欧盟内部社区远程销售¶

欧盟内部社区远程销售涉及向位于欧盟成员国的个人(B2C)销售商品和服务的跨境贸易,销售方需已进行增值税注册。该交易通过在线平台、邮购、电话或其他通信方式远程进行。

欧盟内部社区远程销售需遵守特定的增值税(VAT)规则和法规。供应商必须按照买方所在国家适用的增值税税率进行征税。

注解

即使供应商位于欧盟以外的地区,此规定仍然适用。

配置¶

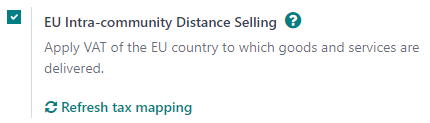

欧盟内部社区远程销售**功能通过根据您公司的所在国家创建和配置新的 **财政位置 和 税项,帮助您遵守该法规。要启用此功能,请转到 ,勾选 欧盟内部社区远程销售,然后 保存。

小技巧

每次您添加或修改税费时,都可以自动更新您的税务地位。为此,请转到 ,然后点击 刷新税费映射。

注解

我们强烈建议在使用之前确认所提议的映射适用于您销售的产品和服务。

另请参见

税款

本地财政法规

财务定位

一站式服务(OSS)¶

The OSS system introduced by the European Union simplifies VAT collection for cross-border sales of goods and services. It primarily applies to business-to-consumer (B2C) cases. With the OSS, businesses can register for VAT in their home country and use a single online portal to handle VAT obligations for their sales within the EU. There are two primary schemes: the Union OSS scheme for cross-border services and the Import OSS scheme for goods valued at or below €150.

报表¶

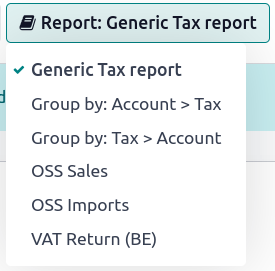

要生成 OSS 销售 或 OSS 进口 报告并将其提交到 OSS 门户,请转至 ,点击 报表:通用税务报表,然后选择 OSS 销售 或 OSS 进口。选定后,在左上角点击 PDF、XLSX 或 XML。这将按照所选格式生成当前打开的报表。生成后,登录您所属联邦主管机构的平台,将报表提交到 OSS 门户。

另请参见