以通过在报表页面点击 书籍 图标并选择其比利时版本:(BE),来访问特定于比利时的报表版本。

另请参见

会计报表

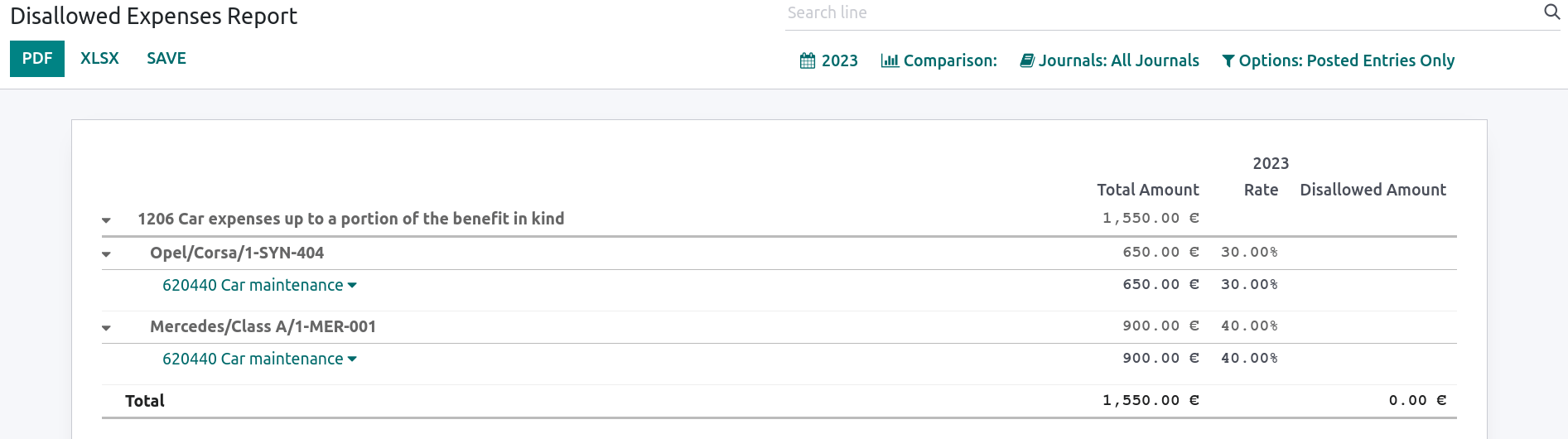

不允许的费用报告¶

不允许扣除的费用 是指可以从您的会计结果中扣除,但不能从您的税务结果中扣除的费用。

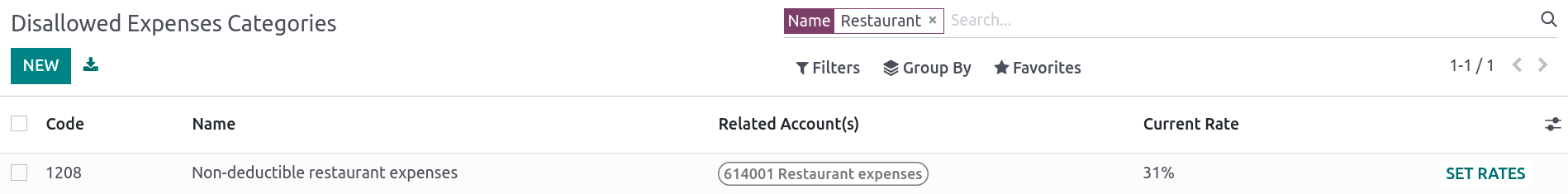

不允许的费用报告**可以通过进入 :menuselection:`会计 –> 报告 –> 管理:不允许的费用` 来查看。该报告可以实现实时的财务结果和定期的更改。此报告是根据 **不允许的费用类别 生成的,您可以通过进入 来访问这些类别。一些类别默认已存在,但尚未设置任何费率。点击 设置费率 来更新特定的类别。

小技巧

您可以为不同日期添加多个汇率。在这种情况下,用于计算费用的汇率取决于计算时的日期以及该日期所设置的汇率。

如果你安装了 Fleet 应用,请在适用的情况下勾选 车辆类别 选项。这将在预订供应商账单时使车辆成为必填项。

要将不允许的费用类别与特定科目关联,请转到 。找到您想要的科目,然后点击 设置。在 不允许的费用 字段中添加 不允许的费用类别。从现在起,当使用此科目的费用创建时,不允许的费用将根据 不允许的费用类别 中提到的比率进行计算。

