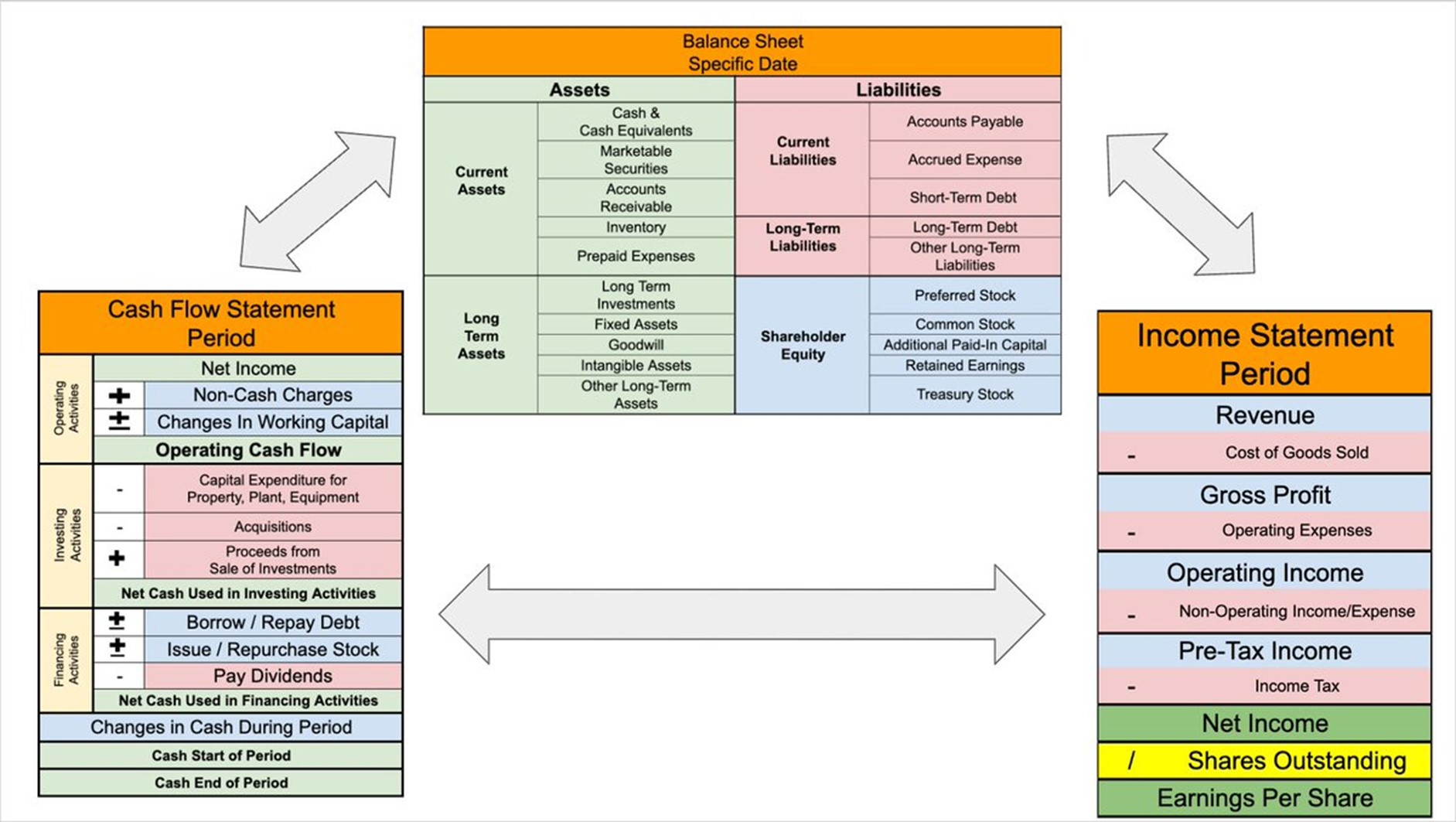

The financial statements are interrelated.

Each views a company's financials from a different angle.

When combined, they provide a more complete view of a company's true financial position.

