递延收入¶

Deferred revenues, or unearned revenues, are invoices addressed to customers for goods yet to be delivered or services yet to be rendered.

公司无法在当前的**利润和损失表**或*收入表*中报告这些内容,因为商品和服务将在未来实际交付/提供。

这些未来的收入必须在公司的资产负债表中作为流动负债进行递延,直到它们可以在损益表中一次性或在定义的期间内被**确认**。

例如,假设一家企业以1200美元的价格销售一年的软件许可。他们立即向客户开具发票,但还不能将其视为已实现收入,因为未来的几个月的许可服务尚未提供。因此,他们将这笔新收入记入递延收入账户,并按月确认。在接下来的12个月中,每个月将确认100美元作为收入。

Odoo 会计通过将递延收入分摊到多个凭证中并定期过账来处理递延收入。

注解

服务器每天检查一次是否需要生成凭证。之后,您可能需要最多24小时才能看到从 草稿 到 已过账 的变化。

配置¶

确保您的业务默认设置已正确配置。为此,请转到:。以下选项可用:

- 日记账

此日记账中已记录递延分录。

- 递延收入

收入在此流动负债账户中递延,直到被确认。

- 生成凭证

默认情况下,Odoo 在您审核客户发票时自动生成 递延分录。但是,您也可以选择通过选择 手动 & 分组 选项来 手动生成它们。

- 基于

假设一张金额为1200美元的发票需要分12个月递延。

“月份”选项按月计算,每月费用为100美元,并根据当月的天数按比例分摊(例如,如果“开始日期”设置为当月15日,则第一个月费用为50美元)。

“完整月份”选项将每个月的开始视为完整的月份(例如,即使将“开始日期”设置为当月的15日,第一个月仍计为100美元);这意味着在使用“完整月份”选项时,第一个部分月份也会确认完整的100美元,从而无需第13个月来确认剩余金额,这与使用“月份”选项时的情况不同。

“天数”选项会根据每个月的天数不同而计算不同的金额(例如,1月约为102美元,2月约为92美元)。

在验证时生成递延分录¶

小技巧

请确保在 发票行 选项卡中显示 开始日期 和 结束日期 字段。在大多数情况下,开始日期 应该与 发票日期 在同一月份。递延收入条目将从发票日期开始入账,并在报表中相应地显示。

对于每条需要递延的发票行,请指定递延期间的开始和结束日期。

如果在 设置 中的 生成分录 字段设置为 在发票/账单验证时,Odoo 在发票验证时会自动生成递延分录。点击 递延分录 智能按钮以查看这些分录。

一张凭证的日期与发票的会计日期相同,将发票金额从收入账户转入递延账户。其他凭证为递延凭证,逐月将发票金额从递延账户转回收入账户,以确认收入。

Example

您可以将一张金额为1200美元的1月份发票分12个月递延,通过指定开始日期为2023年01月01日和结束日期为2023年12月31日。到8月底时,800美元会被确认为收入,而400美元则仍留在递延账户中。

报表¶

待摊收入报表用于计算每个账户所需的摊销分录概览。要访问它,请转到:。

要查看每个账户的分录项,请点击账户名称,然后点击 分录项。

注解

只有会计日期在报告期间结束之前的发票才会被考虑在内。

手动生成分组递延凭证¶

如果您有大量递延收入并希望减少生成的日记账条目数量,可以手动生成递延条目。为此,请在 设置 中将 生成条目 字段设置为 手动且合并. Odoo 随后会将递延金额汇总到一条条目中。

每月末,进入 ,并点击 生成分录 按钮。这将生成两条递延分录:

一份在月末日期生成的凭证,用于汇总每个账户当月的所有递延金额。这意味着该期间内部分递延收入将被确认。

此冲销分录的日期为次日(即下个月的第一天),用于取消之前的分录。

Example

这里有两张发票:

发票 A:1200 美元需从 2023 年 01 月 01 日递延至 2023 年 12 月 31 日

发票 B:600 美元需从 2023 年 01 月 01 日递延至 2023 年 12 月 31 日

- 一月

在1月底,点击 生成分录 按钮后,将生成以下分录:

- 2月

在2月底,点击 生成分录 按钮后,将产生以下分录:

- 3月至10月

每个月都进行相同的计算,直到10月。

- 11月

在11月底,点击 生成分录 按钮后,将生成以下分录:

- 12月

不需要在12月生成分录。实际上,如果对12月进行计算,需要递延的金额为0。

- 总共

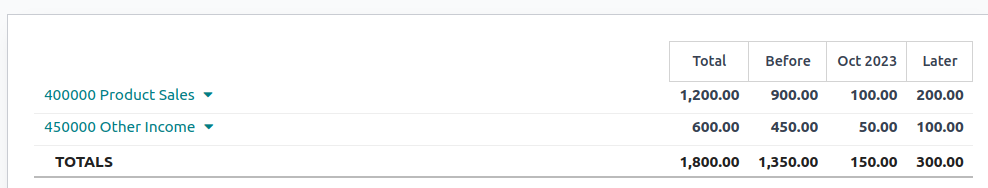

如果我们进行汇总,结果将是:

发票 A 和发票 B

每个月份从一月到十一月各有两个条目(一个用于递延,一个用于冲销)

因此,尽管创建了所有相关分录,但由于冲销机制的作用,发票 A 和 B 在 12 月底仅被确认为一次收入。