巴西¶

简介¶

通过巴西本地化设置,销售税可以自动计算,并可通过 AvaTax(Avalara)通过 API 调用发送商品的电子发票(NF-e)和服务的电子发票(NFS-e)。此外,还可以配置服务税。

在进行商品和服务税计算及电子发票流程时,您需要配置:联系人、公司、产品,以及:ref:在AvaTax创建账户 <brazil/avatax-account>,该账户需要在常规设置中进行配置。

对于服务税,您可以直接在 Odoo 中创建和配置,而无需使用 AvaTax 进行计算。

本地化还包含税项以及一张会计科目表模板,如需修改可进行调整。

配置¶

模块安装¶

安装以下模块以获得巴西本地化的所有功能: 安装

名称 |

技术名称 |

描述 |

|---|---|---|

巴西 - 会计 |

|

默认的 财政本地化包,表示包含通用巴西会计科目表和税项,以及文档类型和识别类型。 |

巴西 - 财务报表 |

|

巴西的会计报表。 |

AvaTax 巴西 & AvaTax 巴西服务版 |

|

通过 Avalara 计算商品和服务税。 |

巴西会计EDI & 服务类巴西会计EDI |

|

通过 AvaTax 为巴西的商品和服务提供电子发票功能。 |

巴西 Pix 二维码 |

|

为巴西实现 Pix 二维码。 |

配置您的公司¶

要配置您的公司信息,请转到 应用程序,并搜索您公司名称。

在页面顶部选择 公司 选项。然后,配置以下字段:

名称

地址: 添加 城市, 州, 邮编, 国家

在 街道 字段中,输入街道名称、门牌号以及任何其他地址信息。

在 街道 2 字段中,输入社区。

识别编号: CNPJ 或 CPF

税号:与身份识别类型相关联

IE:州注册

IM:市政登记

SUFRAMA 编码: 玛瑙斯自由贸易区管理局 - 如适用请添加

电话

电子邮件

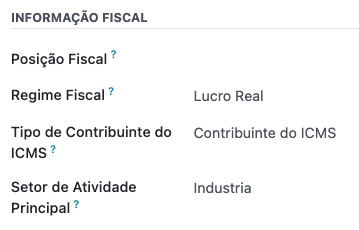

在 销售与采购 选项卡中配置 财政信息:

添加 税务位置 用于 AvaTax Brazil。

税制: 联邦税制

ICMS 纳税人类型: 表示 ICMS 征收制度、免税状态 或 非纳税人

主要活动领域

如果要开具 NFS-e,请配置以下额外的 财政信息:

添加 税务位置 用于 AvaTax Brazil。

COFINS 详情: 应税、非应税、按0%税率应税、免税、暂停

PIS 详情 应税、非应税、税率0%的应税、免税、暂停

CSLL 应税 如果公司适用 CSLL 税则与否

最后,上传公司徽标并保存联系人。

注解

如果您适用简易税率,您需要在 下配置 ICMS 税率。

配置 AvaTax 集成¶

Avalara AvaTax 是一家提供税务计算和电子发票服务的供应商,可以与 Odoo 集成,通过考虑公司、联系人(客户)、产品和交易信息,自动计算税款,以获取正确的税种,并随后与政府处理电子发票。

使用此集成需要 应用内购买 (IAPs) 来计算税款并发送电子发票。每当您计算税款、发送电子文档(NF-e、NFS-e 等)或执行任何电子流程(NF-e 撤销、更正函、作废发票号码范围),都会使用您 IAP 信用余额 中的积分进行 API 调用。

注解

Odoo 是 Avalara Brazil 的认证业务伙伴。

您可以在 odoo.com 上 购买 IAP 信用。

创建时,新数据库将获得 500 个免费积分。

凭证配置¶

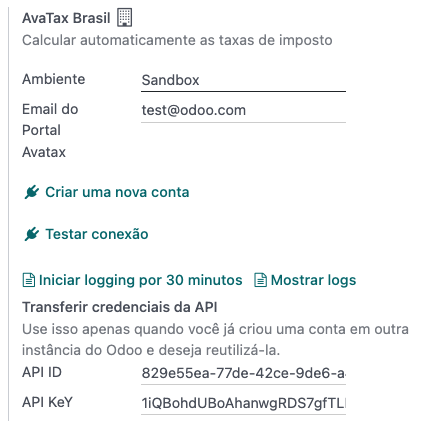

要在 Odoo 中启用 AvaTax,您需要创建一个账户。操作步骤如下:转到 ,在 AvaTax 巴西 部分中,将用于 AvaTax 门户的管理电子邮件地址填写到 AvaTax 门户邮箱 字段中,然后点击 创建账户。

