Colombia¶

Odoo’s Colombian localization package provides accounting, fiscal, and legal features for databases in Colombia – such as chart of accounts, taxes, and electronic invoicing.

In addition, a series of videos on the subject is also available. These videos cover how to start from scratch, set up configurations, complete common workflows, and provide in-depth looks at some specific use cases as well.

Configuration¶

Modules installation¶

Install the following modules to get all the features of the Colombian localization:

Name |

Technical name |

Description |

|---|---|---|

Colombia - Accounting |

|

Default fiscal localization package. This module adds the base accounting features for the Colombian localization: chart of accounts, taxes, withholdings, and identification document type. |

Colombian - Accounting Reports |

|

Includes accounting reports for sending certifications to suppliers for withholdings applied. |

Electronic invoicing for Colombia with Carvajal |

|

This module includes the features required for integration with Carvajal, and generates the electronic invoices and support documents related to the vendor bills, based on DIAN regulations. |

Colombian - Point of Sale |

|

Includes Point of Sale receipts for Colombian localization. |

Note

When Colombia is selected for a company’s Fiscal Localization, Odoo automatically

installs certain modules.

Company configuration¶

To configure your company information, go to the app, and search for your company.

Alternatively, activate developer mode and navigate to . Then, edit the contact form and configure the following information:

Company Name.

Address: Including City, Department and ZIP code.

Identification Number: Select the Identification Type (

NIT,Cédula de Ciudadanía,Registro Civil, etc.). When the Identification Type isNIT, the Identification Number must have the verification digit at the end of the ID prefixed by a hyphen (-).

Next, configure the Fiscal Information in the Sales & Purchase tab:

Obligaciones y Responsabilidades: Select the fiscal responsibility for the company (

O-13Gran Contribuyente,O-15Autorretenedor,O-23Agente de retención IVA,O-47Regimen de tributación simple,R-99-PNNo Aplica).Gran Contribuyente: If the company is Gran Contribuyente this option should be selected.

Fiscal Regimen: Select the Tribute Name for the company (

IVA,INC,IVA e INC, orNo Aplica)Commercial Name: If the company uses a specific commercial name, and it needs to be displayed in the invoice.

Carjaval credentials configuration¶

Once the modules are installed, the user credentials must be configured, in order to connect with Carvajal Web Service. To do so, navigate to and scroll to the Colombian Electronic Invoicing section. Then, fill in the required configuration information provided by Carvajal:

Username and Password: Username and password (provided by Carvajal) to the company.

Company Registry: Company’s NIT number without the verification code.

Account ID: Company’s NIT number followed by

_01.Colombia Template Code: Select one of the two available templates (

CGEN03orCGNE04) to be used in the PDF format of the electronic invoice.

Enable the Test mode checkbox to connect with the Carvajal testing environment.

Once Odoo and Carvajal are fully configured and ready for production, deactivate the Test mode checkbox to use the production database.

Important

Test mode must only be used on duplicated databases, not the production environment.

Report data configuration¶

Report data can be defined for the fiscal section and bank information of the PDF as part of the configurable information sent in the XML.

Navigate to , and scroll to the Colombian Electronic Invoicing section, in order to find the Report Configuration fields. Here the header information for each report type can be configured.

Gran Contribuyente

Tipo de Régimen

Retenedores de IVA

Autorretenedores

Resolución Aplicable

Actividad Económica

Bank Information

Master data configuration¶

Partner¶

Partner contacts can be created in the Contacts app. To do so, navigate to , and click the Create button.

Then, name the contact, and using the radio buttons, select the contact type, either Individual or Company.

Complete the full Address, including the City, State, and ZIP code. Then, complete the identification and fiscal information.

Identification information¶

Identification types, defined by the DIAN, are available on the partner form, as part of the Colombian localization. Colombian partners must have their Identification Number (VAT) and Document Type set.

