Thailand¶

Configuration¶

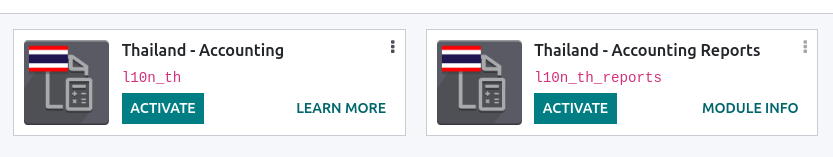

Install the 🇹🇭 Thailand localization package to get all the features of the Thai localization:

Name |

Technical name |

Description |

|---|---|---|

Thailand - Accounting |

|

Default fiscal localization package |

Thailand - Accounting Reports |

|

Country-specific accounting reports |

Chart of accounts and taxes¶

Odoo’s fiscal localization package for Thailand includes the following taxes:

VAT 7%

VAT-exempted

Withholding tax

Withholding income tax

Tax report¶

Odoo allows users to generate Excel files to submit their VAT to the Revenue Department of Thailand.

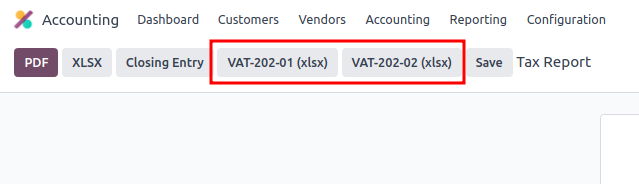

Sales and purchase tax report¶

To generate a sales and purchase tax report, go to . Select a specific time or time range on the tax report, and click VAT-202-01 (xlsx) for purchase tax and VAT-202-02 (xlsx) for sales tax.

Withholding PND tax report¶

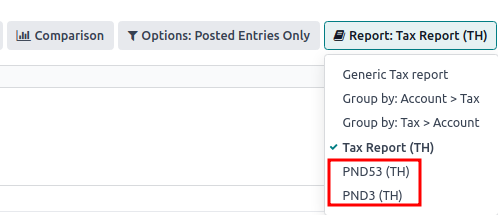

PND report data displays the summarized amounts of the applicable withholding corporate income tax returns (domestic) from vendor bills under the PND53 (TH) and PND3 (TH) tax reports. It is installed by default with the Thai localization.

Note

Withholding corporate income tax returns (domestic) is the tax used in case the company has withheld the tax from “Personal (PND3)” or “Corporate (PND53)” services provided such as rental, hiring, transportation, insurance, management fee, consulting, etc.

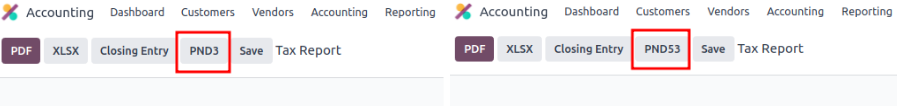

The PND tax report allows users to generate a CSV file for bills to upload on the RDprep for Thailand e-Filling application.

To generate a PND CSV file, go to , select a specific time or time range on the tax report, and click PND3 or PND53.

This generates the Tax Report PND3.csv and Tax Report PND53.csv files that lists all

the vendor bill lines with the applicable withholding tax.

Warning

Odoo cannot generate the PND or PDF report or withholding tax certificate directly. The

generated Tax Report PND3.csv and Tax Report PND53.csv files must be exported

to an external tool to convert them into a withholding PND report or a PDF file.

Tax invoice¶

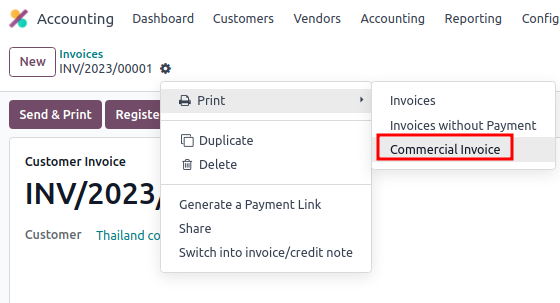

The tax invoice PDF report can be generated from Odoo through the Invoicing module. Users have the option to print PDF reports for normal invoices and tax invoices. To print out tax invoices, users can click on Print Invoices in Odoo. Regular invoices can be printed as commercial invoices by clicking on .

Headquarter/Branch number settings¶

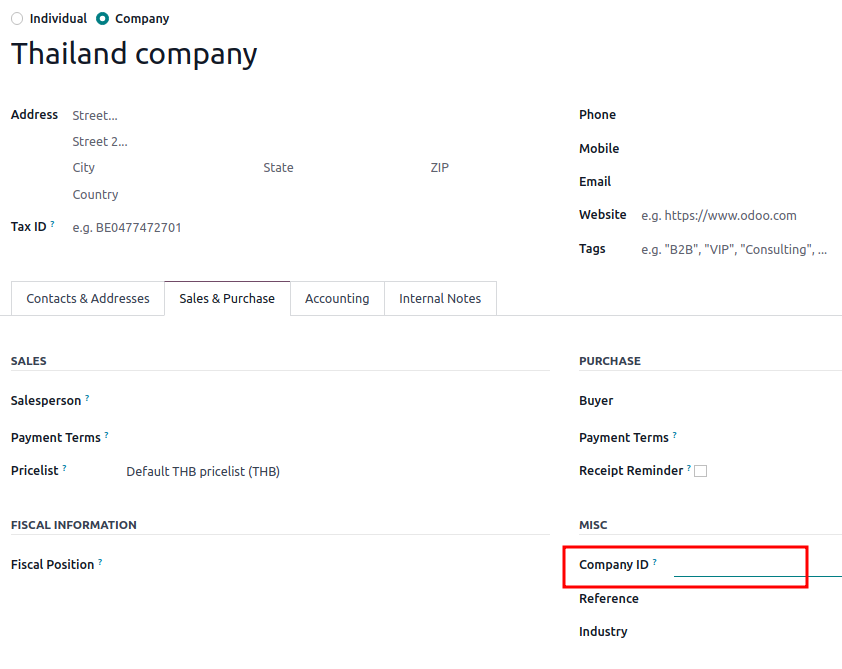

You can inform a company’s Headquarters and Branch number in the Contacts app. Once in the app, open the contact form of the company and under the Sales & Purchase tab:

If the contact is identified as a branch, input the Branch number in the Company ID field.

If the contact is a Headquarters, leave the Company ID field blank.

Tip

This information is used in the tax invoice PDF report and PND tax report export.