警告

在 测试 或 创建生产环境 的 AvaTax 门户邮箱 集成时,无论是在沙箱数据库还是生产数据库中,都应使用真实的电子邮件地址,因为需要登录到 Avalara 门户并设置证书,无论您是想进行测试还是在生产环境中使用。

有两种不同的 Avalara 门户,一个用于测试,一个用于生产:

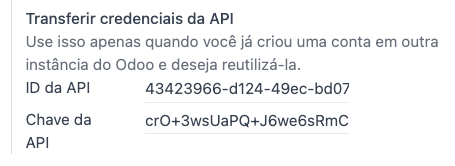

在您从 Odoo 创建账户时,请确保选择正确的环境。此外,用于开通账户的电子邮件不能用于开通另一个账户。请在从 Odoo 创建账户时保存您的 API ID 和 API Key。

在您从 Odoo 创建账户后,需要前往 Avalara 门户设置您的密码:

访问 Avalara 门户。

点击 我的首次访问。

使用你在 Odoo 中注册的电子邮件地址来创建 Avalara/AvaTax 账户,然后点击 请求密码。

您将收到一封包含令牌和创建密码链接的电子邮件。点击此链接并将令牌复制粘贴到相应位置以设置您想要的密码。

小技巧

你可以开始在 Odoo 数据库中使用 AvaTax 进行税费计算 仅 需要创建密码并访问 Avalara 门户。然而,如需使用电子发票服务,你 必须 访问 AvaTax 门户并在那里上传你的证书。

注解

您可以转移 API 凭据。仅在您已在另一个 Odoo 实例中创建了账户并希望重复使用时才使用此功能。

A1 证书上传¶

为了开具电子发票,需要将证书上传至 AvaTax 门户。

证书将与Odoo同步,只要AvaTax门户中的外部标识号(不带特殊字符)与CNPJ号码匹配,并且Odoo中的识别号(CNPJ)与AvaTax中的CNPJ匹配。

重要

要开具NFS-e,某些城市要求您在城市门户网站系统中先绑定证书,然后才能从Odoo开具NFS-e。

If you receive an error message from the city that says Your certificate is not linked to the user, that means this process needs to be done in the city portal.

配置主数据¶

会计科目表¶

默认情况下,会计科目表(chart of accounts)作为本地化模块中包含的数据集的一部分进行安装。这些账户会自动映射到相应的税项,以及默认的应付账款和应收账款字段。

注解

巴西的会计科目表基于SPED科目表,该科目表为巴西所需的会计科目提供了基础。

您可以根据公司的需求添加或删除账户。

凭证类型¶

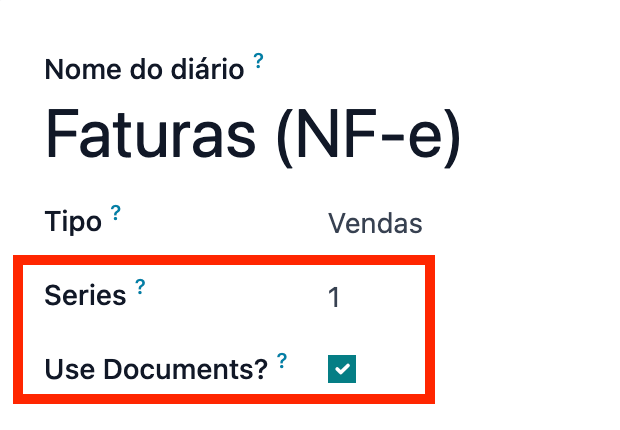

在巴西,*系列*编号与电子发票的序列号范围相关联。系列编号可以在销售日记账的 系列 字段中进行配置。如果需要多个系列,则需要创建一个新的销售日记账,并为每个所需的系列分配一个新的系列编号。