Tip

When the Document Type is NIT, the Identification Number needs to be

configured in Odoo, including the verification digit at the end of the ID, prefixed by a hyphen

(`-`).

Fiscal information¶

The partner’s responsibility codes (section 53 in the RUT document) are included as part of the electronic invoicing module, as it is required by the DIAN.

The required fields can be found under :

Obligaciones y Responsabilidades: Select the fiscal responsibility for the company (

O-13Gran Contribuyente,O-15Autorretenedor,O-23Agente de retención IVA,O-47Regimen de tributación simple, orR-99-PNNo Aplica).Gran Contribuyente: If the company is Gran Contribuyente this option should be selected.

Fiscal Regimen: Select the tribute name for the company (

IVA,INC,IVA e INC, orNo Aplica)Commercial Name: If the company uses a specific commercial name, and it needs to be displayed in the invoice.

Products¶

To manage products, navigate to , then click on a product.

When adding general information on the product form, it is required that either the UNSPSC Category (Accounting tab), or Internal Reference (General Information tab) field is configured. Be sure to Save the product once configured.

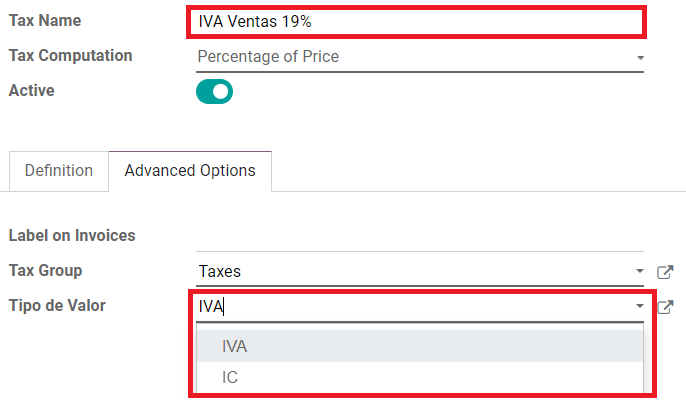

Taxes¶

To create or modify taxes, go to , and select the related tax.

If sales transactions include products with taxes, the Value Type field in the Advanced Options tab needs to be configured per tax. Retention tax types (ICA, IVA, Fuente) are also included. This configuration is used to display taxes correctly in the invoice PDF.

Sales journals¶

Once the DIAN has assigned the official sequence and prefix for the electronic invoice resolution, the sales journals related to the invoice documents must be updated in Odoo. To do so, navigate to , and select an existing sales journal, or create a new one with the Create button.

On the sales journal form, input the Journal Name, Type, and set a unique Short Code in the Journals Entries tab. Then, configure the following data in the Advanced Settings tab:

Electronic invoicing: Enable UBL 2.1 (Colombia).

Invoicing Resolution: Resolution number issued by DIAN to the company.

Resolution Date: Initial effective date of the resolution.

Resolution end date: End date of the resolution’s validity.

Range of Numbering (minimum): First authorized invoice number.

Range of Numbering (maximum): Last authorized invoice number.

Note

The sequence and resolution of the journal must match the one configured in Carvajal and the DIAN.

Invoice sequence¶

The invoice sequence and prefix must be correctly configured when the first document is created.

Note

Odoo automatically assigns a prefix and sequence to the following invoices.

Purchase journals¶

Once the DIAN has assigned the official sequence and prefix for the support document related to vendor bills, the purchase journals related to their supporting documents need to be updated in Odoo. The process is similar to the configuration of the sales journals.

Chart of accounts¶

The chart of accounts is installed by default as part of the localization module, the accounts are mapped automatically in taxes, default account payable, and default account receivable. The chart of accounts for Colombia is based on the PUC (Plan Unico de Cuentas).

Main workflows¶

Electronic invoices¶

The following is a breakdown of the main workflow for electronic invoices with the Colombian localization:

Sender creates an invoice.

Electronic invoice provider generates the legal XML file.