Each answers a unique question:

1. Balance Sheet: What's your net worth?

2. Income Statement: Are you profitable?

3. Cash Flow Statement: Are you generating cash?

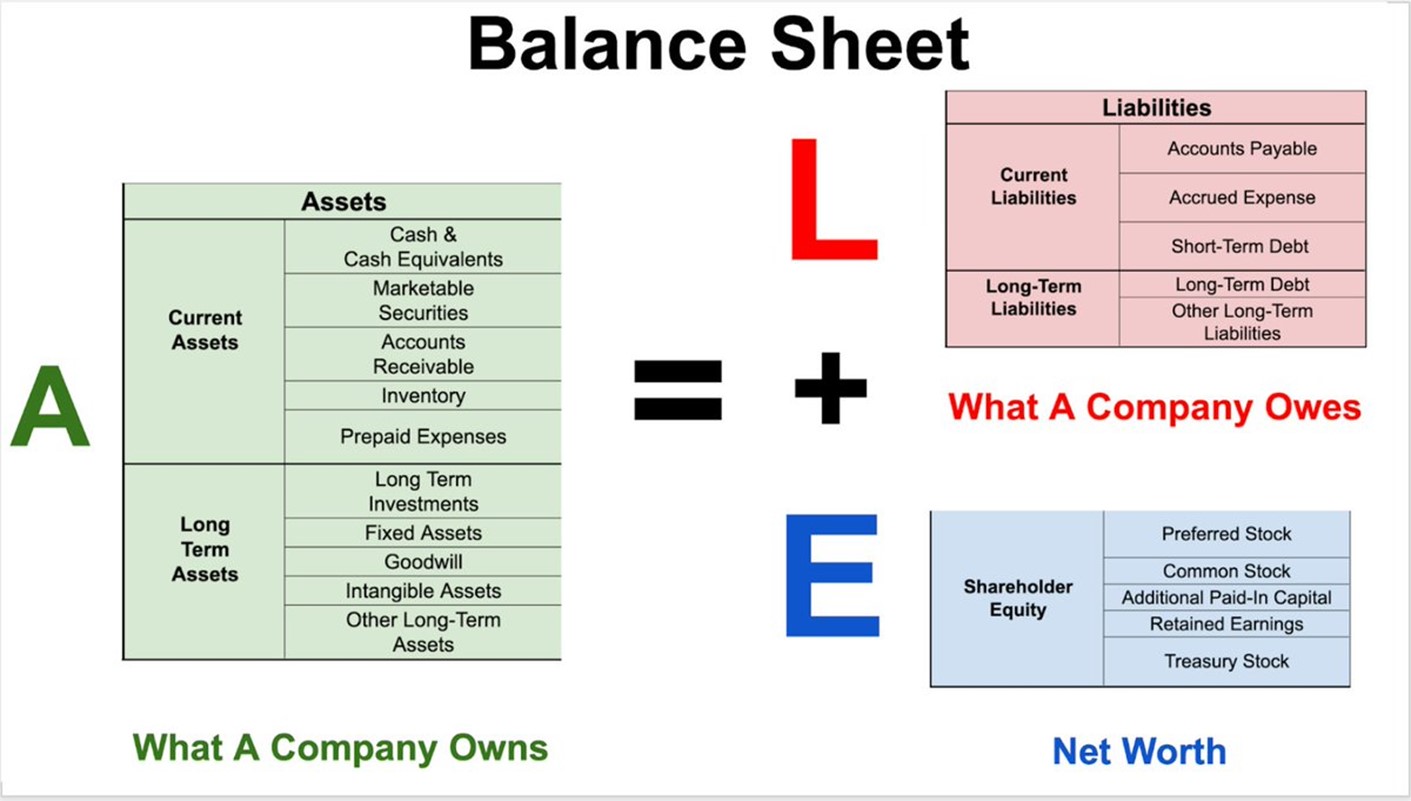

资产负债表

This tells you a company's net worth at a specific point in time.