需要选择 使用文档 字段。在开具电子和非电子发票时,类型 字段用于选择创建发票时使用的文档类型。只有在凭证中选择了 使用文档 字段时,类型 字段才会显示。

注解

在创建凭证时,请确保勾选字段:专用贷项通知单序列 为未选中状态,因为在巴西,发票、贷项通知单和借项通知单之间的序列是按系列编号共享的,这意味着每个凭证(journal)对应一个序列。

税项¶

当安装巴西本地化模块时,税项会自动创建。税项已预先配置,其中一些税项在计算销售订单或发票中的税款时会被 Avalara 使用。

税项可以进行编辑,或添加更多税项。例如,某些用于服务的税项需要手动添加和配置,因为税率可能因您提供服务的城市而异。

重要

如果您决定手动处理服务税,将无法开具 NFS-e。要电子发送 NFS-e,您需要使用 Avalara 计算税款。

警告

请勿删除税项,因为它们用于AvaTax税务计算。如果删除,当在|SO|或发票中使用并使用AvaTax计算税务时,Odoo会重新创建这些税项,但需要在税项的 定义 选项卡下的 发票分摊 和 退款分摊 部分重新配置用于登记税项的账户。

另请参见

产品¶

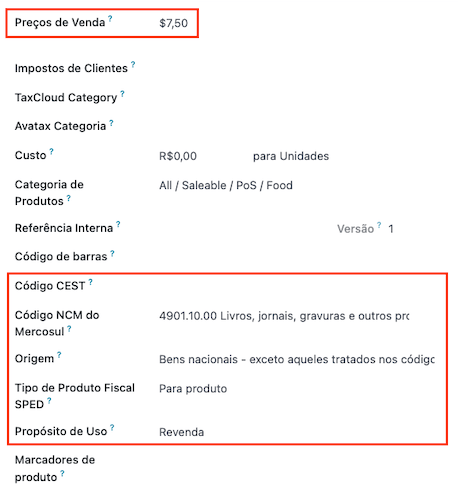

要在销售订单和发票中使用AvaTax集成,首先根据产品的预期用途在产品上指定以下信息:

商品电子发票(NF-e)¶

CEST 编码: 适用于 ICMS 税收替代的产品编码

Mercosul NCM Code: 共同市场共同产品分类代码

来源: 表示产品的来源,可以是国外或国内,根据具体使用场景还可能有其他选项。

SPED 税务产品类型: 根据 SPED 列表表格的税务产品类型

用途: 指定该产品的预期用途

注解

Odoo 会自动生成三个产品,用于与销售相关的运输成本。它们的名称分别为 运费、保险 和 其他费用。这些产品已预先配置好,如果需要创建更多产品,请复制并使用相同的配置(配置要求:产品类型 设置为 服务,运输成本类型 设置为 保险、运费 或 其他费用)。

服务电子发票(NFS-e)¶

Mercosul NCM Code: 共同市场共同产品分类代码

用途: 指定该产品的预期用途

服务代码来源: 服务商注册的城市服务代码

服务代码: 服务提供的城市服务代码,如果没有添加代码,则使用来源城市代码

劳动力分配: 定义您的服务是否包含人工成本

联系人¶

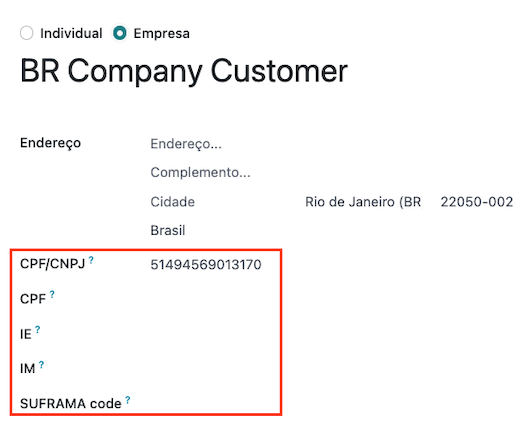

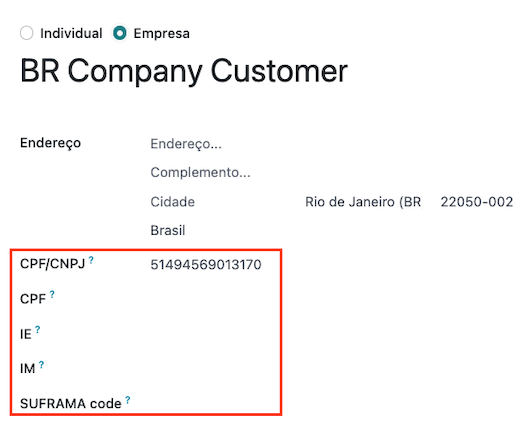

在使用集成之前,请在联系人上指定以下信息:

联系人的通用信息:

选择 公司 选项,用于具有税号(CNPJ)的联系人,或勾选 个人 选项,用于具有CPF的联系人。

名称

地址: 添加 城市, 州, 邮编, 国家

在 街道 字段中,输入街道、门牌号以及任何额外的地址信息。

在 街道 2 字段中,输入社区。

识别编号: CNPJ 或 CPF

税号:与身份识别类型相关联

IE:国家税务识别号

IM:市政税号

SUFRAMA 编码: SUFRAMA 注册编号

电话

电子邮件

注解

CPF、IE、IM 和 SUFRAMA 编码 字段在将 国家 设置为

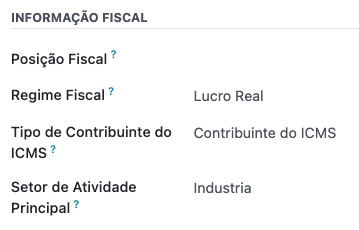

巴西之前是隐藏的。联系人 under the 销售 & 采购 标签页中的财政信息:

税务位置: 添加 AvaTax 税务位置,以在销售订单和发票上自动计算税款

税制: 联邦税制

ICMS 纳税人类型:纳税人类型用于确定联系人是否属于 ICMS 征收范围、免税状态 或 非纳税人。

主要活动领域: 联系人的主要活动领域列表

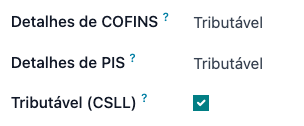

如果要开具 NFS-e,请配置以下额外的 财政信息:

添加 税务位置 用于 AvaTax Brazil

COFINS 详情: 应税、非应税、按0%税率应税、免税、暂停

PIS 详情: 应税、非应税、税率0%的应税、免税、暂停

CSLL 应税: 该公司是否适用 CSLL 税

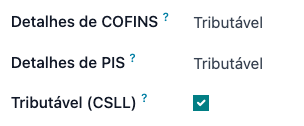

财政位置¶

要计算销售订单和发票的税款并发送电子发票,必须在 税务位置 中同时启用 自动检测 和 使用 AvaTax API 选项。

该 财政定位 可以在 联系人 中进行配置,也可以在创建销售订单或发票时进行选择。

工作流¶

本节概述了触发税务计算的`API调用 <https://en.wikipedia.org/wiki/API>`_ 的操作,并提供了如何向政府提交电子发票(NF-e)和服务业发票(NFS-e)以进行验证的说明。

警告

请注意,每次 API 调用都会产生费用。请留意触发这些调用的操作,以有效管理成本。

税款计算¶

报价和销售订单中的税务计算¶

通过以下任何一种方式,触发对报价单或销售订单的税务计算的 API 调用,使用 AvaTax 自动计算税款:

- 报价确认

将报价单确认为销售订单。

- 手动触发

点击 使用 AvaTax 计算税款。

- 预览

点击 预览 按钮。

- 将报价单/销售订单发送邮件

通过电子邮件将报价单或销售订单发送给客户。

- 在线报价访问

当客户通过门户视图在线访问报价单时,会触发 API 调用。

发票上的税务计算¶

通过以下任何一种方式,触发对客户发票的税务计算的 API 调用,使用 AvaTax 自动完成:

- 手动触发

点击 使用 AvaTax 计算税款。

- 预览

点击 预览 按钮。

- 在线发票访问

当客户通过门户视图在线访问发票时,会触发 API 调用。

注解

对于这些操作自动计算税费,必须将 财务位置 设置为 自动税务映射 (Avalara Brazil)。

另请参见

电子文档¶

客户发票¶

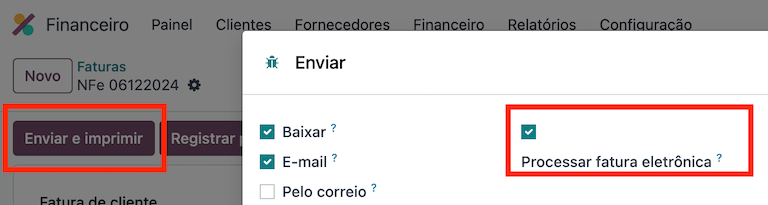

要处理电子发票(NF-e)或服务发票(NFS-e),需要先通过Avalara确认发票并计算税款。完成此步骤后,点击左上角的 发送与打印 按钮。在弹出的窗口中,点击 处理电子发票,以及其它任何选项 - 下载 或 电子邮件。最后,点击 发送与打印 以将发票提交给政府。

