United Arab Emirates¶

Installation¶

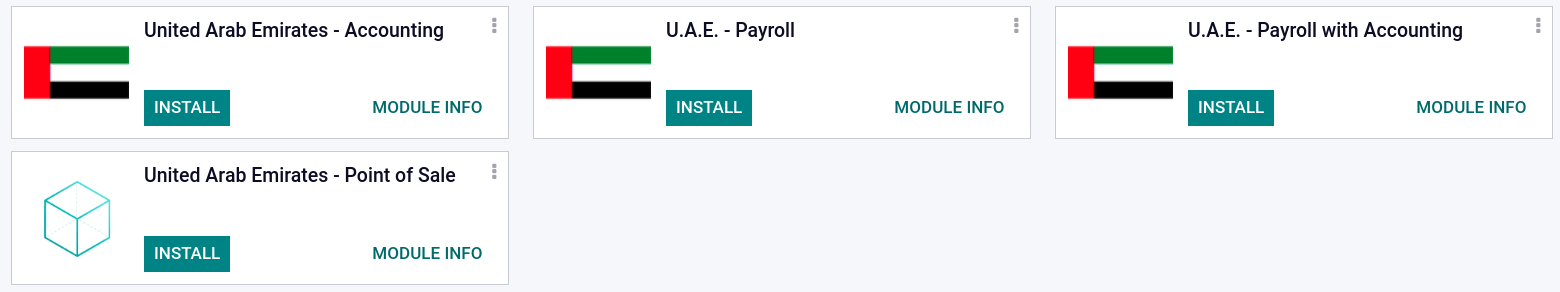

Install the following modules to get all the features of the United Arab Emirates localization:

Name |

Technical name |

Description |

|---|---|---|

United Arab Emirates - Accounting |

|

Default fiscal localization package. Includes all accounts, taxes, and reports. |

U.A.E. - Payroll |

|

Includes all rules, calculations, and salary structures. |

U.A.E. - Payroll with Accounting |

|

Includes all accounts related to the payroll module. |

United Arab Emirates - Point of Sale |

|

Includes the UAE-compliant POS receipt. |

Chart of accounts¶

Go to to view all default accounts available for the UAE localization package. You can filter by Code using the numbers on the far left or by clicking on . You can Enable/Disable reconciliation or configure specific accounts according to your needs.

Important

Always keep at least one receivable account and one payable account active.

It is also advised to keep the accounts below active, as they are used either as transitory accounts by Odoo or are specific to the UAE localization package.

Code

Account Name

Type

102011

Accounts Receivable

Receivable

102012

Accounts Receivable (POS)