让我们以**餐厅**和**汽车费用**为例。

餐厅费用¶

在比利时,餐饮**费用的31%是不可抵扣的。创建一个新的 **不允许抵扣的费用类别,并设置 相关科目 和 当前税率。

汽车费用:车辆分摊¶

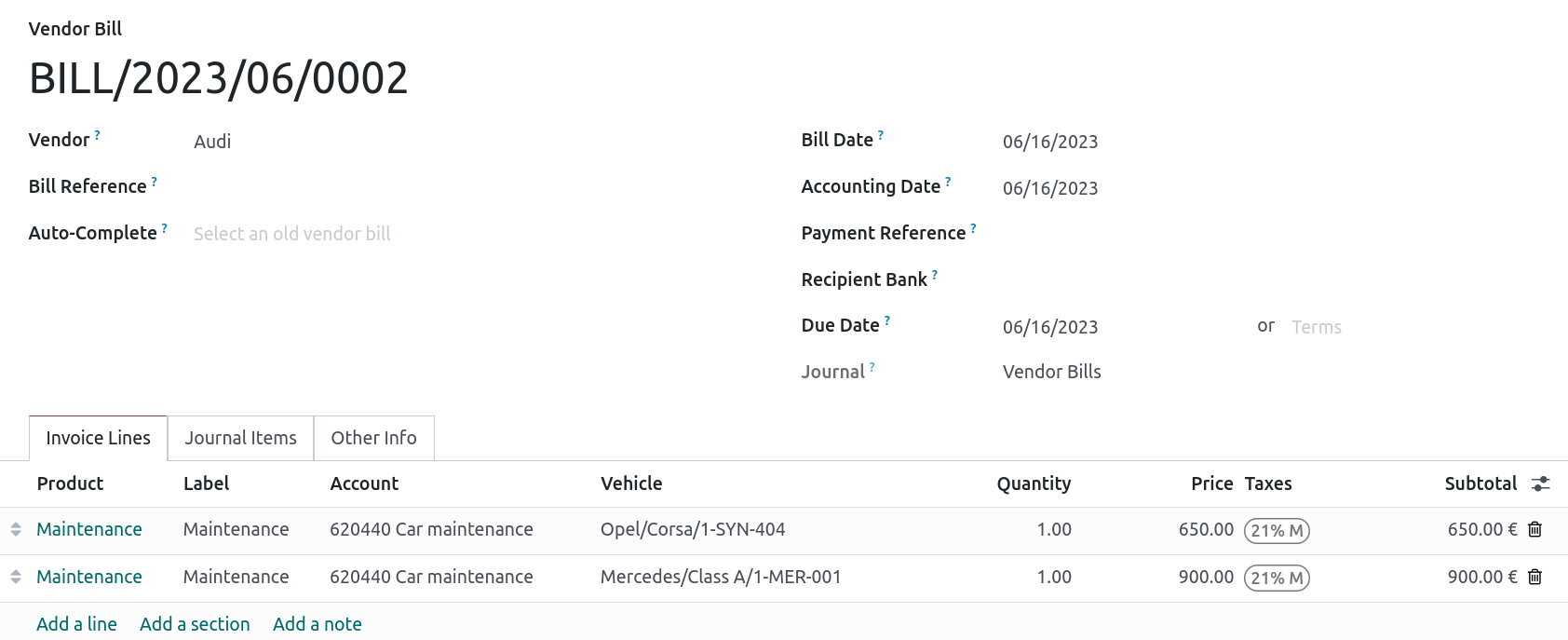

在比利时,可抵扣比例因车而异,因此应为每辆车单独注明。为此,请打开 并选择一辆车辆。在 税费信息 选项卡中,进入 不允许的费用比例 部分,然后点击 添加一行。添加一个 开始日期 和一个 %。所有车辆的费用均计入同一科目。