Electronic invoice provider creates the CUFE (Invoice Electronic Code) with the electronic signature.

Electronic invoice provider sends a notification to DIAN.

DIAN validates the invoice.

DIAN accepts or rejects the invoice.

Electronic invoice provider generates the PDF invoice with a QR code.

Electronic invoice provider sends invoice to the acquirer.

Acquirer sends a receipt of acknowledgement, and accepts or rejects the invoice.

Sender downloads a

.zipfile with the PDF and XML.

Invoice creation¶

Note

The functional workflow taking place before an invoice validation does not alter the main changes introduced with the electronic invoice.

Electronic invoices are generated and sent to both the DIAN and customer through Carvajal’s web service integration. These documents can be created from your sales order or manually generated. To create a new invoice, go to , and select Create. On the invoice form configure the following fields:

Customer: Customer’s information.

Journal: Journal used for electronic invoices.

Electronic Invoice Type: Select the type of document. By default, Factura de Venta is selected.

Invoice Lines: Specify the products with the correct taxes.

When done, click Confirm.

Invoice validation¶

After the invoice confirmation, an XML file is created and sent automatically to Carvajal. The invoice is then processed asynchronously by the E-invoicing service UBL 2.1 (Colombia). The file is also displayed in the chatter.

The Electronic Invoice Name field is now displayed in the EDI Documents tab, with the name of the XML file. Additionally, the Electronic Invoice Status field is displayed with the initial value To Send. To process the invoice manually, click on the Process Now button.

Reception of legal XML and PDF¶

The electronic invoice vendor (Carvajal) receives the XML file, and proceeds to validate its structure and information.

After validating the electronic invoice, proceed to generate a legal XML which includes a digital signature and a unique code (CUFE), a PDF invoice that includes a QR code and the CUFE is also generated. If everything is correct the Electronic Invoicing field value changes to Sent.

A .zip containing the legal electronic invoice (in XML format) and the invoice in (PDF

format) is downloaded and displayed in the invoice chatter:

The electronic invoice status changes to Accepted.

Credit notes¶

The process for credit notes is the same as for invoices. To create a credit note with reference to an invoice, go to . On the invoice, click Add Credit Note, and complete the following information:

Credit Method: Select the type of credit method.

Partial Refund: Use this option when it is a partial amount.

Full Refund: Use this option if the credit note is for the full amount.

Full refund and new draft invoice: Use this option if the credit note is auto-validated and reconciled with the invoice. The original invoice is duplicated as a new draft.

Reason: Enter the reason for the credit note.

Reversal Date: Select if you want a specific date for the credit note or if it is the journal entry date.

Use Specific Journal: Select the journal for your credit note or leave it empty if you want to use the same journal as the original invoice.

Refund Date: If you chose a specific date, select the date for the refund.

Once reviewed, click the Reverse button.

Debit notes¶

The process for debit notes is similar to credit notes. To create a debit note with reference to an invoice, go to . On the invoice, click the Add Debit Note button, and enter the following information:

Reason: Type the reason for the debit note.

Debit note date: Select the specific options.

Copy lines: Select this option if you need to register a debit note with the same lines of invoice.

Use Specific Journal: Select the printer point for your debit note, or leave it empty if you want to use the same journal as the original invoice.

When done, click Create Debit Note.

Support document for vendor bills¶

With master data, credentials, and the purchase journal configured for support documents related to vendor bills, you can start using support documents.

Support documents for vendor bills can be created from your purchase order or manually. Go to and fill in the following data:

Vendor: Enter the vendor’s information.

Bill Date: Select the date of the bill.

Journal: Select the journal for support documents related to the vendor bills.

Invoiced Lines: Specify the products with the correct taxes.

Once reviewed, click the Confirm button. Upon confirmation, an XML file is created and automatically sent to Carvajal.

