智利¶

模块¶

Install the following modules to utilize all the features of the Chilean localization.

名称 |

技术名称 |

描述 |

|---|---|---|

智利 - 会计 |

|

按照智利 SII 的法规和指南,为公司运营添加必要的会计功能。 |

智利 - 财务报表 |

|

新增 Propuesta F29 和 税务平衡表(8列) 报表。 |

智利 - 电子发票 |

|

包括根据 SII 规定在线接收和生成**电子收据**和**发票**的所有技术和功能要求。 |

智利商品电子出口 |

|

包括根据 SII 和海关法规生成出口货物电子发票的技术和功能要求。 |

智利 - 电子发票交付指南 |

|

包含通过基于 SII 规定的 Web 服务生成交货指南的所有技术和功能需求。 |

注解

Odoo 会根据创建数据库时选择的国家自动安装相应的公司包。

智利-电子发票交付指南 模块依赖于 库存 应用程序。

重要

所有功能仅在公司已完成 SII 市场发票系统 认证流程后才可用。

公司信息¶

导航至 ,并确保以下公司信息已更新且正确填写:

公司名称

地址:

街道

城市

状态

邮编

国家

税号: 输入所选 纳税人类型 的识别号码。

活动名称: 选择最多四个活动代码。

公司业务描述: 输入对公司业务的简短描述。

会计设置¶

接下来,导航至 ,并按照说明进行配置:

财政信息¶

配置以下 纳税人信息:

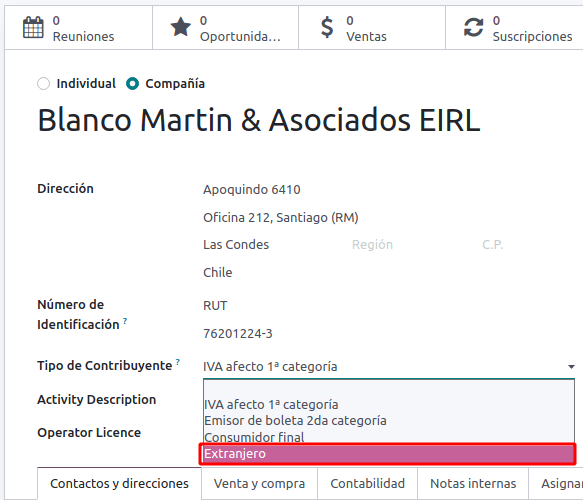

纳税人类型,选择适用的纳税人类型:

增值税影响(第一类): 适用于向客户征收税款的发票

费用收据签发人(第二类): 用于开具费用收据(Boleta)的供应商

最终消费者: 仅开具收据

外国人

SII 办公室: 选择您公司所属的 SII 区域办公室

电子发票数据¶

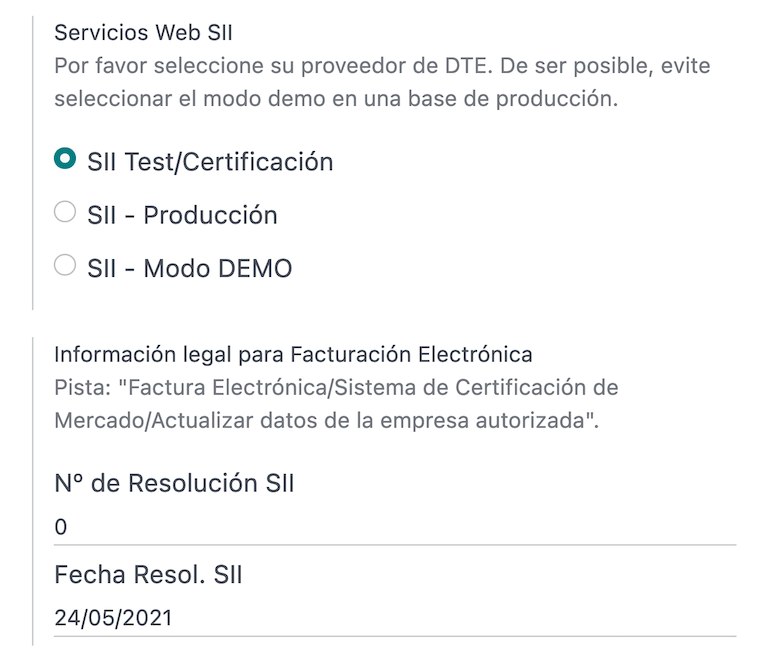

选择您的 SII Web Services 环境:

SII - 测试:用于使用从 SII 获取的测试 CAFs 的测试数据库。在此模式下,可以直接测试连接流程,文件将发送至 SII。

SII - 生产: 用于生产数据库。

SII - 演示模式: 在演示模式下,文件会自动创建并被接受,但它们**不会**发送至 SII. 因此,在此模式下不会出现拒绝错误或“接受但有异议”的情况。所有内部验证都可以在演示模式下进行测试。请避免在生产数据库中选择此选项。

然后,输入 法定电子发票数据:

SII 解决方案编号

SII 解决日期

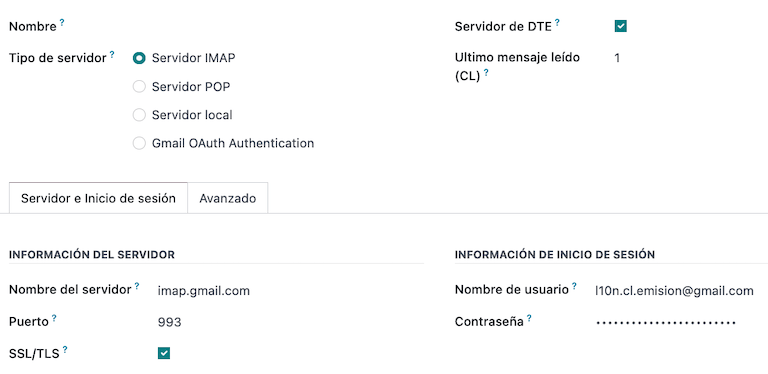

DTE 入站电子邮件服务器¶

您可以将 DTE 电子发票邮箱 设置为接收客户的通知和确认邮件。如果您希望将 电子发票邮箱 用作 DTE 的传入邮件服务器,则必须从 启用此选项。

重要

为了接收您的 SII 文档,需要设置您自己的电子邮件服务器。有关如何操作的更多信息,请参阅此文档:Communication in Odoo by email

首先点击 配置 DTE 进站邮件,然后点击 新建 以添加一个服务器并填写以下字段:

名称:为服务器命名。

服务器类型: 选择使用的服务器类型。

IMAP 服务器

POP 服务器

本地服务器:使用本地脚本获取邮件并创建新记录。该脚本可以在 配置 部分中找到,并在此选项被选中时启用。

Gmail OAuth 认证: 需要在常规设置中配置您的 Gmail API 凭据。可以直接在 登录信息 部分找到配置链接。

DTE 服务器: 启用此选项。勾选此选项后,该电子邮件账户将用于接收供应商发送的电子发票,以及来自 SII 关于已开具电子发票的通信。在这种情况下,该电子邮件地址应与在 SII 网站“*ACTUALIZACION DE DATOS DEL CONTRIBUYENTE*(纳税人信息更新)”栏目下的 *Mail Contacto SII*(SII 联系邮箱)和 *Mail Contacto Empresas*(企业联系邮箱)中声明的电子邮件地址一致。

在 服务器与登录 选项卡(用于 IMAP 和 POP 服务器)中:

服务器名称: 输入服务器的主机名或IP地址。

端口: 输入服务器端口。

SSL/TLS:如果连接使用 SSL/TLS 协议进行加密,请启用此选项。

用户名: 输入服务器登录用户名。

密码: 输入服务器登录密码。

小技巧

在正式上线之前,建议从您的邮箱中归档或删除所有与供应商账单无关、无需在 Odoo 中处理的邮件。

证书¶

需要一个 .pfx 格式的数字证书来生成电子发票的签名。要添加证书,请在 签名证书 部分下点击 配置签名证书。然后点击 新建 来配置证书:

证书密钥: 单击 上传您的文件 并选择

.pfx文件。证书密码: 输入文件的密码。

主题序列号: 根据证书格式,此字段可能不会自动填写。在这种情况下,请输入证书的法定代表人 RUT。

证书所有者:如果需要将证书限制为特定用户,请选择一个。留空此字段以与所有计费用户共享。

多货币¶

官方汇率由 Chilean mindicador.cl 提供。导航至 ,以设置汇率自动更新的 间隔,或选择其他 服务。

业务伙伴信息¶

配置业务伙伴联系方式也是发送 SII 电子发票所必需的。请打开 应用来进行此操作,并在新的或现有的联系人表单中填写以下字段。

名称

电子邮件

识别编号

纳税人类型

活动描述

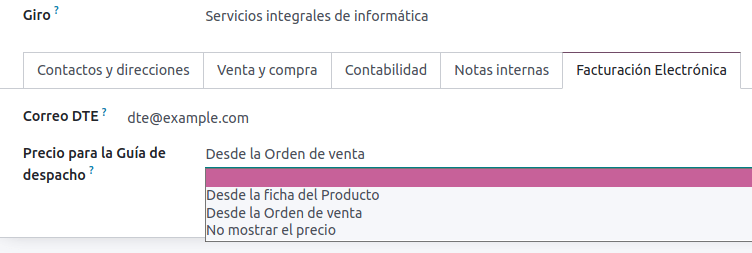

在 电子发票 选项卡中:

DTE 邮件: 输入该业务伙伴的发件人电子邮件地址。

发货单价格:选择发货单显示的价格(如果有)。

注解

DTE 邮件 是用于发送电子文件的电子邮件,必须在将作为电子文件一部分的联系人中进行设置。

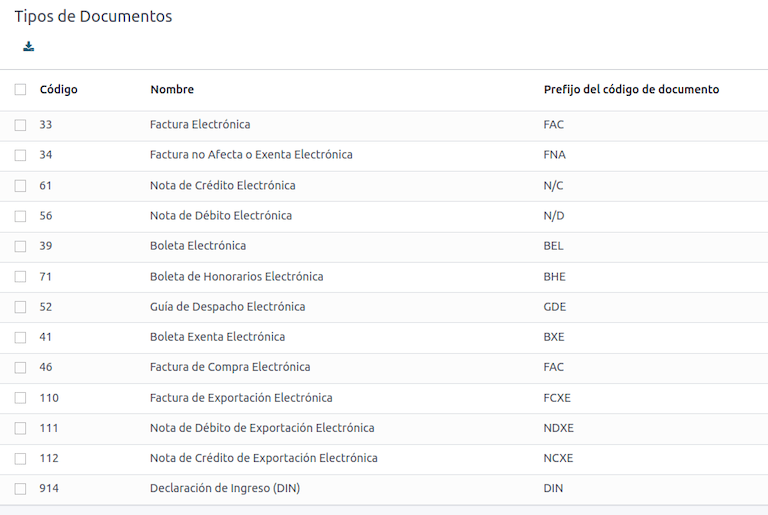

文档类型¶

会计凭证按照 SII 定义的凭证类型进行分类。

凭证类型会在安装本地化模块时自动创建,可以通过导航至 进行管理。

注解

默认情况下,多种文档类型处于非激活状态,但可以通过切换 激活 选项来启用。

用于发票¶

每笔交易的单据类型由以下因素决定:

与发票相关的日记账,用于标识该日记账是否使用单据。

根据发行方和接收方的类型应用的条件(例如,买方或供应商的税务制度)。

凭证类型¶

销售日记账 在 Odoo 中通常表示一个业务单元或地点。

Example

圣地亚哥销售

瓦尔帕莱索销售

对于零售商店来说,通常每个 POS 对应一个凭证。

Example

收银员 1.

收银员 2.

采购 交易可以通过一个日记账进行管理,但有时公司会使用多个日记账,以便处理与供应商发票无关的某些会计交易。此配置可以通过使用以下模型轻松设置。

Example

向政府缴纳的税款。

员工薪酬

创建销售日记账¶

要创建销售日记账,请导航至:。然后,点击 新建 按钮,并填写以下必填信息:

类型:从客户发票账簿的下拉菜单中选择 销售。

销售点类型: 如果销售日记账将用于电子文档,则必须选择选项 在线。否则,如果该日记账用于从旧系统导入的发票,或者您正在使用 SII 门户 Facturación MiPyme,可以使用选项 手动。

使用文档:如果该分录簿将使用文档类型,请勾选此字段。此字段仅适用于可以与智利可用的不同文档类型集相关联的采购和销售分录簿。默认情况下,所有创建的销售分录簿都将使用文档。

接下来,在 分录行 选项卡中,于 会计信息 部分定义 默认收入账户 和 专用贷项通知单序列。配置这些字段是其中一个借项通知单 使用场景 的必要条件。

咖啡¶

每种将要电子开具的文档类型都需要一个“凭证授权码”(CAF)。CAF(凭证授权码) 是由 SII(国内税务局) 提供给开具方的文件,其中包含用于电子发票文档的已授权的序号/序列。

您的公司可以申请多个发票号段并获取与不同发票号段相关的多个 CAFs。这些 CAFs 在所有账簿中共享,因此您只需为每种单据类型激活一个有效的 CAF,它将应用于所有账簿。

请参考 SII 文档,以查看如何获取 CAF 文件的详细信息。

重要

所需的 CAFs 由 SII 提出,与生产环境和测试环境(认证模式)不同。请确保根据您的环境正确设置了 CAF。

上传 CAF 文件¶

一旦从 SII 门户获取了 CAF 文件,就需要通过导航到 将其上传到数据库。然后,点击 新建 开始配置。在 CAF 表单中,通过点击 上传您的文件 按钮上传您的 CAF 文件,然后点击 保存。

上传后,状态会变为:正在使用中。在此时,当该文档类型用于交易时,发票编号将使用序列中的第一个序号。

重要

文档类型在上传 CAF 文件之前必须处于激活状态。如果某些文件号已在之前的系统中使用过,则在创建第一笔交易时必须设置下一个有效的文件号。

会计科目表¶

会计科目表默认作为本地化模块中包含的数据集的一部分进行安装。账户会自动映射到:

税项

默认应付账款账户

默认应收账款账户

转账账户

汇率

另请参见

会计入门 - 账户结构

税项¶

作为本地化模块的一部分,税项会自动创建,并关联相应的财务账户和配置。这些税项可以从 进行管理。

智利有多种税种,最常见的包括:

增值税:常规增值税可以有多种税率。

ILA:酒精饮料税。

另请参见

会计/税款

使用和测试¶

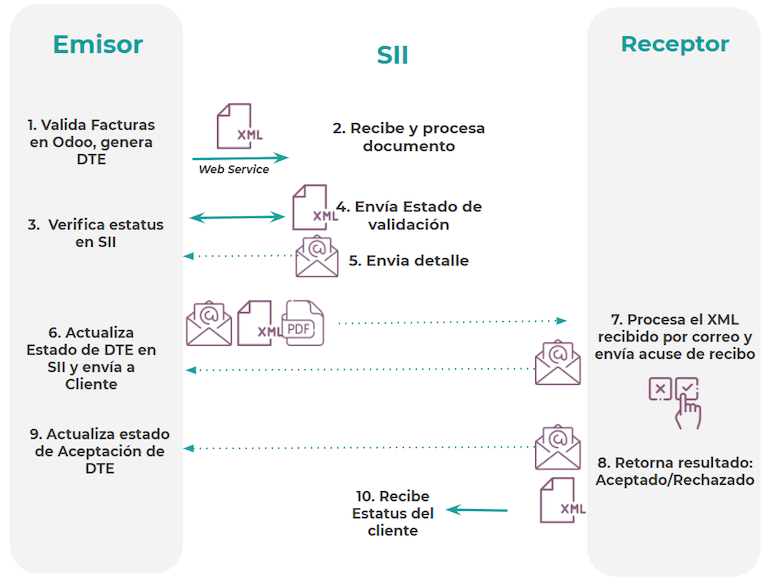

电子发票流程¶

在智利本地化设置中,电子发票流程包括客户发票的开具和供应商发票的接收。下图解释了信息如何共享至 SII, 客户和供应商。

客户发票开具¶

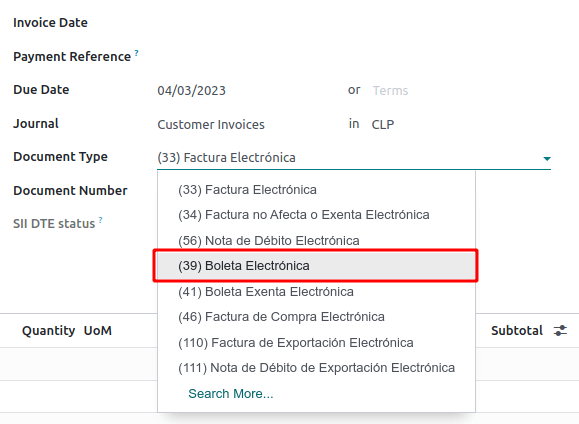

在创建并配置好合作伙伴和账簿后,发票将按照标准方式创建。对于智利而言,其中一个不同之处是根据纳税人自动选择的单据类型。如果需要,可以在发票上通过导航至 手动更改单据类型。