当你为汽车费用创建发票时,可以通过填写 车辆 列,将每项费用关联到特定的车辆,以便应用正确的比例。

“车辆分摊”选项在不允许费用报告中可用,可让您查看每辆车的费率和不允许报销的金额。

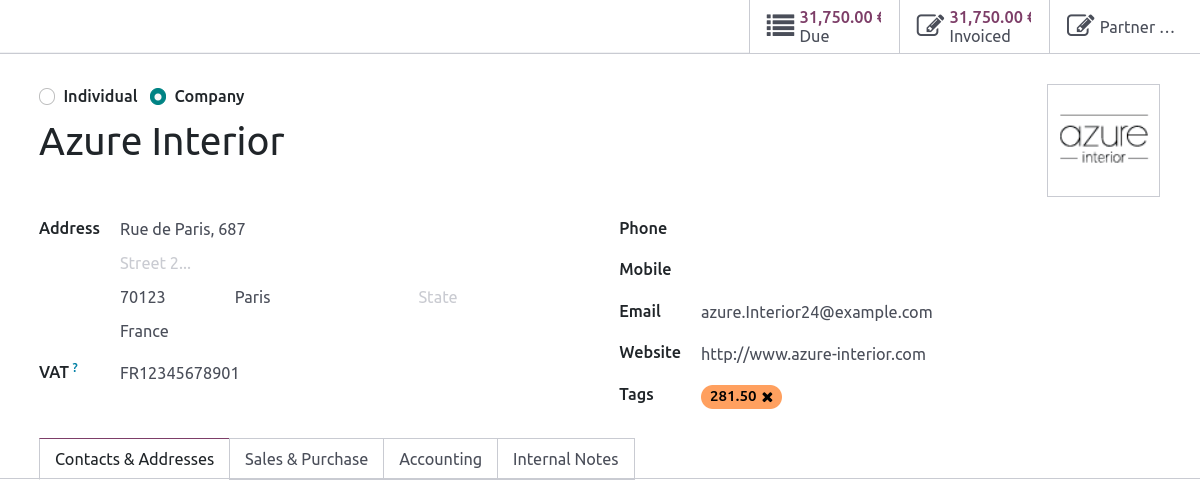

费用表 281.50 和表 325¶

费用表 281.50¶

每年,必须向税务机关报告一份 281.50 费用表。为此,必须在受 281.50 费用影响的实体的 联系人表单 上添加标签 281.50。要添加该标签,请打开 ,选择您希望为其创建 281.50 费用表 的人员或公司,并在 标签 字段中添加 281.50 标签。

注解

确保在 联系人表单 上也填写 街道、邮编、国家 和 增值税号码。

然后,根据费用的性质,在影响的会计科目上添加相应的 281.50 标签。为此,请转到 ,并点击 设置,在受影响的会计科目上添加相应的 281.50 标签,即根据费用的性质,添加 281.50 - 佣金。

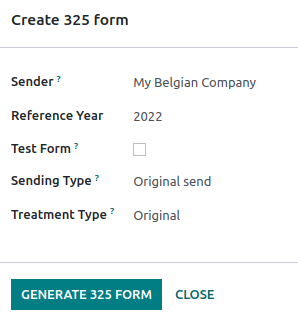

表单 325¶

你可以通过进入 来创建一个 325表格。会弹出一个新页面:选择正确的选项,然后点击 生成325表格。要打开已生成的 325表格,请进入 。

CODA 和 SODA 报表¶

CODA¶

CODA 是一种用于导入比利时银行对账单的电子 XML 格式。您可以从银行下载 CODA 文件,并通过点击仪表盘上的 导入文件 从您的 银行 日记账中直接将其导入 Odoo。

另请参见

SODA¶

SODA 是一种用于导入与工资相关的会计分录的电子 XML 格式。您可以通过进入您的会计 仪表盘,并在相关日记账卡片表单中点击 上传,将 SODA 文件导入您用于记录工资的日记账中。