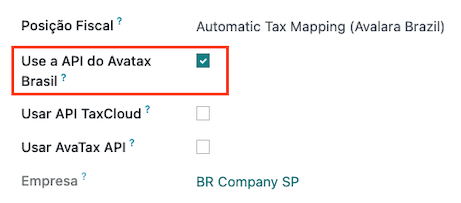

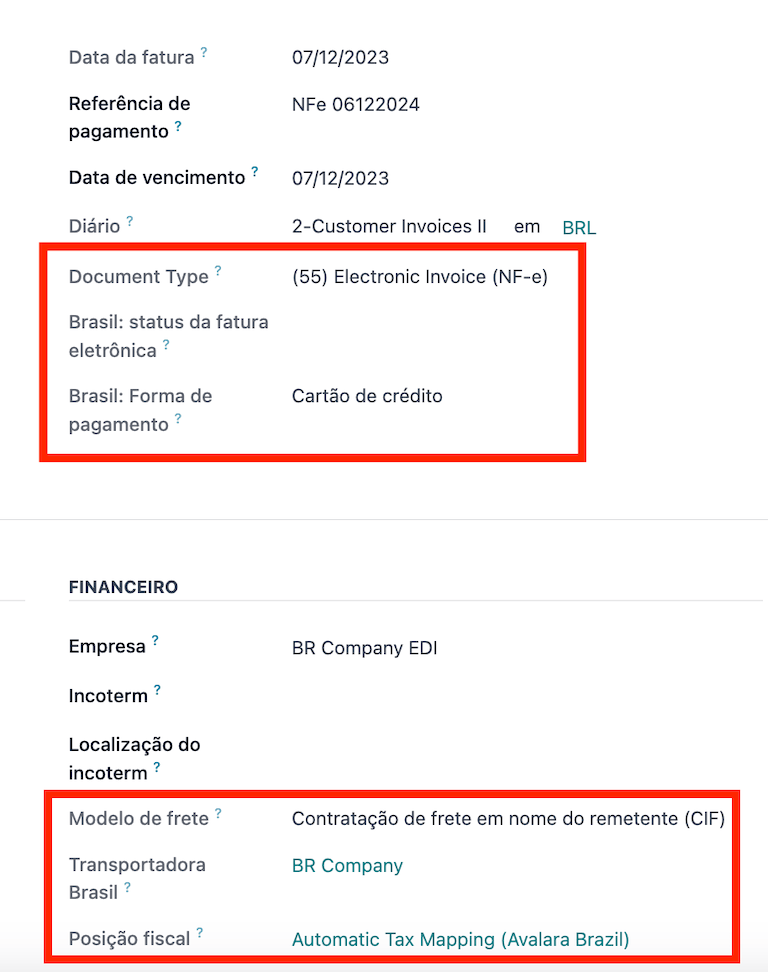

在发送货物的电子发票(NF-e)或服务的电子发票(NFS-e)之前,需要在发票上填写一些字段:

客户,包含所有客户信息

付款方式:巴西: 发票计划如何支付

财政位置 设置为 自动税务映射(Avalara Brazil)

单据类型 设置为 (55) 电子发票 (NF-e) 或 (SE) 电子服务发票 (NFS-e)

还有一些其他可选字段,这些字段取决于交易的性质。这些字段不是必填项,因此在大多数情况下,如果未填写这些可选字段,政府也不会出现错误提示:

运输方式 确定货物的运输计划 - 国内运输

巴西运输商 确定由谁负责运输

注解

所有可用于开具电子发票的发票字段在销售订单中也均可使用,如需的话。在创建第一张发票时,会显示字段:文档编号,该字段将被分配为后续发票依次使用的第一个编号。

贷项通知单¶

如果需要登记销售退货,则可以在 Odoo 中创建一张贷项通知单,并发送给政府进行审核。

注解

仅适用于货物的电子发票(NF-e)的贷项通知单。

另请参见

借项通知单¶

如果需要补充额外信息,或更正原始发票中未准确提供的数值,可以开具贷项通知单。

注解

借方通知仅适用于商品的电子发票(NF-e)。

只有原始发票中包含的产品才能成为贷项通知单的一部分。虽然可以对产品的单价或数量进行修改,但**不能**将产品添加到贷项通知单中。此文件的目的是仅声明您希望针对相同或更少数量的产品添加到原始发票中的金额。

另请参见

发票作废¶

可以取消由政府验证的电子发票。

注解

检查电子发票是否仍在可撤销期限内,该期限可能因各州的法律规定而有所不同。

商品电子发票(NF-e)¶

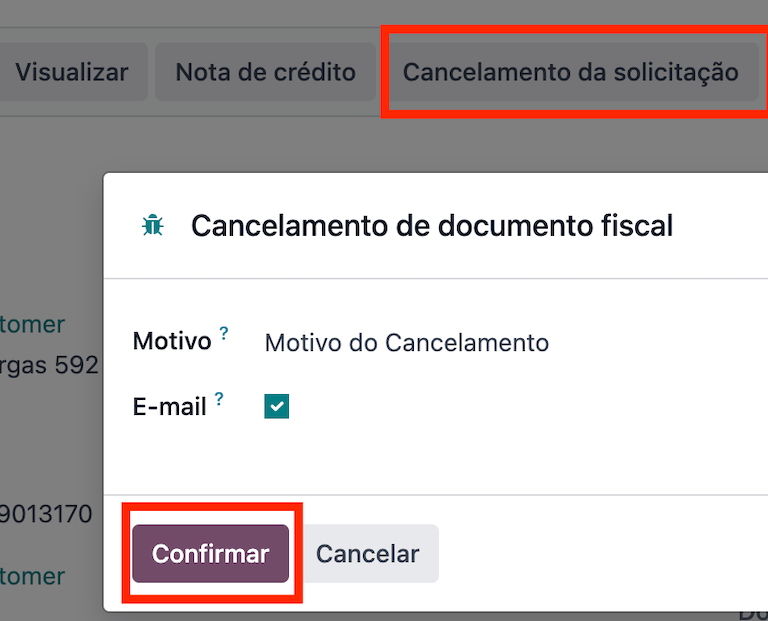

在 Odoo 中,通过点击 请求作废 并在弹出窗口中添加作废 原因,即可对电子发票(NF-e)进行作废操作。如果您希望通过电子邮件将此作废原因发送给客户,请激活 邮件 复选框。

注解

这是一个电子作废操作,意味着 Odoo 将向政府发送请求以取消 NF-e,并因此消耗一个 IAP 信用额度,因为发生了 API 调用。

服务电子发票(NFS-e)¶

在 Odoo 中通过点击 请求作废 来取消服务类电子发票(NFS-e)。在这种情况下,由于并非所有城市都提供此服务,因此没有电子作废流程。用户需要在城市门户网站上手动取消该 NFS-e。完成此步骤后,他们可以在 Odoo 中请求作废,这将取消该发票。