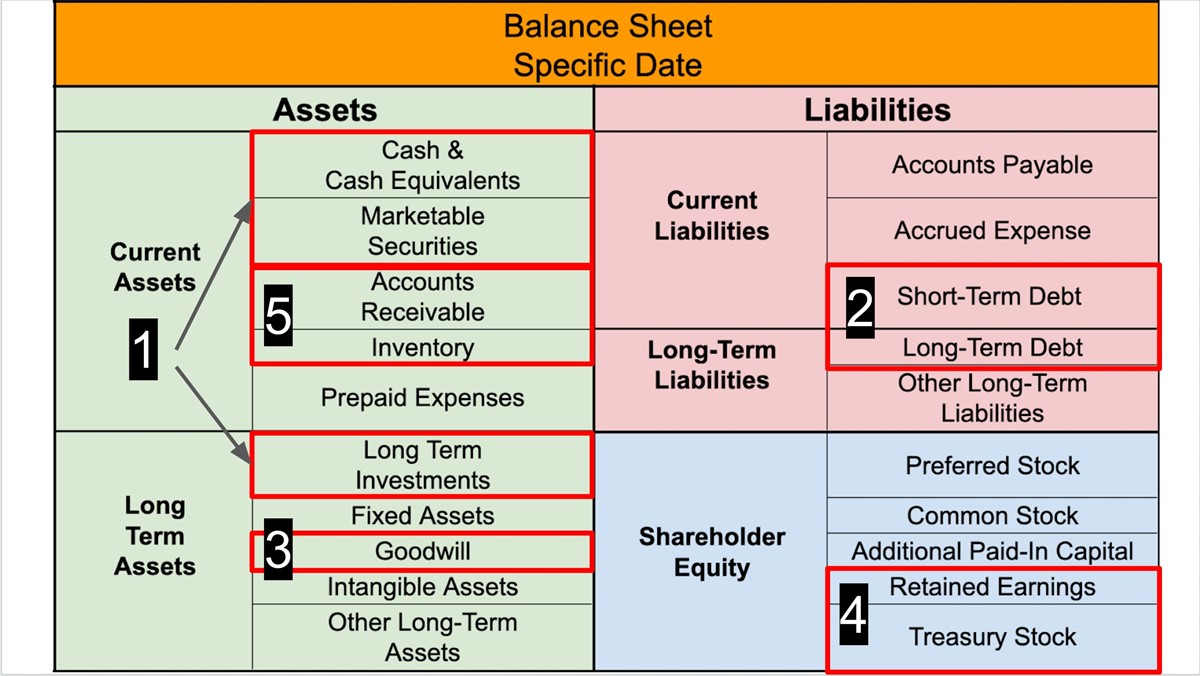

What I focus on first:

1,Cash & Equivalents: How much?

2,Debt: How much vs. cash?

3,Goodwill: How much?

4,Retained Earnings (+ T.S.): Positive?

5,Receivables & Inventory: How much?