一旦您的 SODA 文件被导入,薪资日记账中将自动生成相关条目。

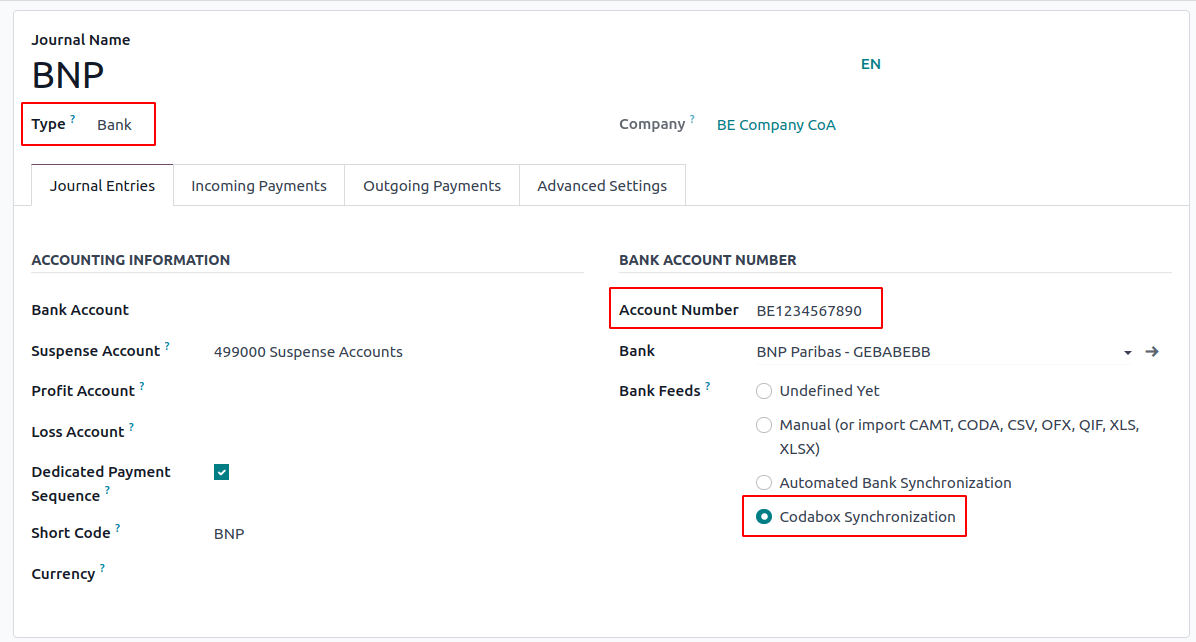

CodaBox¶

CodaBox 是一项服务,允许比利时的会计事务所访问其客户的银行信息和对账单。Odoo 提供了一种自动导入此类对账单的方式。

注解

作为一家会计事务所,您必须在独立的数据库中管理您的客户,并分别进行配置,以避免数据混淆。连接必须由会计事务所使用有效的CodaBox Connect凭证进行。

配置¶

配置必须在每个客户端数据库上完成。在以下说明中,我们将把您的客户公司称为 Company,将您的会计师事务所称为 Accounting Firm。

您必须先 安装 CodaBox 才能开始。

重要

Make sure the company settings are correctly configured, i.e., the country is set to Belgium, the Tax ID and Accounting Firm fields are filled, as well as the Tax ID of the Accounting Firm.

配置凭证簿¶

在 账户号码 字段中正确填写 IBAN。

选择 CodaBox 同步 作为 银行对账单。

小技巧

在处理使用不同货币的银行交易时,建议创建多个日记账,使用相同的银行账户但不同的货币。

创建一个新的其他日记账。

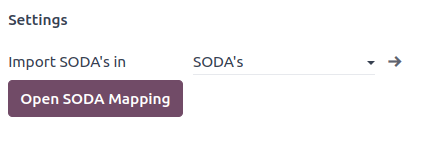

前往 ,然后进入 CodaBox 部分。

在 SODA 科目表字段中选择您刚刚创建的科目表。

配置连接¶

前往 ,然后进入 CodaBox 部分。

单击 管理连接 以打开连接向导,该向导将显示用于连接的 会计师事务所税号 和 公司税号。

如果你是**首次连接**,请单击 创建连接。向导将确认连接已在**Odoo 的一侧**成功创建。请按照步骤在**CodaBox 的一侧**也完成连接的验证。

如果这是**您第一次连接**,则在首次连接时由 Odoo 提供的 会计事务所密码 将用于创建新的连接。

注解

此 会计事务所密码 仅适用于 Odoo,必须在您这边安全存储。

“状态”现在应该已切换为“已连接”。

同步¶

连接建立后,Odoo 可以与 CodaBox 进行同步。

CODA 文件每 12 小时从 CodaBox 自动导入。您无需进行任何操作。但是,如果您希望,也可以通过点击会计仪表板中的 从 CodaBox 获取 来手动执行此操作。

SODA 文件每天会自动从 CodaBox 导入为草稿。您无需进行任何操作。但是,如果您希望,也可以通过点击会计仪表板中的 从 CodaBox 获取 来手动执行此操作。

