现金折扣和税收减免¶

**现金折扣**是为鼓励客户及时支付发票而对客户应支付金额进行的减少。这些折扣通常是发票总金额的一个百分比,并在客户在规定时间内付款时适用。现金折扣有助于公司保持稳定的现金流。

Example

您在1月1日开具了一张100欧元的发票。全额付款应在30天内支付,如果您客户在7天内付款,您还可以提供2%的折扣。

客户可以在1月8日前支付98欧元。过了该日期后,他们必须在1月31日前支付100欧元。

一种 税收减免 也可以根据国家或地区进行应用。

另请参见

付款条款

../支付

配置¶

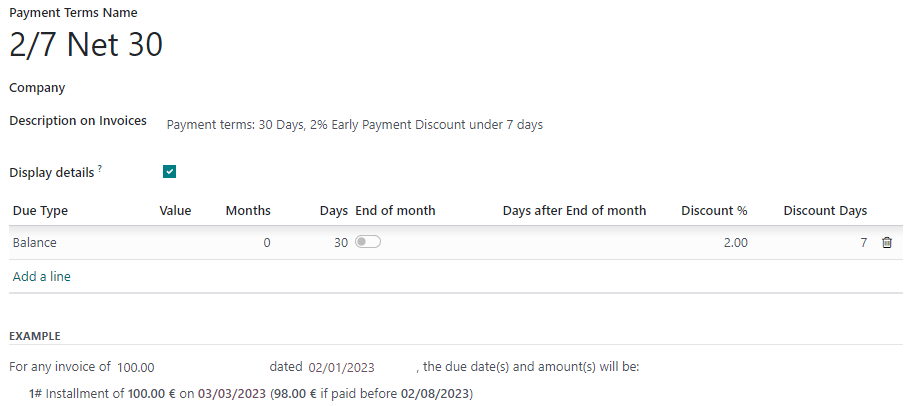

要向客户授予现金折扣,您首先必须验证 损益账户。然后,配置 付款条件,并通过勾选 提前折扣 复选框并填写折扣百分比、折扣天数和 税额减免 字段来添加现金折扣。

现金折扣损益账户¶

采用现金折扣时,您获得的金额取决于客户是否享受了现金折扣。这不可避免地会导致收益和损失,这些损益将记录在默认账户中。

要修改这些科目,请转到: ,并在 默认科目 部分中,选择用于 现金折扣收益科目 和 现金折扣损失科目 的科目。

付款条款¶

现金折扣是在 付款条件 中定义的。通过进入 进行配置,确保填写折扣百分比、折扣天数以及 税款减免 字段。

税收减免¶

根据国家或地区不同,用于计算税款的基础金额可能会有所变化,这可能导致 税款减免。由于税款减免是针对单个付款条款设置的,每个条款可以使用特定的税款减免。

要配置税款减免的适用方式,请进入一个启用了 提前折扣 复选框的付款条件,并选择以下三种选项之一:

- 始终(在开具发票时)

税款总是被减少。用于计算税款的计税金额是折扣后的金额,无论客户是否享受了折扣。

- 提前付款

该税款仅在客户提前付款时予以减免。计算税款的计税基础与销售金额相同:如果客户享受了减免,则税款也会相应减少。这意味着,根据客户的不同,发票开具后税款金额可能会有所变化。

- 从不

税款永远不会减少。用于计算税款的计税金额是全额,无论客户是否享受折扣。

Example

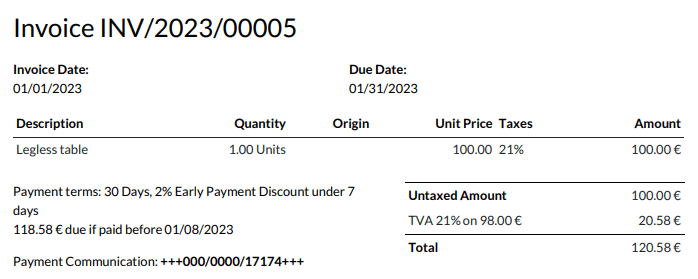

您于1月1日开具一张不含税的100欧元发票,税率为21%。全额付款应在30天内完成,如果您客户在7天内付款,您还提供2%的折扣。

到期日期 |

应付总金额 |

计算 |

|---|---|---|

1月8日 |

€118.58 |

€98 + (21% 的 €98) |

1月31日 |

€120.58 |

€100 + (21% 的 €98) |

到期日期 |

应付总金额 |

计算 |

|---|---|---|

1月8日 |

€118.58 |

€98 + (21% 的 €98) |

1月31日 |

€121.00 |

€100 + (21% 的 €100) |

到期日期 |

应付总金额 |

计算 |

|---|---|---|

1月8日 |

€119.00 |

€98 + (21% 的 €100) |

1月31日 |

€121.00 |

€100 + (21% 的 €100) |

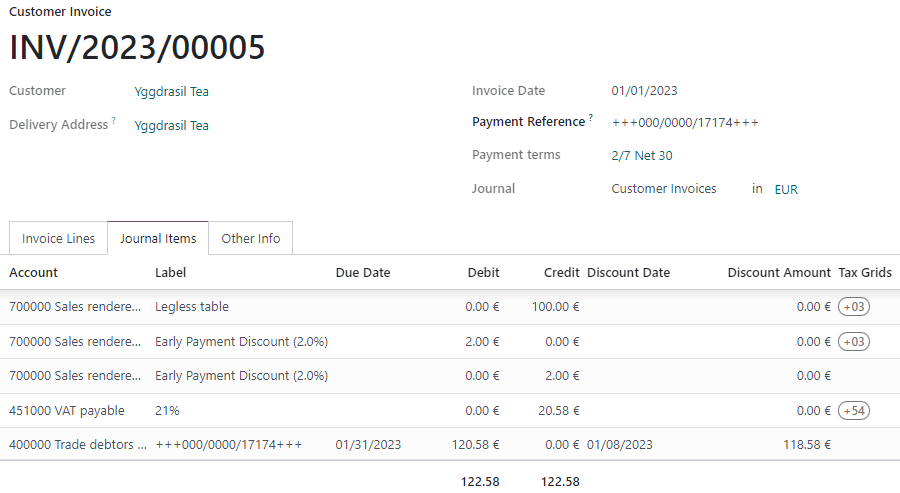

对客户发票应用现金折扣¶

在客户发票上,通过选择 您创建的付款条件 来应用现金折扣。Odoo 会自动计算正确的金额、税额、到期日期和会计记录。

在 日记账条目 选项卡下,您可以通过点击“切换”按钮并添加 折扣日期 和 折扣金额 列来显示折扣详情。

如果在付款条款中勾选了 显示分期日期 选项,折扣金额和到期日也会在发送给客户的生成发票报告中显示。

付款对账¶

当你记录一条 付款 或 对账银行交易 时,Odoo 会考虑客户付款的日期,以确定客户是否可以享受现金折扣。

注解

如果您的客户在折扣日期**之后**支付了折扣金额,您始终可以决定将发票标记为全额付款(通过冲销处理)或部分付款。