重要

文档类型 33 电子发票必须至少包含一项带有税项的商品,否则 SII 将拒绝该文档的验证。

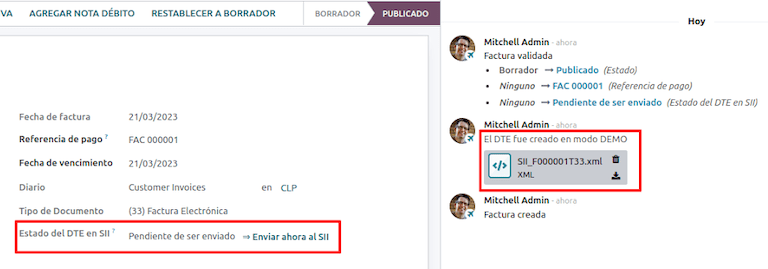

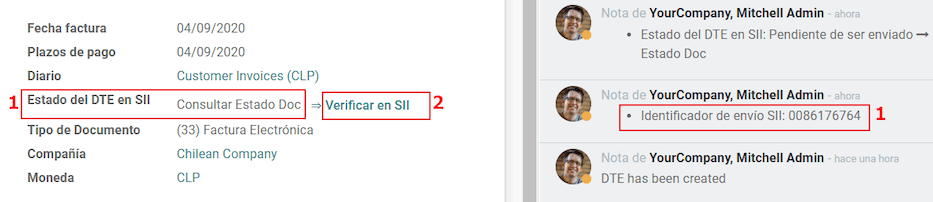

验证和DTE状态¶

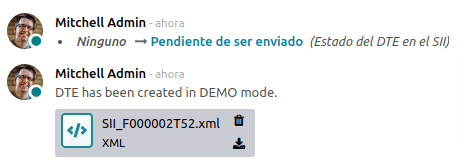

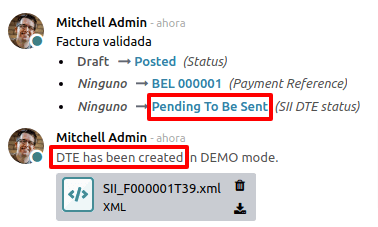

在填写完所有发票信息后,无论是手动填写还是从销售订单自动生成,都需验证发票。发票入账后:

该 DTE 文件会自动创建并在聊天记录中进行记录。

该 DTE SII 状态设置为 待发送 以进行发送。

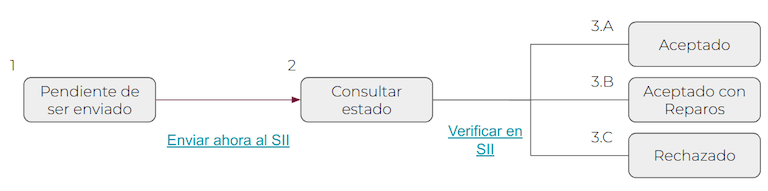

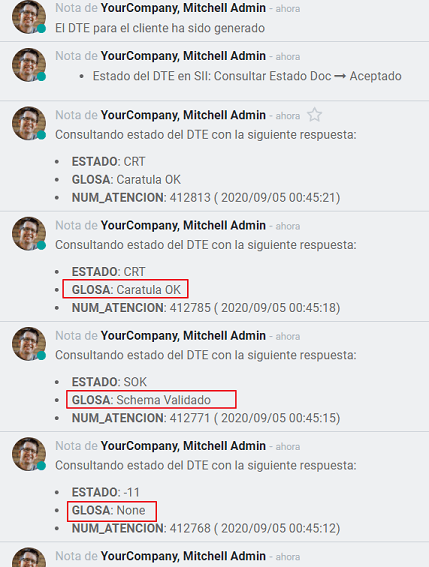

Odoo 会通过每天夜间运行的计划任务自动更新 DTE 状态。如果需要立即获取 SII 的响应,您也可以通过遵循 DTE 状态工作流手动进行操作:

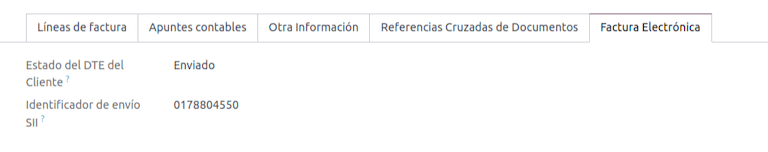

第一步是将 DTE 发送到 SII. 可以通过点击 立即发送 按钮手动发送。这会为发票生成一个 SII 跟踪编号,该编号用于通过电子邮件查看 SII 发送的详细信息。然后,DTE 状态 将更新为 查询状态。

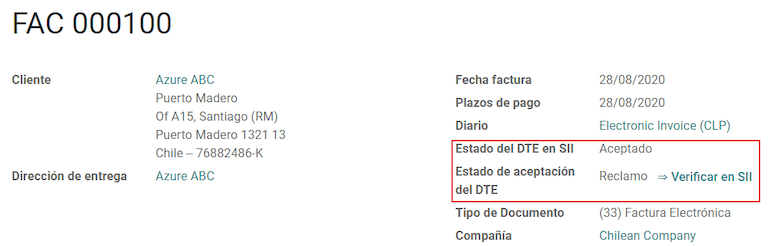

一旦收到 SII 的响应,Odoo 会更新 DTE 状态。如需手动操作,请点击按钮 在 SII 上验证。结果可以是 已接受、已接受(有异议) 或 已拒绝。

重要

在 SII 的接受或拒绝之前,存在中间状态。建议 不要 连续点击 在 SII 验证 以确保处理顺畅。

来自 SII 的最终响应可以是以下值之一:

已接受:表示发票信息正确,我们的文件现在具有财务有效性,并会自动发送给客户。

带异议接受: 表示发票信息正确,但发现了一个小问题,不过该文件现在已具有财政有效性,并会自动发送给客户。

已拒绝: 表示发票信息有误,必须进行更正。详细信息将发送至您在 SII 注册的电子邮件。如果在 Odoo 中正确配置,一旦邮件服务器处理完成,相关信息也会在聊天记录中显示。

如果发票被拒绝,请按照以下步骤操作:

将文档更改为 草稿。

根据从 SII 收到的消息,在消息栏中进行必要的更正。

再次开具发票。

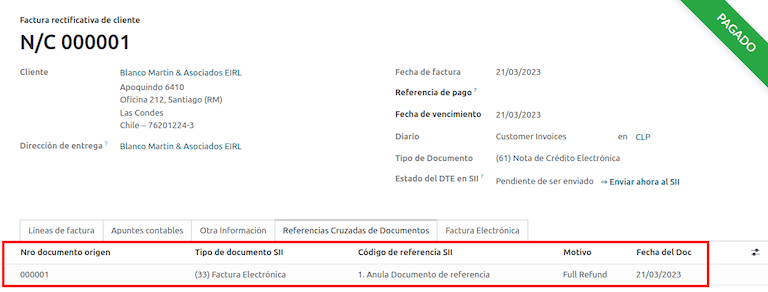

交叉引用¶

当发票是由于其他财政文件而创建时,与原始文件相关的信息必须在 跨参考 选项卡中进行登记。此选项卡通常用于贷项或借项通知单,但在某些情况下也可以用于客户发票。对于贷项和借项通知单,Odoo 会自动进行设置。

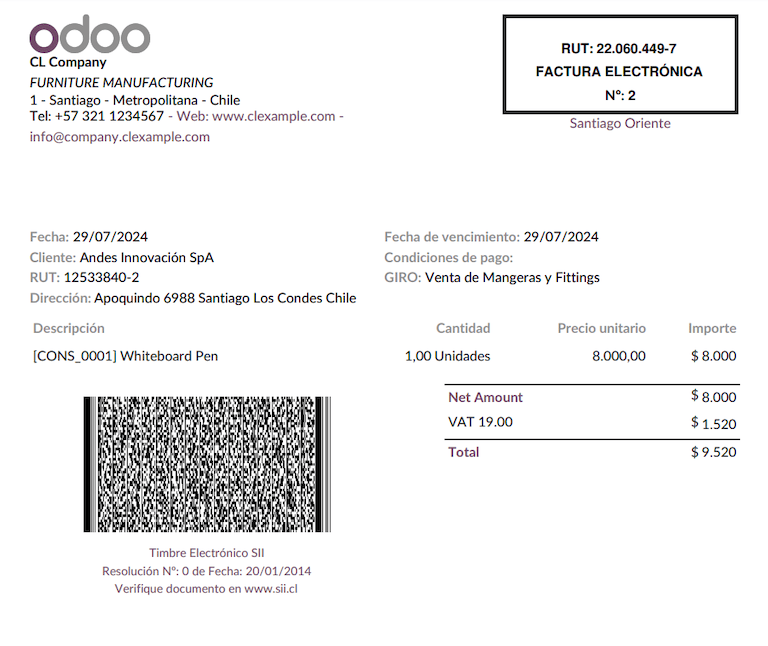

发票 PDF 报表¶

一旦发票经 SII 接受并验证,并且打印了 PDF 文件,该文件将包含表明该文件具有法律效力的财政要素。

重要

如果您使用的是 Odoo SH 或本地部署版本,您需要手动安装 pdf417gen 库。请使用以下命令进行安装:pip install pdf417gen。

商业验证¶

一旦发票已发送给客户:

DTE 业务伙伴状态 更改为 已发送。

客户必须发送接收确认邮件。

随后,如果商业条款和发票数据正确,将发送接受确认;否则,将发送索赔通知。

字段 DTE 接受状态 会自动更新。

已处理的索赔发票¶

一旦发票被 SII (国内税务局) ` 接受,**在 Odoo 中无法取消该发票**。如果您收到客户的索赔,正确的处理方式是开具贷方通知单以取消或更正该发票。有关更多详情,请参阅 :ref:`chile/credit-notes 章节。

常见错误¶

导致从 SII 被拒绝的原因有很多,但以下是一些你可能会遇到的常见错误以及解决方法:

- 错误:

拒绝 - 无原产地社区提示: 请确保公司地址正确填写,包括州和城市。 - 错误:

金额 - 增值税需申报提示: 发票行中应包含一种增值税税项,请确保在每一张发票行中都添加一种。 - 错误:

未经授权的Rut签名提示: 输入的 RUT 不允许开具电子发票,请确认公司 RUT 是否正确,并且在 SII 中有效,以支持电子发票。 - 错误:

无效的决议日期/编号 RECHAZO- CAF 已过期 : (DTE 签名日期[AAAA-MM-DD] - CAF 日期[AAAA-MM-DD]) > 6 个月提示: 尝试为此文档添加一个新的与之相关的 CAF,因为您当前使用的 CAF 已过期。 - 错误:

元素 '{http://www.sii.cl/SiiDte%7DRutReceptor}': 此元素不符合预期。预期为 ( {http://www.sii.cl/SiiDte%7DRutEnvia } )。提示: 请确保在客户和主公司中设置字段 文档类型 和 增值税。 - 错误:

用户没有发送权限。提示: 此错误表明,您的公司很可能尚未通过 SII - 系统的 认证流程。如果确实如此,请联系您的客户经理或客户服务,因为此认证不属于 Odoo 服务范围,但我们可为您提供一些替代方案。如果您已经通过了认证流程,此错误会在非证书持有者尝试向 SII 发送 DTE 文件时出现。 - 错误:

封面提示: 此错误可能出现的原因仅有五个,且都与 XML 中的 Caratula 部分有关:公司的 RUT 号码不正确或缺失。

证书持有者 RUT 号码不正确或缺失。

该 SII’s RUT 号码(默认情况下应为正确)不正确或缺失。

解决日期不正确或缺失。

分辨率编号不正确或缺失。

贷项通知单¶

当需要对已验证的发票进行取消或更正时,必须生成一张贷项通知单。需要注意的是,贷项通知单需要一个 CAF 文件,该文件在 SII 中标识为 文档类型 61。有关如何在每种文档类型上加载 CAF 的更多信息,请参阅 CAF 部分。

用例¶

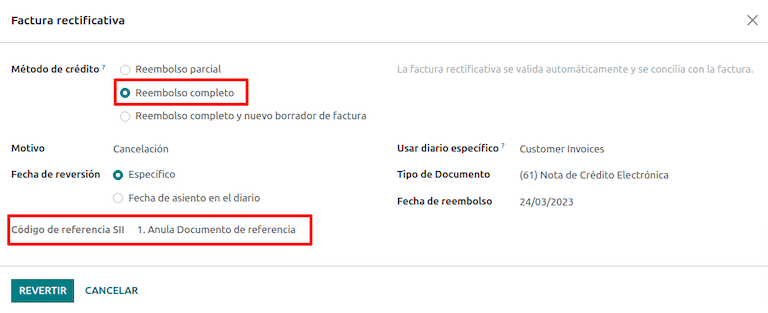

取消关联的单据¶

如果需要取消或作废发票,请导航至:,并选择所需的发票。然后,使用按钮 添加贷项通知单,并选择 全额退款,此时 SII(国内税务局) 的参考代码将自动设置为 注销参考文档。

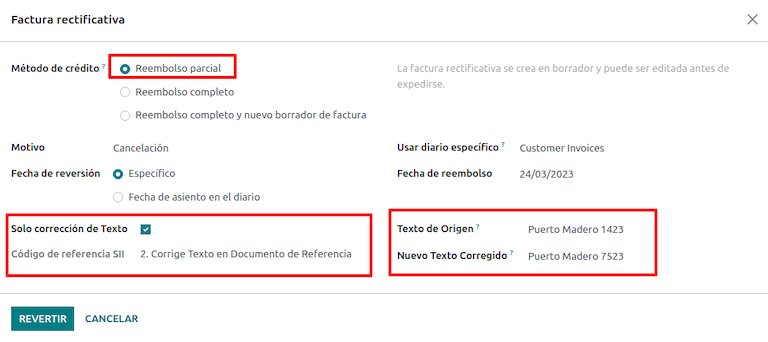

正确引用的文档¶

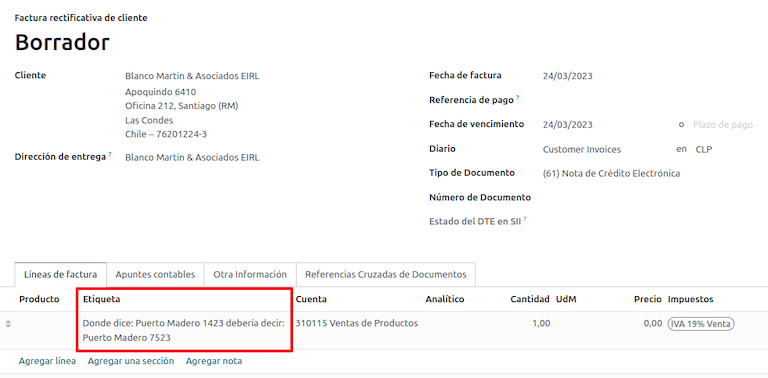

如果需要对发票信息进行更正,例如原始发票上的街道名称有误,则使用按钮 添加贷项通知单,选择 部分退款,并选择选项 仅文本更正。在这种情况下,SII 参考代码 字段会自动设置为 更正引用文档的文本。