默认情况下,如果 SODA 文件中的某个账户未映射到 Odoo 中的账户,则会使用暂挂账户(499000),并在创建的分录中添加一条备注。

注解

你可以通过进入 ,并在 CodaBox 部分点击 打开 SODA 映射 按钮,来查看 SODA 与 Odoo 账户之间的映射关系。

潜在问题¶

CodaBox 尚未配置。请检查您的配置。

要么未设置 公司税号,要么未设置 会计师事务所税号。

与这些会计事务所和公司税号没有连接。 请检查您的配置。

这可能发生在检查连接状态时,此时 会计事务所税号 和 公司税号 的组合仍需进行注册。如果您在建立连接后更改了 公司税号,也可能出现此情况。出于安全考虑,您需要 重新创建一个连接 以使用此 公司税号。

似乎您的 CodaBox 连接已不再有效。请重新连接。

这可能发生在您撤销 Odoo 对您的 CodaBox 账户的访问权限,或者仍然需要完成配置过程时。在这种情况下,您必须取消现有连接并创建一个新的连接。

提供的密码对该会计事务所无效。 您必须使用首次连接时从 Odoo 获得的密码。

您提供的密码与首次连接 Odoo 时收到的密码不同。您必须使用首次连接 Odoo 时收到的密码,为这家会计事务所创建新的连接。如果您遗失了密码,首先必须在 CodaBox 的一侧(即您的 myCodaBox 门户上)撤销 Odoo 连接。然后,您可以在 Odoo 的一侧撤销连接,并 创建一个新的连接。

您提供的公司或会计师事务所的增值税号似乎无效。 请检查您的配置。

要么 公司税号,要么 会计事务所税号 的格式不符合比利时的有效格式。

似乎您提供的会计事务所的增值税号在 CodaBox 中不存在。 请检查您的配置。

您提供的 会计事务所增值税号 在 CodaBox 中未注册。您可能未将有效的 CodaBox 许可证与该增值税号关联。

看起来您已经使用该会计事务所创建了与 CodaBox 的连接。 要创建新的连接,您必须先在 myCodaBox 门户上撤销旧的连接。

您必须前往您的 myCodaBox 门户并撤销 Odoo 对您 CodaBox 账户的访问权限。然后,您可以在 Odoo 端 创建新的连接。

小技巧

要撤销 Odoo 与 CodaBox 之间的连接,请转到:,向下滚动到 CodaBox 部分,点击 管理连接,然后点击 撤销。

电子发票¶

Odoo 支持 Peppol BIS Billing 3.0 (UBL) 电子发票格式。要为客户提供此功能,请前往 ,打开其联系人表单,并在 会计 选项卡下,选择 Peppol BIS Billing 3.0 格式。

现金折扣¶

在比利时,如果发票上提供了提前付款折扣,税款将基于折扣后的总金额计算,无论客户是否实际享受了该折扣。

为了正确计算税额并在增值税申报表中正确报告,请将税收减免设置为:始终(在发票上)。

另请参见

财政认证:餐厅收银机¶

在比利时,从事餐饮业务(如餐厅或食品卡车)的业主根据法律规定,必须使用政府认证的**收银系统**来处理其收据。如果其年收入(不含增值税、饮料和外带食品)超过25,000欧元,则适用此规定。

This government-certified system entails the use of a certified POS system, along with a device called a Fiscal Data Module (or black box) and a VAT Signing Card.

重要

不要忘记在 联邦公共事务部财政注册表 上注册为 食品服务行业经理。

认证的POS系统¶

Odoo POS 系统已通过 Odoo Online 和 Odoo.sh 上托管的主要数据库版本的认证。请参考以下表格,确保您的 POS 系统已获得认证。

Odoo 在线版 |

Odoo.sh |

本地部署 |

|

|---|---|---|---|

Odoo 17.0 |

已认证 |

已认证 |

未认证 |

Odoo 16.0 |

已认证 |

已认证 |

未认证 |

Odoo 15.0 |

已认证 |

已认证 |

未认证 |

Odoo 14.0 |

已认证 |

已认证 |

未认证 |

另请参见

一个 认证的收银系统 必须遵守严格的政府法规,这意味着它的运行方式与非认证的收银系统不同。

在认证的 POS 设备上,您无法执行以下操作:

设置并使用 全局折扣 功能(

pos_discount模块已被禁止,无法激活)。设置并使用 忠诚度计划 功能(

pos_loyalty模块被禁止使用,无法激活)。重新打印收据(

pos_reprint模块已被屏蔽,无法激活)。修改订单行中的价格。

在POS订单中修改或删除订单行。

可以向没有有效增值税编号的客户销售产品。

使用一个未连接到物联网箱的收银机。

必须启用并设置 现金舍入 功能,将 舍入精度 设置为

0,05,并将 舍入方法 设置为 四舍五入。税费必须设置为包含在价格中。要进行设置,请转到 ,然后从 会计 部分,点击默认销售税字段旁边的箭头以打开 默认销售税 表单。在那里,点击 高级选项 并启用 包含在价格中。

在开始一次POS会话时,用户必须点击 上班 来签到。这样可以允许注册POS订单。如果用户未签到,则无法创建POS订单。同样地,用户在会话结束时必须点击 下班 来签出。

警告

如果你将一个 POS 配置为与 :abbr:`FDM (税务数据模块) ` 一起使用,则在没有它的前提下无法再次使用它。

财政数据模块(FDM)¶

一种FDM(或称为**黑匣子**),是一种政府认证的设备,它与销售点(POS)应用程序协同工作,并保存您的POS订单信息。具体来说,为每笔POS订单生成一个**哈希值**(唯一代码),并添加到其收据中。这使得政府能够验证所有收入是否已申报。

警告

只有 Boîtenoire.be 提供的 FDM,且其 FDM 认证编号为 BMC04,才被 Odoo 支持。请 联系制造商(GCV BMC) 进行订购。

配置¶

在设置数据库以与FDM配合使用之前,请确保您具备以下硬件:

黑盒模块¶

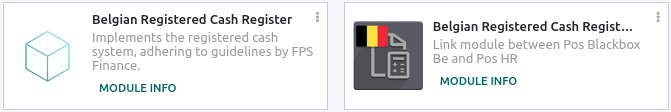

作为先决条件,激活 比利时注册收银机 模块(技术名称:pos_blackbox_be)。

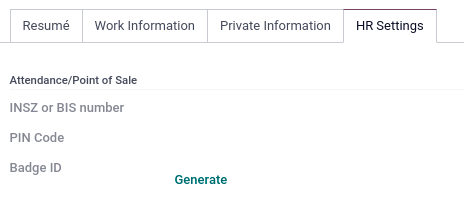

模块激活后,将您的增值税号码添加到公司信息中。要进行设置,请转至:,并填写 增值税号码 字段。然后,为每个操作 POS 系统的员工输入一个国家注册号码。为此,请进入 员工 应用程序并打开员工表单。在该表单中,转到 ,并填写 INSZ 或 BIS 号码 字段。

小技巧

要输入您的信息,请点击您的头像,进入 ,并在指定字段中输入您的 INSZ 或 BIS 编号。

警告

您必须在生产数据库中直接配置 FDM。在测试环境中使用可能会导致错误的数据存储在 FDM 中。

物联网网关¶

要使用 FDM(财政数据模块),您需要注册一个物联网盒子。要注册您的物联网盒子,您必须通过我们的 支持联系表单 与我们联系,并提供以下信息:

您的增值税号码;

您公司的名称、地址和法律结构;以及

您的物联网箱的 MAC 地址。

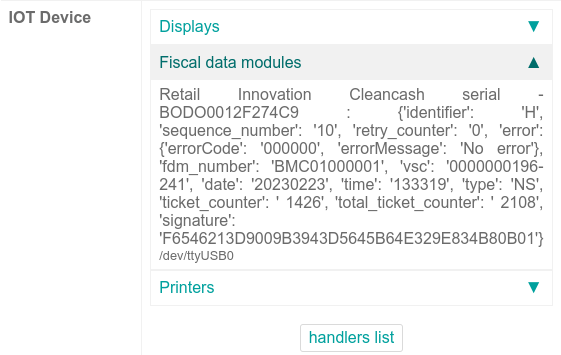

一旦您的 IoT 箱体通过认证,连接 到您的数据库。要验证 IoT 箱体是否识别了 FDM,请转到 IoT 首页并向下滚动至 IoT 设备 部分,其中应显示 FDM。

然后,将 IoT 添加到您的 POS。为此,请转到 ,选择您的 POS,向下滚动到 连接设备 部分,并启用 IoT 箱。最后,在 财政数据模块 字段中添加 FMD。

注解

要使用 FDM,您至少需要连接一个 收据打印机。

增值税签购卡¶

当你打开 POS 会话并进行首次交易时,系统会提示你输入随 VSC 提供的 PIN 码。该卡片由 FPS 在 注册 后发放。