Philippines¶

Configuration¶

Install the 🇵🇭 Philippines fiscal localization package to get all the default accounting features of the Philippine localization, such as a chart of accounts, taxes, and the BIR 2307 report. These provide a base template to get started with using Philippine accounting.

Note

When creating a new database and selecting the

Philippinesas a country, the fiscal localization module Philippines - Accounting is automatically installed.If the module is installed in an existing company, the chart of accounts and taxes will not be replaced if there are already posted journal entries.

The BIR 2307 report is installed, but the withholding taxes may need to be manually created.

Chart of accounts and taxes¶

A minimum configuration default chart of accounts is installed, and the following types of taxes are installed and linked to the relevant account:

Sales and Purchase VAT 12%

Sales and Purchase VAT Exempt

Sales and Purchase VAT Zero-Rated

Purchase Withholding

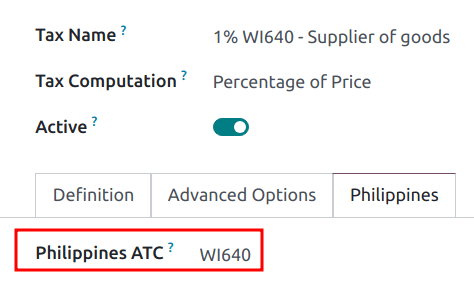

For the withholding taxes (), there is an additional Philippines ATC field under the Philippines tab.

Note

Taxes’ ATC codes are used for the BIR 2307 report. If a tax is created manually, its ATC code must be added.

Contacts¶

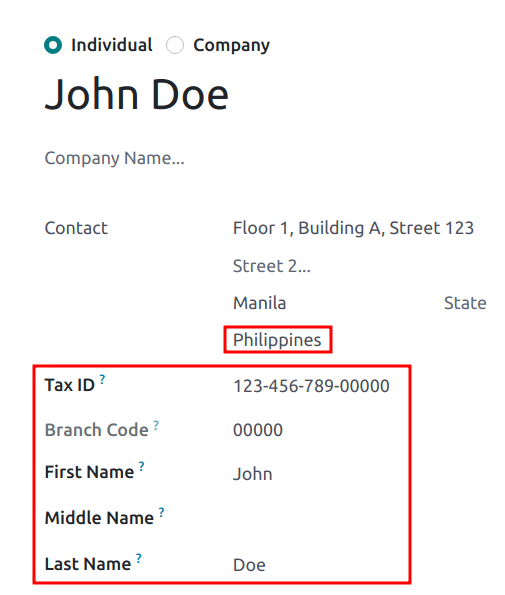

When a company or an individual (not belonging to a company) contact is located in the Philippines,

fill in the Tax ID field with their Taxpayer Identification Number (TIN).

For individuals not belonging to a company, identify them by using the following additional fields:

First Name

Middle Name

Last Name

Note

For both Company and Individual, the TIN should follow the

NNN-NNN-NNN-NNNNN format. The branch code should follow the last digits of the TIN, or else it

can be left as 00000.

BIR 2307 report¶

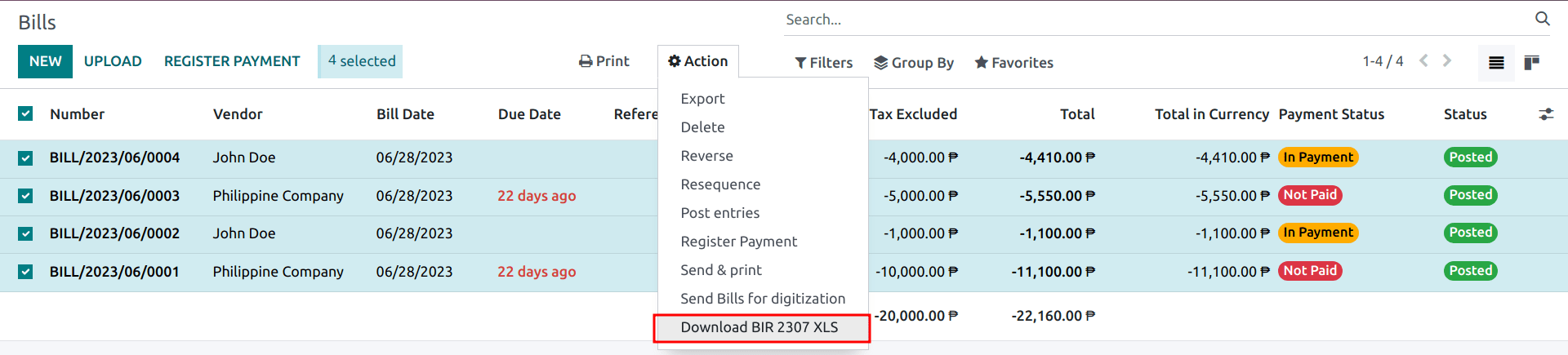

BIR 2307 report data, also known as Certificate of Creditable Tax Withheld at Source, can be generated for purchase orders and vendor payments with the applicable withholding taxes.