Receivable

201002

Payables

Payable

101004

Bank

Bank and Cash

105001

Cash

Bank and Cash

100001

Liquidity Transfer

Current Assets

101002

Outstanding Receipts

Current Assets

101003

Outstanding Payments

Current Assets

104041

VAT Input

Current Assets

100103

VAT Receivable

Non-current Assets

101001

Bank Suspense Account

Current Liabilities

201017

VAT Output

Current Liabilities

202001

End of Service Provision

Current Liabilities

202003

VAT Payable

Non-current Liabilities

999999

Undistributed Profits/Losses

Current Year Earnings

400003

Basic Salary

Expenses

400004

Housing Allowance

Expenses

400005

Transportation Allowance

Expenses

400008

End of Service Indemnity

Expenses

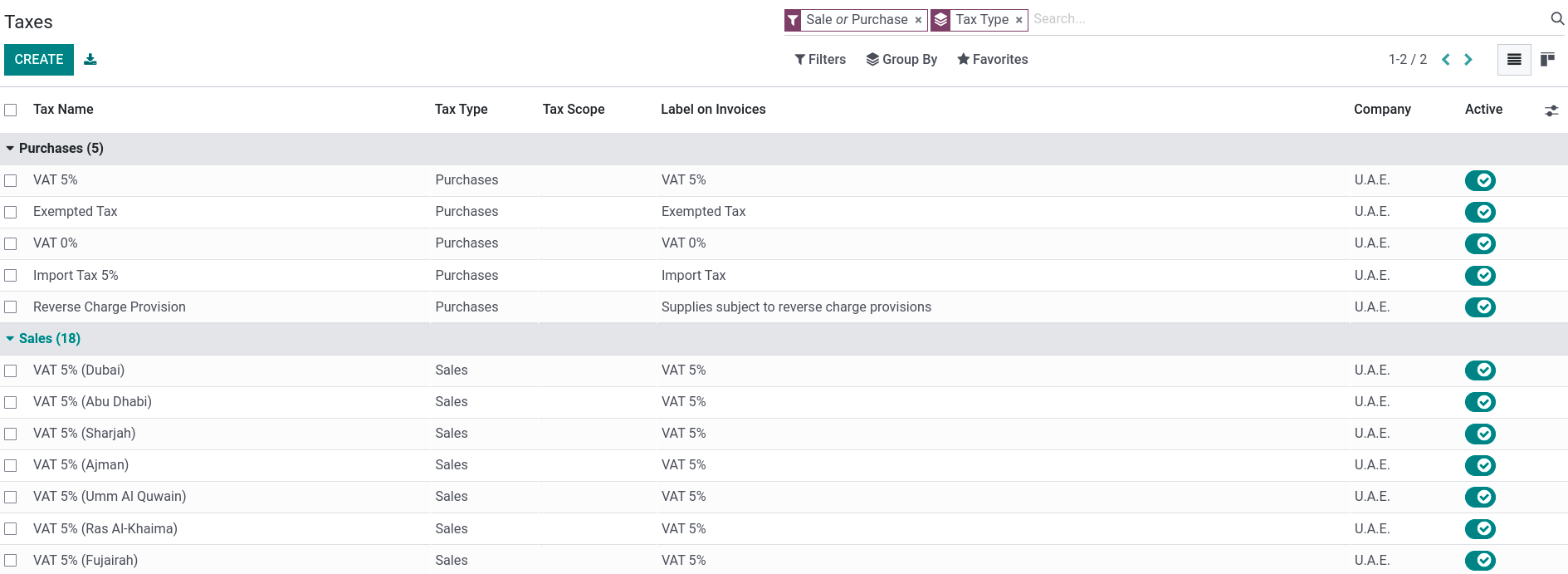

Taxes¶

To access your taxes, go to . Activate/deactivate, or configure the taxes relevant to your business by clicking on them. Remember to only set tax accounts on the 5% tax group, as other groups do not need closing. To do so, enable the developer mode and go to . Then, set a Tax current account (payable), Tax current account (receivable), and an Advance Tax payment account for the 5% group.

Note

The RCM is supported by Odoo.

Currency exchange rates¶

To update the currency exchange rates, go to . Click on the update button (🗘) found next to the Next Run field.

To launch the update automatically at set intervals, change the Interval from Manually to the desired frequency.

Note

By default, the UAE Central Bank exchange rates web service is used. Several other providers are available under the Service field.

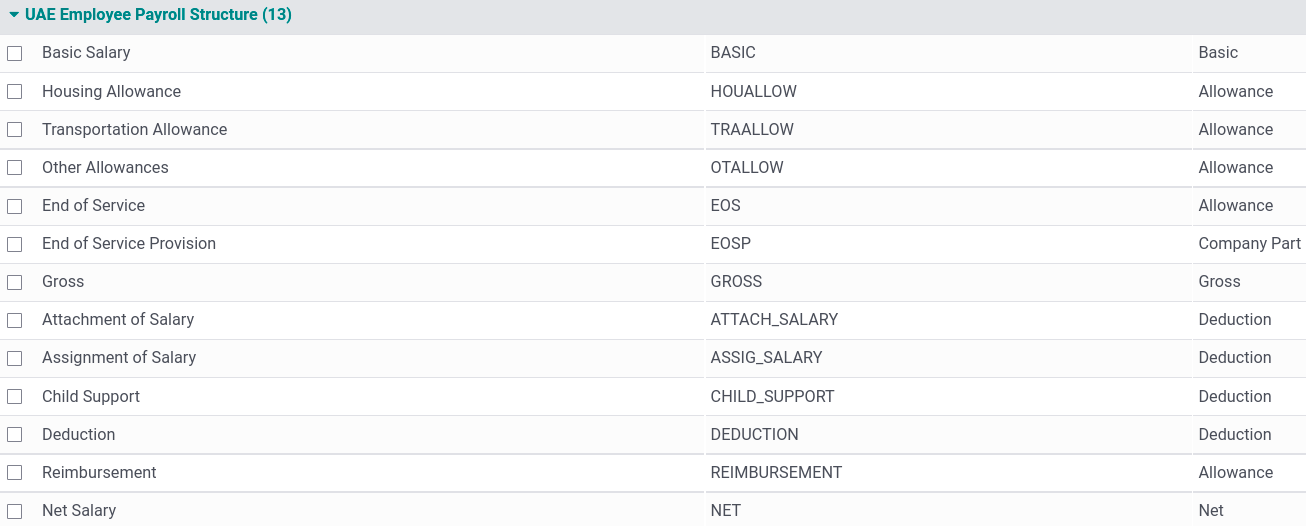

Payroll¶

The UAE - Payroll module creates the necessary salary rules in the Payroll app in compliance with the UAE rules and regulations. The salary rules are linked to the corresponding accounts in the chart of accounts.

Salary rules¶

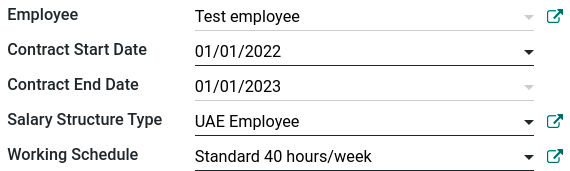

To apply these rules to an employee’s contract, go to and select the employee’s contract. In the Salary Structure Type field, select UAE Employee.

Under the Salary Information tab, you can find details such as the:

Wage;

Housing Allowance;

Transportation Allowance;

Other Allowances;

Number of Days: used to calculate the end of service provision.

Note

Leave deductions are calculated using a salary rule linked to the unpaid leave time-off type;

Any other deductions or reimbursements are made manually using other inputs;

Overtimes are added manually by going to ;

Salary attachments are generated by going to . Then, Create an attachment and select the Employee and the Type (Attachment of Salary, Assignment of Salary, Child Support).

Tip

To prevent a rule from appearing on a paycheck, go to . Click on UAE Employee Payroll Structure, select the rule to hide, and uncheck Appears on Payslip.

End of service provision¶

The provision is defined as the total monthly allowance divided by 30 and then multiplied by the number of days set in the field Number of days at the bottom of a contract’s form.

The provision is then calculated via a salary rule associated with two accounts: the End Of Service Indemnity (Expense account) and the End of Service Provision (Non-current Liabilities account). The latter is used to pay off the end of service amount by settling it with the payables account.

Note

The end of service amount is calculated based on the gross salary and the start and end dates of the employee’s contract.

Invoices¶

The UAE localization package allows the generation of invoices in English, Arabic, or both. The localization also includes a line to display the VAT amount per line.