Odoo 在发票中创建一张贷项通知单,其中包含更正后的文本以及 价格 0.00。

重要

请确保在销售日记账中特别为此用途定义 默认信用账户。

更正所引用单据金额¶

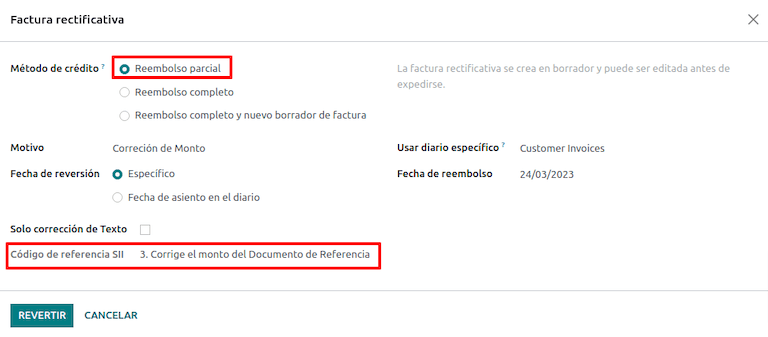

当需要对金额进行更正时,请使用按钮 添加贷方发票,并选择 部分退款。在这种情况下,SII 参考代码 会自动设置为 更正参考文档的金额。

借项通知单¶

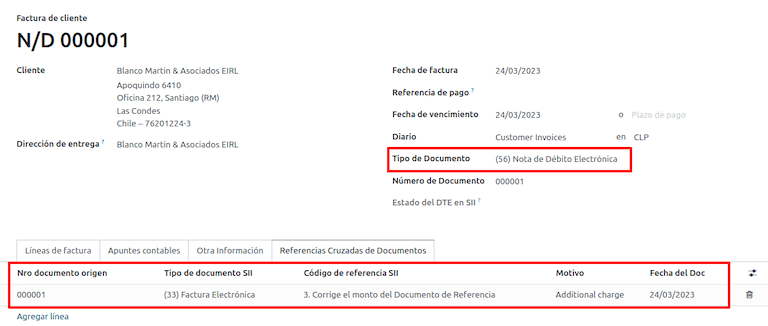

在智利本地化中,除了可以创建贷方凭证外,还可以使用 添加借方凭证 按钮创建借方凭证,主要有两种使用场景。

用例¶

在发票上添加债务¶

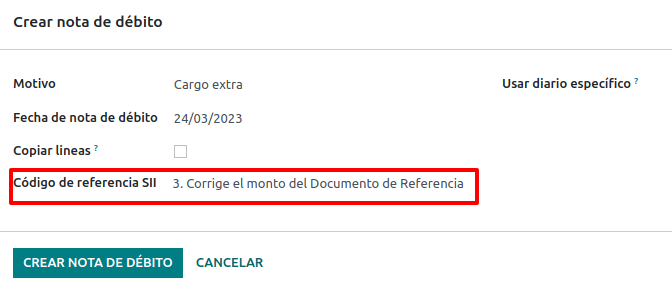

借项通知单的主要用途是增加现有发票的价值。为此,请为 参考代码 SII 字段选择选项 3. 更正参考文档的金额。

在这种情况下,Odoo 会自动将 源发票 包含在 交叉引用 选项卡中。

小技巧

您只能将借项通知单添加到已由SII接受的发票上。

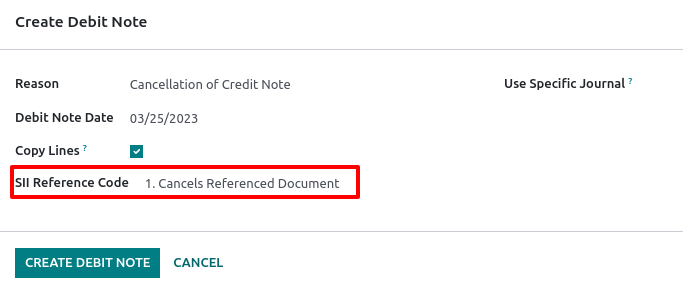

取消信用凭证¶

在智利,借项通知单用于取消有效的贷项通知单。为此,请点击 添加借项通知单 按钮,并为 参考代码 SII 字段选择 1: 撤销参考文档 选项。

供应商发票¶

作为智利本地化的一部分,您可以将您的传入电子邮件服务器配置为与您在 SII 注册的服务器相匹配,以便实现以下目的:

自动接收供应商的发票 DTE 并根据此信息创建供应商发票。

自动将收货确认发送给您的供应商。

接受或声明该文件,并将此状态发送给您的供应商。

接待¶

一旦收到带有附加的 DTE 的供应商邮件:

供应商发票映射了包含在 XML 中的所有信息。

供应商收到接收确认后,会发送一封电子邮件给供应商。

“DTE 状态” 设置为 “已发送收据确认”。

接受¶

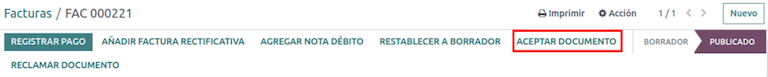

如果您的供应商发票上的所有商业信息正确,您可以使用 接受文档 按钮来接受该文件。一旦完成此操作,DTE 接受状态 将变为 已接受,并向供应商发送一封接受确认邮件。

索赔¶

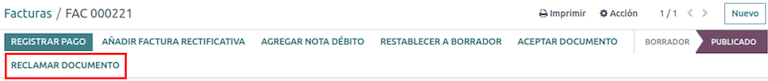

如果您的供应商发票存在商业问题或信息不正确,您可以在验证发票之前使用 申诉 按钮对该单据进行申诉。一旦操作完成,DTE 接受状态 将变为 申诉,并向供应商发送一封拒绝邮件。

如果您报销了供应商发票,状态会从 草稿 自动更改为 已取消。考虑到这是最佳实践,所有已报销的单据都应予以取消,因为它们将不再适用于您的会计记录。

电子采购发票¶

电子采购发票 是 l10n_cl_edi 模块中的一项功能。

在完成 电子发票 的所有配置后(例如上传有效的公司证书、设置主数据等),电子采购发票需要自己的 CAFs(单据授权码)。请参考 CAFs 文档,了解如何获取电子采购发票所需的 CAFs(单据授权码) 的详细信息。

当供应商没有义务为你采购的货物提供电子供应商发票时,电子采购发票会很有用。尽管如此,你的义务要求你必须将一份文件发送至 SII 作为购买证明。

配置¶

要从供应商发票生成电子采购发票,该发票必须在启用了*使用文档*功能的采购日记账中创建。可以在以下流程中修改现有采购日记账或创建一个新的日记账。

要修改现有的采购日记账,或创建一个新的采购日记账,请导航至:。然后,点击 新建 按钮,并填写以下必填信息:

类型: 从供应商发票科目的下拉菜单中选择 采购。

使用文档:勾选此字段,以便凭证可以生成电子文档(在此情况下为电子采购发票)。

生成电子采购发票¶

要生成此类文档,需要在 Odoo 中创建一张供应商发票。操作方法是:导航至 ,然后点击 新建 按钮。

当所有电子采购发票信息填写完毕后,在 单据类型 字段中选择选项 (46) 电子采购发票:

供应商发票过账后:

该 DTE 文件(电子税务单据)会自动创建并添加到讨论区中。

DTE SII 状态 设置为 待发送。

Odoo 每天晚上通过计划操作自动更新 DTE 状态。如需立即从 SII 获取响应,请点击 立即发送至 SII 按钮。

送货指南¶

要安装 交付指南 模块,请转到 并搜索 智利 (l10n_cl)。然后点击模块 智利 - 电子发票交付指南 上的 安装。

注解

智利 - 电子发票交付指南 与 智利 - 电子发票 存在依赖关系。当安装 交付指南 模块时,Odoo 将自动安装该依赖项。

发货指南 模块具备将 DTE 发送到 SII 的功能,并可在发货的 PDF 报告中添加印章。

在完成 电子发票 的所有配置后(例如上传有效的公司证书、设置主数据等),送货单需要其自身的 CAFs。请参考 CAFs 文档,了解如何获取用于电子送货单的 CAF 的详细信息。

请验证以下在 配送指南价格 配置中的重要信息:

从销售订单:发货指南从销售订单中获取产品价格,并在文档中显示。

从产品模板: Odoo 会使用产品模板中配置的价格,并在文档中显示该价格。

不显示价格: 在送货单中不显示价格。

电子交货指南用于将库存从一个地方转移到另一个地方,它们可以代表销售、样品、寄售、内部调拨,以及基本上任何产品移动。

销售流程中的发货指南¶

警告

发货指南应**不超过一页**或包含超过 60 行产品。

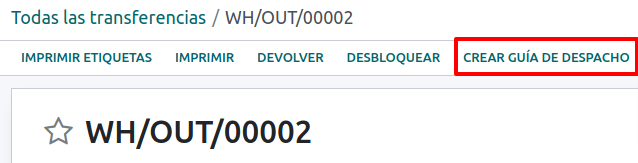

当创建并确认销售订单时,将生成发货单。在验证发货单后,将激活创建发货指南的选项。

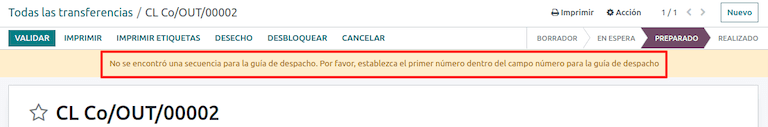

警告

首次点击 创建发货指南 时,会弹出一个警告消息,内容如下:

未找到运单的序列。请在运单编号字段中设置第一个编号

此警告信息表示用户需要指定 Odoo 在生成发货单时应使用的下一个序列号(例如,下一个可用的 CAF 编号),并且仅在在 Odoo 中首次创建发货单时出现。在第一个文档正确生成后,Odoo 将从 CAF 文件中获取下一个可用编号,用于生成后续的发货单。

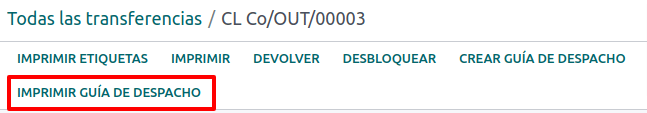

发货指南创建后:

该 DTE 文件(电子税务单据)会自动创建并添加到 聊天 中。

DTE SII 状态 设置为 待发送。

DTE 状态 由 Odoo 通过每天夜间运行的计划操作自动更新。如需立即从 SII 获取响应,请点击 立即发送至 SII 按钮。

一旦发货单发送后,可以通过点击 打印发货单 按钮进行打印。

配送指南将包含财政要素,表明该文档在打印时具有财政有效性(如果托管在 Odoo SH 或 本地部署 中,请记得手动添加 pdf417gen 库,该库在 发票 PDF 报表部分 中有提及)。

电子收据¶

要安装 电子收据 模块,请转到 并搜索 智利 (l10n_cl)。然后点击模块 智利 - 电子收据 上的 安装。

注解

智利 - 电子发票 与 智利 - 电子发票 存在依赖关系。当安装 电子发票配送指南 模块时,Odoo 将自动安装该依赖项。

在完成 电子发票 的所有配置后(例如上传有效的公司证书、设置主数据等),电子收据需要其自身的 CAFs。请参考 CAFs 文档,了解如何获取用于电子收据的 CAFs 的详细信息。