Best Possible Answers

1,Cash & Equivalents: More than debt

2,Short & Long-Debt: None

3,Goodwill: Zero

4,Retained Earnings (+ T.S.): Positive

5,Receivables & Inventory: None

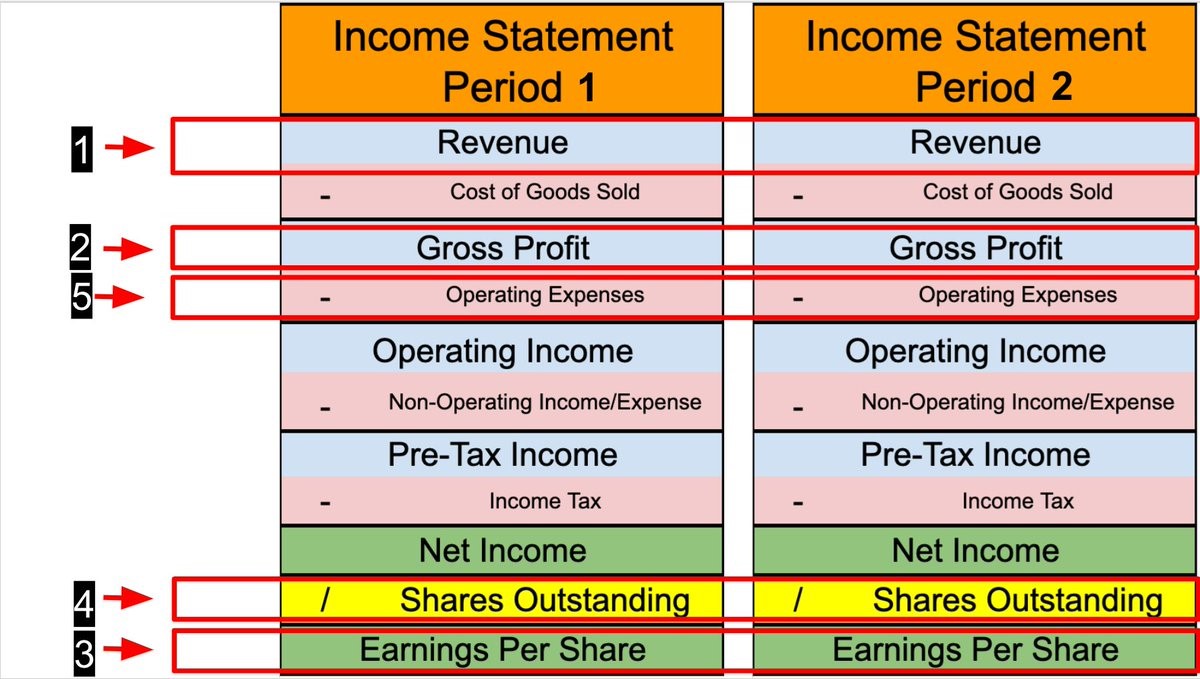

利润表

This tells you if a company is "profitable" or not during a period of time

I look at 2 income statements with comparable periods.

What I focus on first:

1,Revenue: Up or down?

2,Gross Profit: Up or down?

3,EPS (Diluted): Positive or negative?

4,Shares Outstanding: Up or down?

5,Operating Expenses: Up or down?