To generate a BIR 2307 report, select one or multiple vendor bills from the list view, and click .

Tip

The same action can be performed on a vendor bill from the form view.

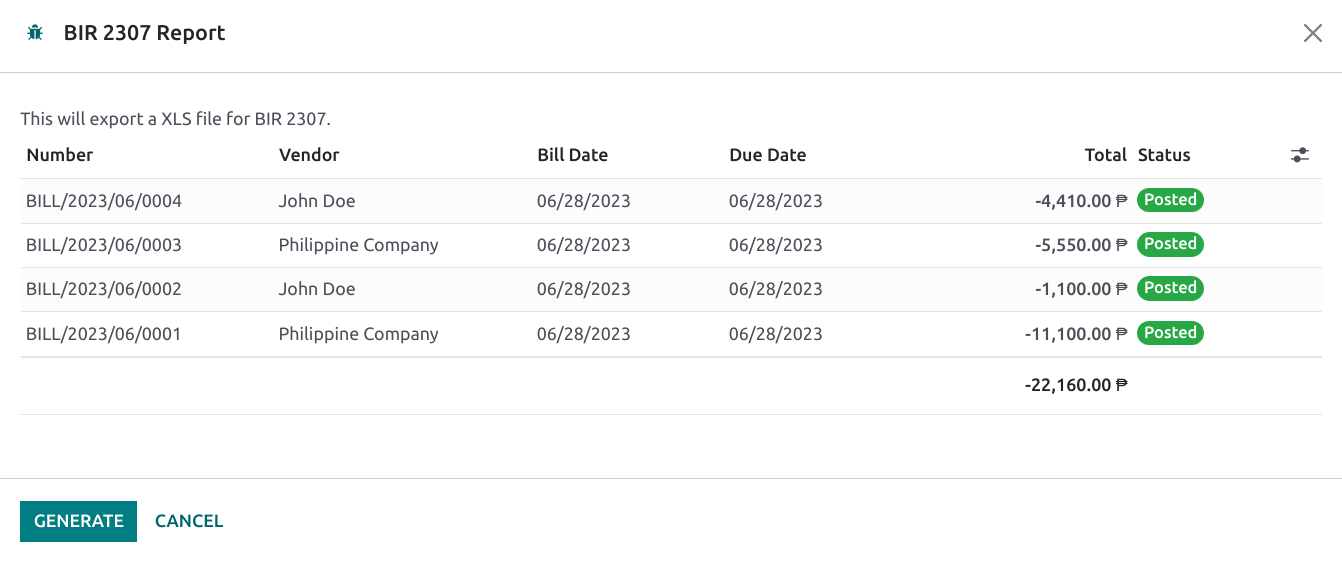

A pop-up appears to review the selection, then click on Generate.

This generates the Form_2307.xls file that lists all the vendor bill lines with the applicable

withholding tax.

The process above can also be used for a single vendor payment if it is linked to one or more vendor bills with applied withholding taxes.

Note

If no withholding tax is applied, then the XLS file will not generate records for those vendor bill lines.

When grouping payments for multiple bills, Odoo splits the payments based on the contact. From a payment, clicking generates a report that only includes vendor bills related to that contact.

Important

Odoo cannot generate the BIR 2307 PDF report or DAT files directly. The generated

Form_2307.xls file can be exported to an external tool to convert it to BIR DAT or PDF

format.

SLSP Report¶

The SLSP report, also known as the Summary List of Sales and Purchases, can be viewed and exported (in XLSX format). The report can be viewed from .

The report is split into two sections, which can be accessed from their respective buttons at the top:

- Sales for SLS reportAll customer invoices with the associated sales taxes applied are shown in this report.

- Purchases for SLP reportAll vendor bills with the associated purchase taxes applied are shown in this report.

By default, both reports exclude journal entries containing partners without a TIN number set and those with importation taxes set. To view or hide them, the Options: button gives additional filters to include these, among others:

Including Partners Without TINIncluding Importations

Important

Odoo cannot generate the DAT files directly. The Export SLSP and XLSX buttons export an XLSX file, which can be processed using an external tool to convert to the DAT format.

2550Q Tax report¶

The tax report report is accessible by navigating to . The form is based on the latest 2550Q (Quarterly Value-Added Tax Return) Jan. 2023 version.

Tip

Most lines in the tax report are automatically computed based on the taxes. For more accurate reporting and filing of the tax report, manual journal entries can also be mapped to the tax report through preconfigured Tax Grids for each tax report line.

Important

Odoo cannot generate the 2550Q BIR formatted PDF report directly. It should be used as a reference when externally filing the form manually or online.