Common errors¶

During the XML validation, the most common errors are related to missing master data (Contact Tax ID, Address, Products, Taxes). In such cases, error messages are shown in the chatter after updating the electronic invoice status.

After the master data is corrected, it’s possible to reprocess the XML with the new data and send the updated version, using the Retry button.

Financial reports¶

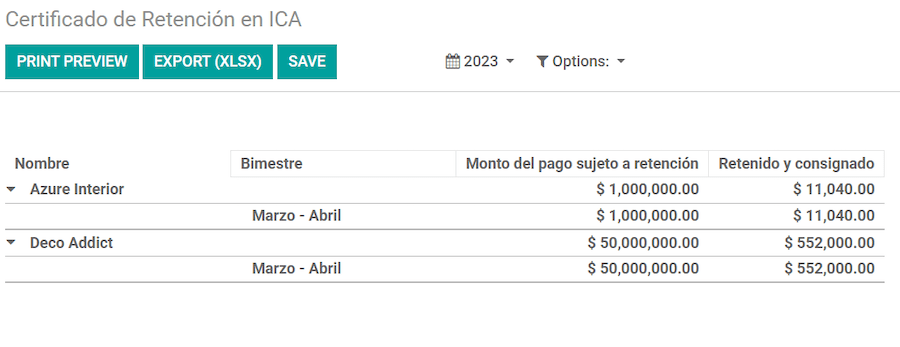

Certificado de Retención en ICA¶

This report is a certification to vendors for withholdings made for the Colombian Industry and Commerce (ICA) tax. The report can be found under .

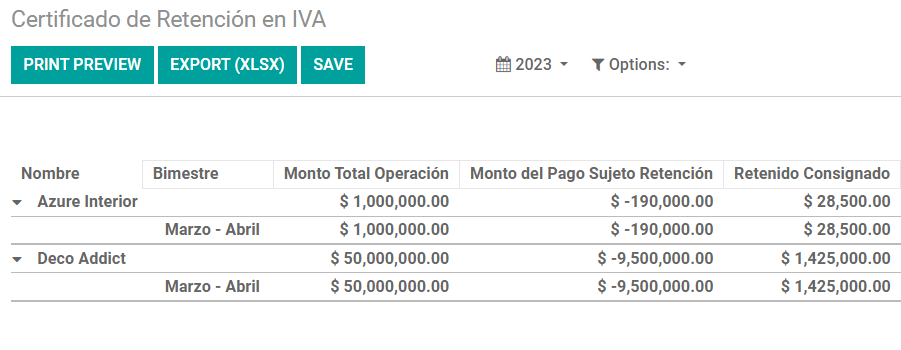

Certificado de Retención en IVA¶

This report issues a certificate on the amount withheld from vendors for VAT withholding. The report can be found under .

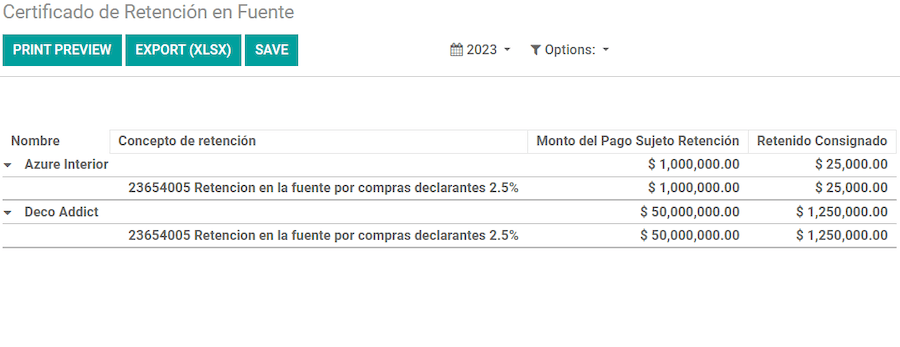

Certificado de Retención en la Fuente¶

This certificate is issued to partners for the withholding tax that they have made. The report can be found under .