更正函¶

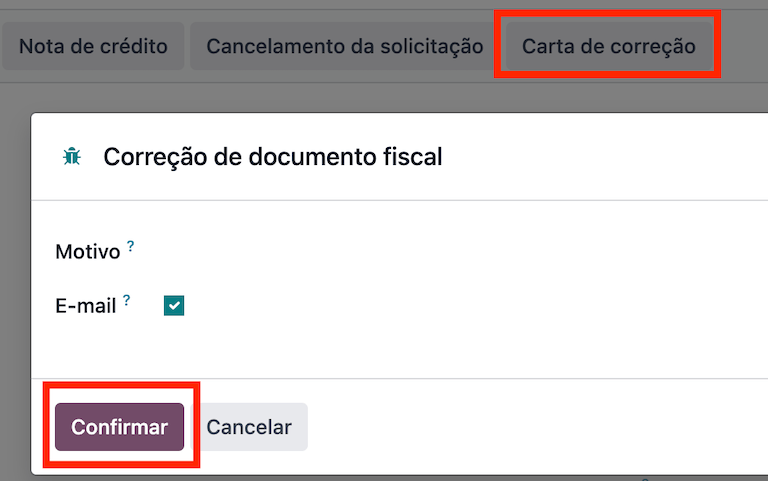

可以创建一份更正函,并将其与已由政府验证的电子货物发票(NF-e)相关联。

可以通过点击 更正函 并在弹出的窗口中添加更正 原因 来在 Odoo 中完成此操作。若要通过电子邮件将此更正原因发送给客户,请启用 电子邮件 复选框。

注解

更正函仅适用于货物的电子发票(NF-e)。

作废发票号码范围¶

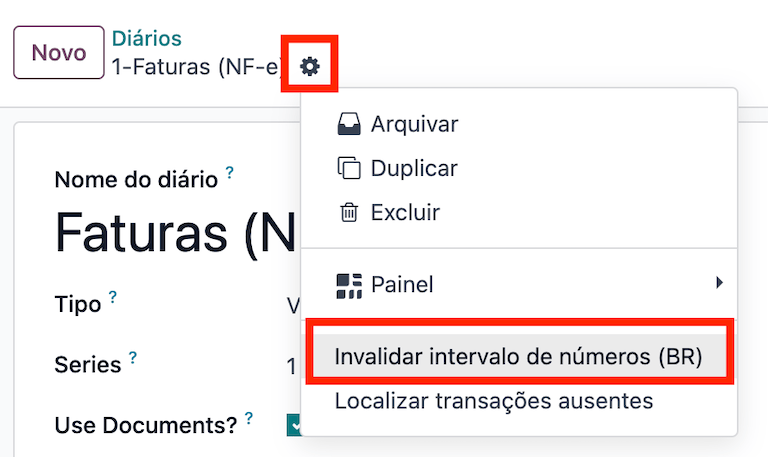

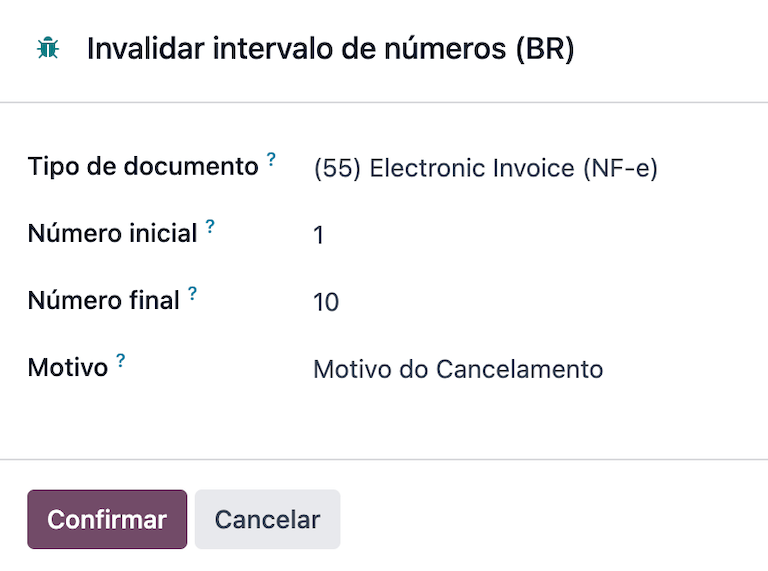

可以将政府未使用且将来也不会使用的销售日记账的序列范围进行作废。为此,请导航至日记账,然后点击 。在 作废编号范围 (BR) 向导中,输入需要取消的范围的 起始编号 和 结束编号,并输入作废的 原因。

注解

仅对商品电子发票(NF-e)可用作无效发票编号范围的文档。

注解

已取消号码的日志连同 XML 文件记录在日记的聊天中。

供应商发票¶

在供应商发票方面,当收到供应商的发票时,您可以通过在 Odoo 中添加所有商业信息,以及与 客户发票 上记录的相同巴西特定信息来录入该发票。

这些巴西特有的字段包括:

付款方式:巴西: 发票计划如何支付

单据类型: 由您的供应商使用

单据编号: 供应商提供的发票号码

运输方式: NF-e 特定 说明货物计划如何运输 - 国内运输

巴西承运人: 电子发票(NF-e)专用,负责运输的人员。