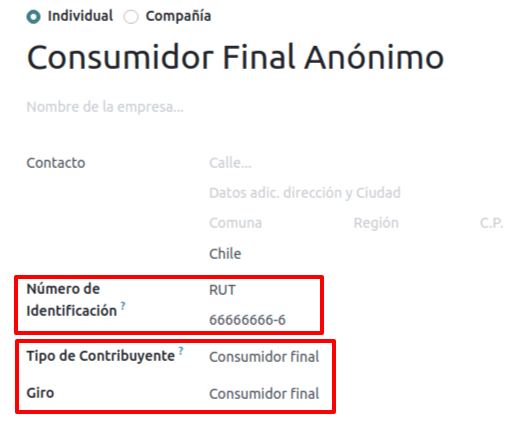

电子收据在客户不需要电子发票时非常有用。默认情况下,数据库中有一个名为 匿名最终消费者 的业务伙伴,其通用 RUT(唯一税务编号) 为 66666666-6,纳税人类型为 最终消费者。此业务伙伴可用于电子收据,也可以为相同目的创建新的记录。

虽然应为最终消费者使用带有通用 RUT 的电子收据,但也可以用于特定的合作伙伴。在创建并配置好合作伙伴和账簿后,电子收据可以按照标准方式创建为电子发票,但在发票表单中应选择文档类型 (39) 电子收据:

验证和DTE状态¶

当所有电子收据信息填写完毕后,手动(或自动)从销售订单中验证收据。默认情况下,电子发票 会被选为 文档类型,但为了正确验证收据,请确保编辑 文档类型 并更改为 电子收据。

已过账收货单后:

该 DTE 文件(电子税务文档)会自动生成并添加到 聊天 中。

DTE SII 状态 设置为 待发送。

DTE 状态 由 Odoo 通过每天夜间运行的计划操作自动更新。如需立即从 SII 获取响应,请点击 立即发送至 SII 按钮。

请参阅 DTE 流程,以了解电子发票的相关流程,因为电子收据的流程与此相同。

货物电子出口¶

要安装 电子货物出口 模块,请转到 并搜索 智利 (l10n_cl)。然后点击模块 智利电子货物出口 上的 安装。

注解

智利 - 智利商品电子出口 与 智利 - 电子发票 存在依赖关系。

在完成 电子发票 的所有配置后(例如上传有效的公司证书、设置主数据等),电子出口货物需要单独的 CAFs。请参考 CAFs 文档,了解如何获取用于电子收据的 CAFs 的详细信息。

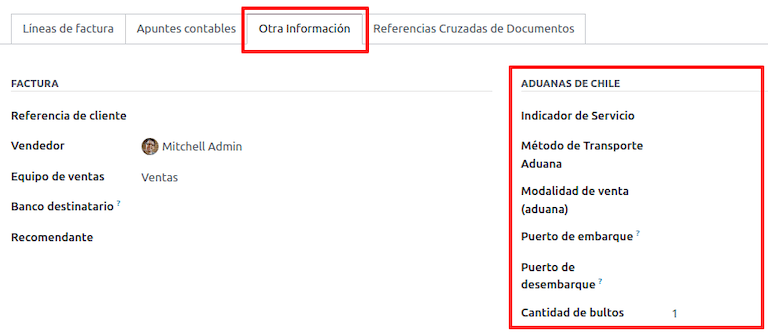

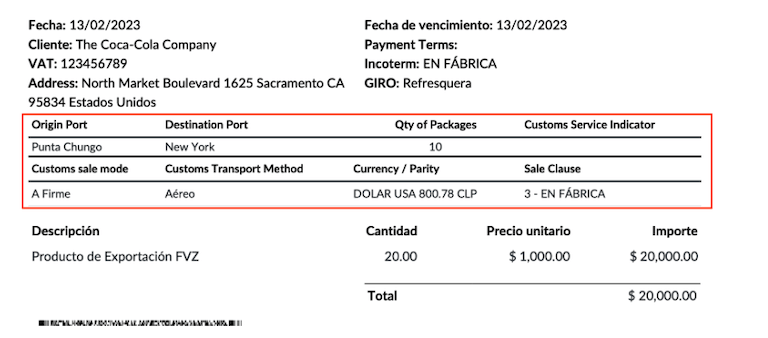

出口商品的电子发票是税务文件,不仅用于 SII,还用于海关,并包含其要求的信息。

联系人配置¶

智利海关¶

在创建电子出口商品发票时,这些新字段在 其他信息 选项卡中是必填项,以符合智利法规的要求。

PDF 报告¶

一旦发票经 SII 接受并验证,并且打印了 PDF 文件,该文件将包含表明该文件具有法律效力的税务要素,并新增了用于海关所需的章节。

电子商务电子发票¶

要安装 智利电商 模块,请转到 搜索该模块,并点击 激活 按钮。

此模块启用了以下功能和配置:

从 电子商务 应用生成电子文档

电子商务 应用程序中对必填财务字段的支持

有效让最终客户决定为其采购生成的电子文档

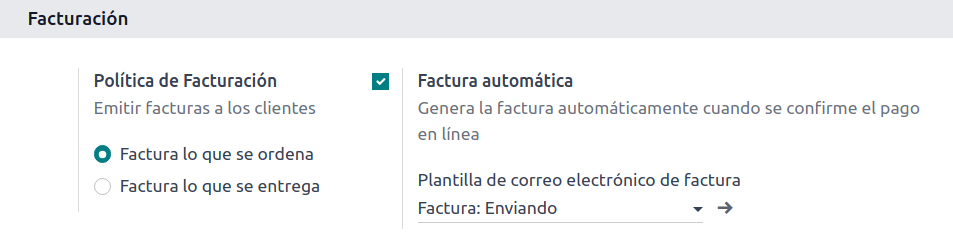

在完成智利 电子发票 流程的所有配置后,还需要进行以下配置,以便集成电子商务流程。

要配置您的网站以在销售过程中生成电子文档,请转到 ,并启用 自动开票 功能。启用此功能后,当在线付款确认时,将自动生成电子文档。

由于生成*自动发票*功能所需的在线付款需要确认,因此必须为相关网站配置支付网关。

注解

请查阅 在线支付 文档,了解 Odoo 中支持的支付提供商以及如何进行配置。

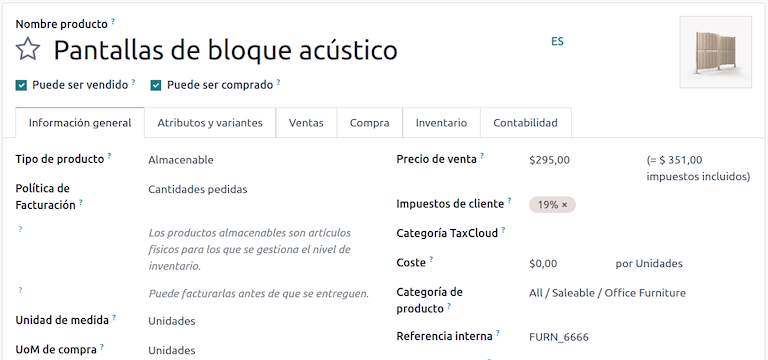

建议您配置您的产品,以便在在线付款确认后能够生成发票。为此,请前往:,并选择所需产品的产品模板。然后,将 开票策略 设置为 订购数量。

开票流程¶

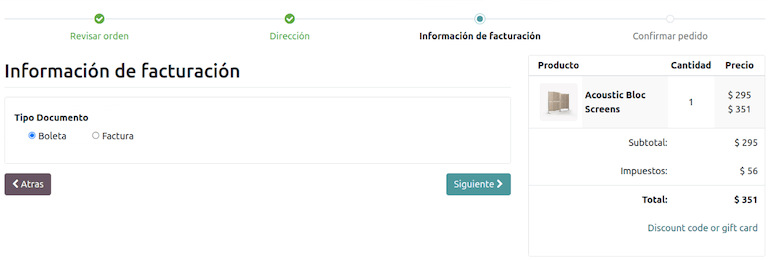

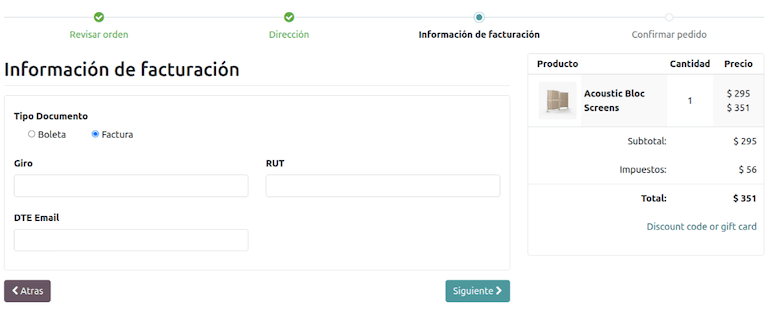

智利的客户在结账过程中将新增一个步骤,以便选择他们购买时是否需要**发票**或**收据**。

如果客户选择了 电子发票 选项,则必须填写财政字段,包括 活动描述、识别号码 及其 DTE 邮箱。

如果客户选择 电子收据 选项,他们将进入下一步,系统将为 匿名最终消费者 联系人生成电子文档。

其他国家的客户,其电子收据将由 Odoo 自动为其生成。

注解

如果通过电商平台进行采购需要出口,客户需要联系您的公司以生成电子出口发票(单据类型 110),这可以在 会计 应用程序中完成。

销售点电子发票¶

要安装 智利门店销售模块,请进入主 Odoo 仪表板上的 应用程序,通过其技术名称 l10n_cl_edi_pos 搜索该模块,然后点击 激活 按钮。

此模块可启用以下功能和配置:

从 销售点 应用程序生成电子文档

支持在 销售点 应用程序中创建的联系人所需的财务字段

有效让最终客户决定为其采购生成的电子文档类型

在票务中打印二维码或5位数字代码,以访问电子发票

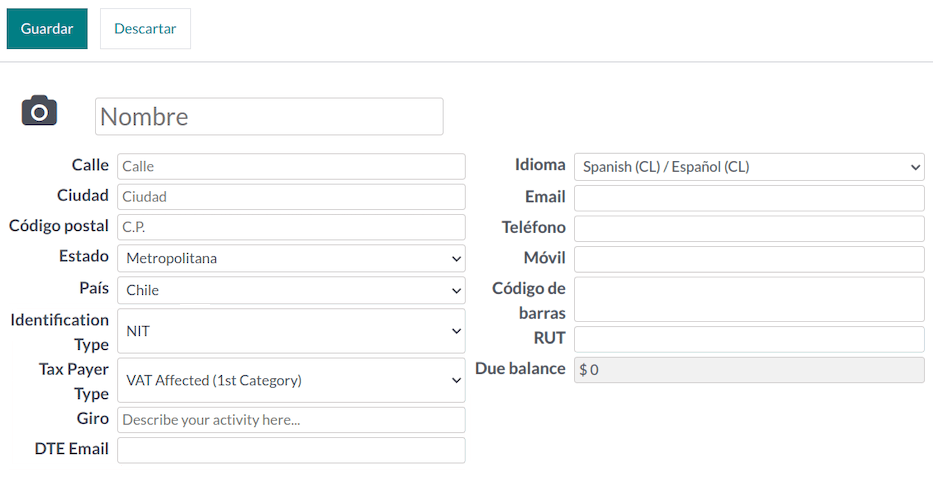

要配置包含所需财政信息的联系人,请查看 业务伙伴信息 部分,或直接修改联系人。导航至 ,并编辑以下任意字段:

名称

电子邮件

识别类型

纳税人类型

支票类型

DTE 邮件

RUT

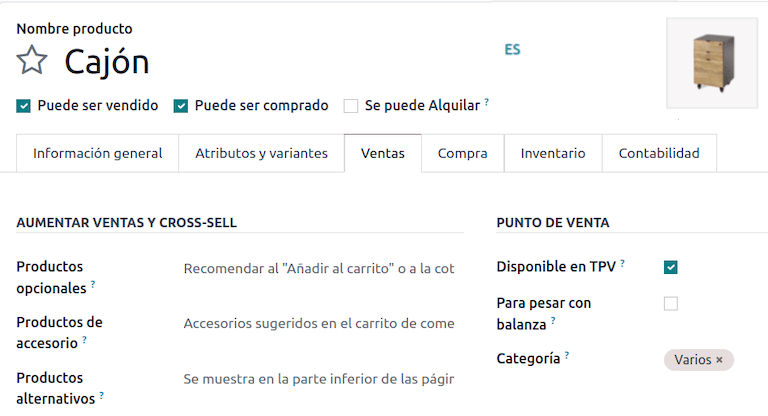

要配置产品,请导航至:,并选择一个产品记录。在产品表单的 销售 标签页中,需要将产品标记为 适用于 POS,这会使该产品在 销售点 应用中可供销售。

可选地,以下功能可在 部分中进行配置:

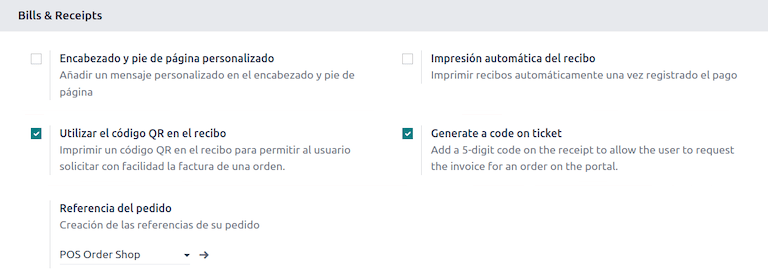

在票务上使用二维码:此功能可在用户的收据上打印二维码,以便他们在购买后轻松申请发票。

在票务上生成代码: 此功能可在收据上生成一个5位数的代码,允许用户通过客户门户申请发票

开票流程¶

以下章节涵盖 销售点 应用程序的开票流程。

电子收据:匿名终端用户¶

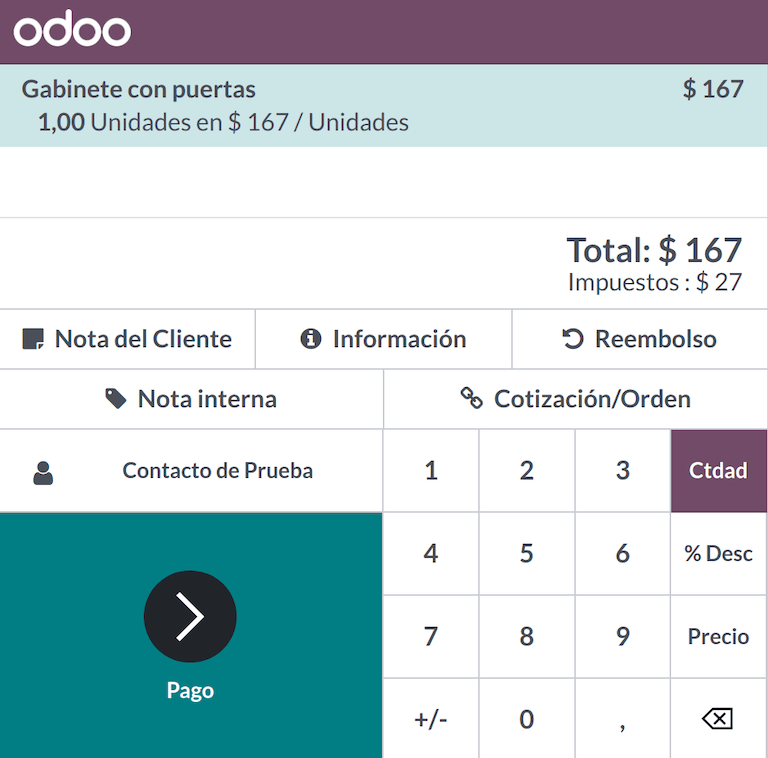

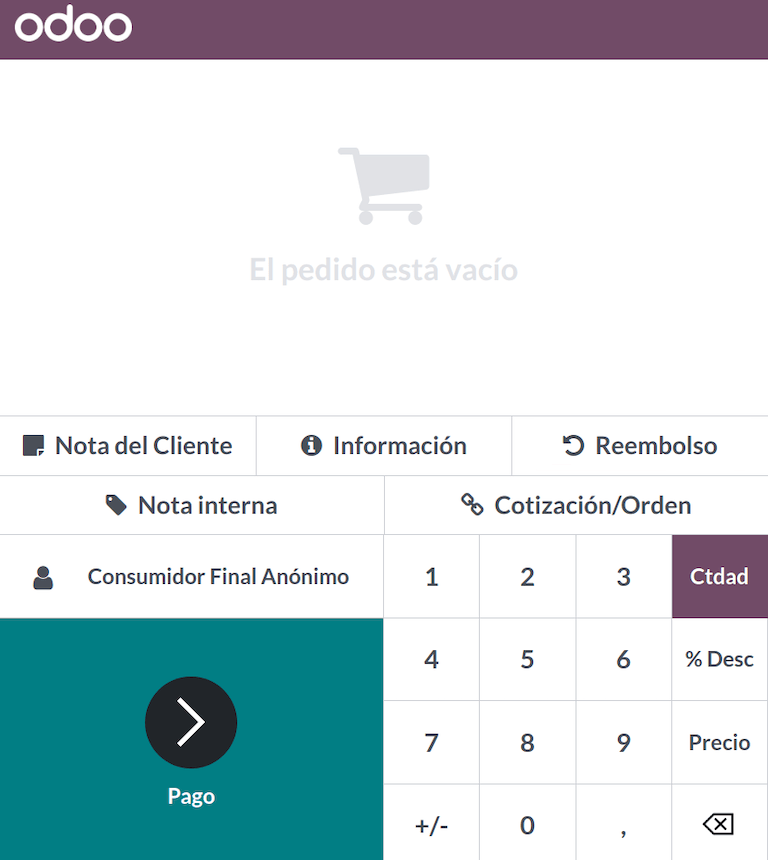

当匿名用户进行采购且不请求电子发票时,Odoo 会自动选择 最终匿名消费者 作为订单联系人并生成电子收据。

注解

如果客户因退货而要求开具贷项通知单,应使用 会计 应用程序来开具贷项通知单。有关详细操作说明,请参阅 贷项通知单与退款 文档。

电子凭证:特定客户¶

当特定用户进行不需电子发票的采购时,Odoo 会自动将订单的联系人设为 匿名消费者,并允许您选择或创建具有相关税务信息的客户联系人以用于收据。

注解

如果客户因此类采购的退货而要求开具贷项通知单,可以在此处直接从 POS 会话中管理贷项通知单和退货流程。

电子发票¶

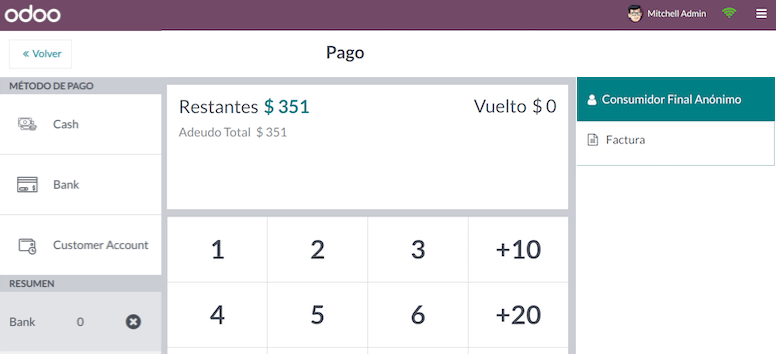

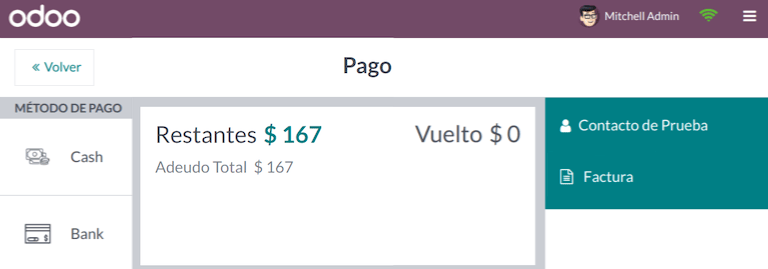

当客户请求电子发票时,可以选择或创建包含其税务信息的联系人。在进行付款时,请选择选项:发票 以生成文档。

注解

对于电子收据和发票,如果产品不受税项影响,Odoo 会检测到这一点,并为免税销售生成正确类型的文件。

返回¶

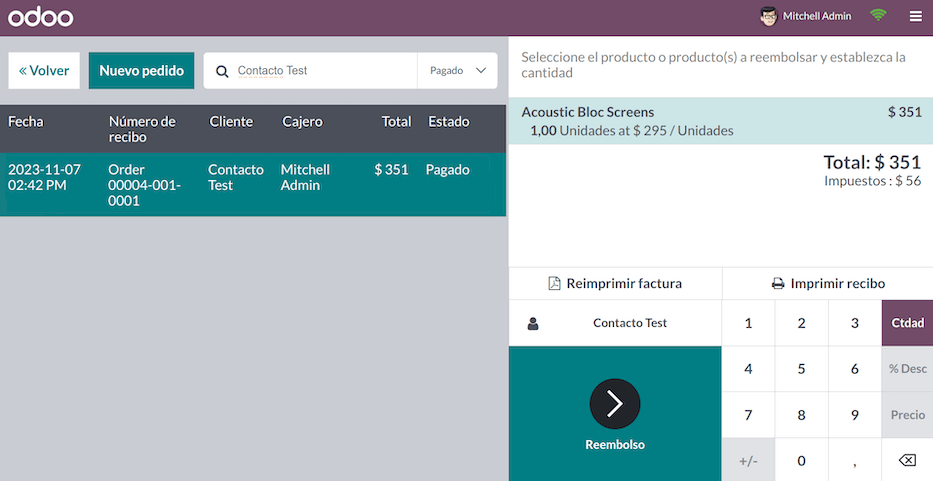

对于电子收据(不适用于*匿名最终消费者*)和电子发票,可以通过选择 退单 按钮来管理通过 POS 订单售出产品的退货流程。

订单可以通过订单状态或联系人进行搜索,并可选择用于根据客户的原始订单进行退款。

当退货付款被验证后,Odoo 会生成相应的贷项通知单,引用原始的收据或发票,部分或全部取消该单据。

另请参见

财务报表¶

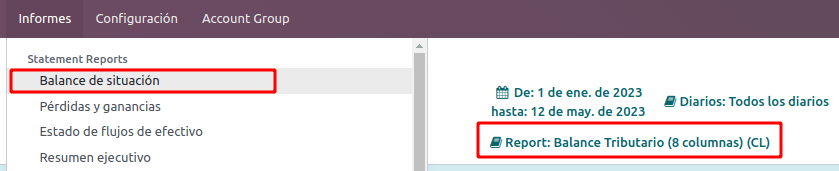

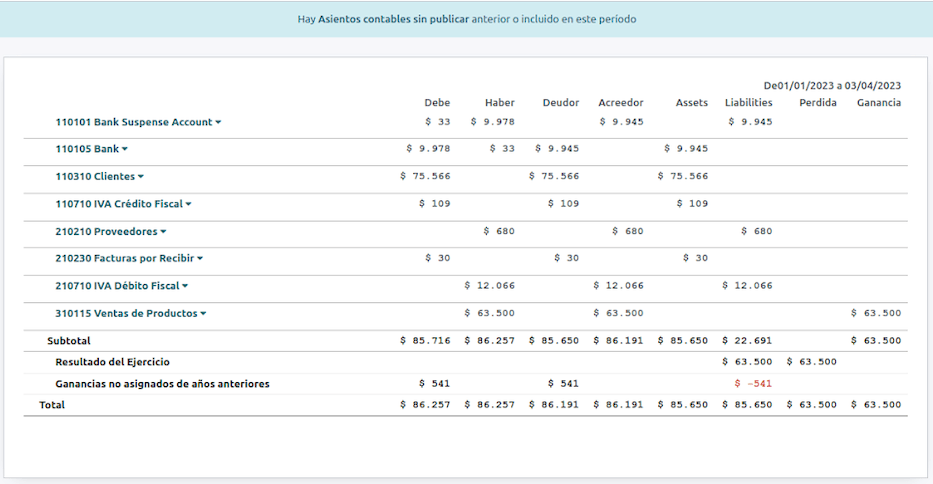

八列税务余额¶

本报告详细列示了各项账户(包括各自的余额),并根据其来源进行分类,以确定企业在评估期间的盈利或亏损水平。

您可以在 中找到此报表,并在 报表 字段中选择选项 智利财政资产负债表(8列)(CL)。

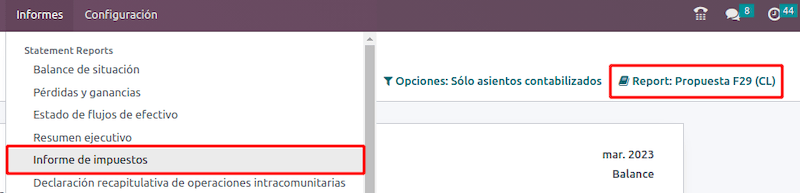

提案 F29¶

F29 表单是 SII 为纳税人启用的新系统,用于替代 采购与销售账簿。该报告由采购登记簿(CR)和销售登记簿(RV)组成。其目的是支持与增值税相关的交易,提高对其控制和申报的效率。

重要

Odoo 中的 Propuesta F29 (CL) 报告为您的最终税务申报提供了基本法律要求的初步方案。

此记录由已由 :abbr:`SII (国内税务局) ` 接收的电子税务文件(DTE)提供。

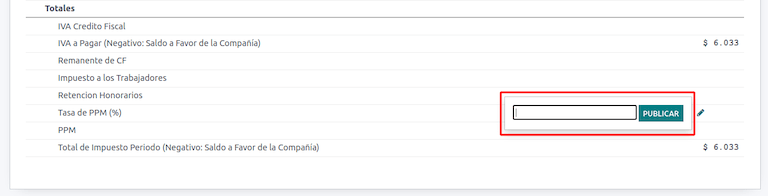

您可以在 中找到该报表,并选择 报表 选项 F29(CL)提案。

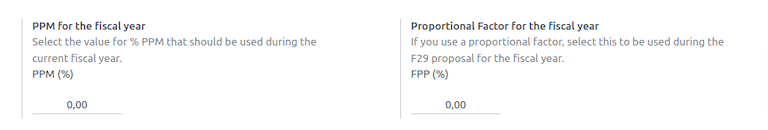

可以从 中设置 PPM 和 财政年度比例系数。

或者在报表中通过点击 ✏️ (铅笔) 图标手动操作。