Best Possible Answers

- Revenue: Up 30%+

- Gross Profit: Up 30%+

- EPS: Up 30%+

- Shares Outstanding: Down 4%+

- Operating Expenses: Stable

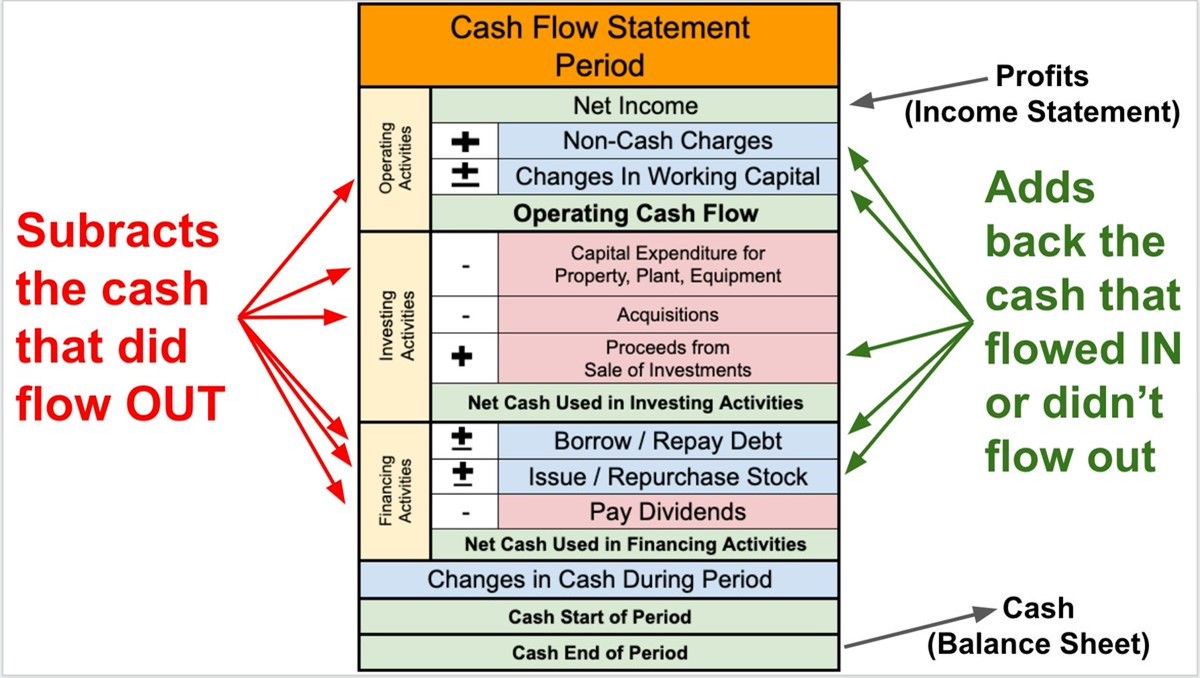

现金流量

This tells you how cash moves in and out of a business over a period of time.

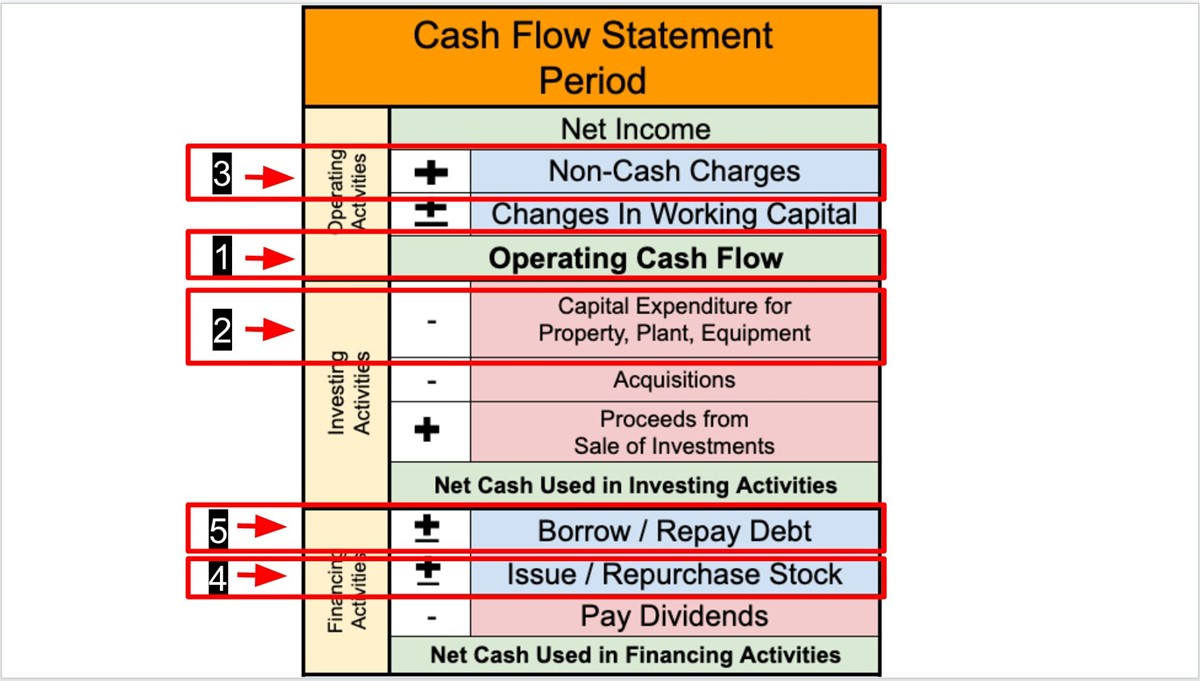

What I focus on first:

1,OCF: Positive or negative?

2,CapEx: More or less than OCF?

3,NCC: Any big numbers? S.B.C.?

4,Stock: Issuance or buybacks?

5,Debt: Borrow or repay?

Best possible answers

1,OCF: Positive (+ Growing)

2,CapEx: Much less than OCF

3,NCC: Nothing noteworthy + Low SBC

4,Stock: Buybacks ✅

5,Debt: Repayment✅